A lot of corn growers will hear from their brokers and elevators this week, but not for holiday greetings. If you have open hedges with December futures or hedge-to-arrive contracts, it’s gut check time to decide whether – or how -- to fish or cut bait with unpriced inventory.

Before first notice day for December on Nov. 30, hedgers must spot, roll, liquidate or convert those contracts to options, minimum price or basis positions. And, while soybean sellers using January have another month, it won’t be long before they must also take stock.

There’s no one-size-fits-all answer on how to proceed because each farm’s markets, cash flow needs, and tolerance for risk is different. And this year strategies for corn and soybeans could be markedly different. In some markets corn basis is stronger than bids for beans; in other locations the opposite is true.

Corn close-up

On average, though corn basis appears stronger than normal headed into delivery, while soybean bids are lagging typical levels headed into the end of the year. One gauge of the difference is carry. Spreads between December corn futures and deferreds for March, May and July are tighter than normal, while the difference with January soybean futures is larger. This suggest the market is providing some incentive for farmers to store soybeans, and at the same time encouraging movement of corn as ethanol plants compete with exporters and feedlots for supplies.

Carry from December to July for corn closed last week at just 11.75 cents, or 1.675 cents per month. Storage, even in on-farm bins that are completely paid for isn’t free, of course. The cost of interest alone for holding grain with a combination of CCC and operating loans is equal to current carry, and that doesn’t include any additional charges for managing inventory and keeping it in condition. If those expenses are figured at a conservate penny per bushel per month, farmers rolling December hedges are betting that basis will strengthen enough to make the strategy better than just moving the corn now.

Myriad factors affect basis, including supply and demand, transportation costs and storage expenses. Moving grain is expensive this year due to supply chain snafus and high fuel prices. Those could tend to hold back basis appreciation unless buyers are willing to foot more of the bill to secure what they need. With 2021 crop usage forecast to hit record levels by the end of the marketing year Aug. 31, end users could indeed pony up, so there’s at least some reason to believe that wager will pay off.

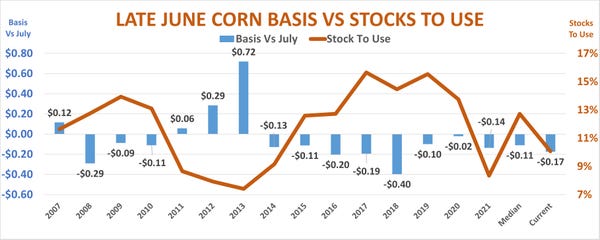

Current basis vs July futures at key locations around the Corn Belt I track is running around 17 under. The median late June basis at those markets over the past 15 years is 11 cents. Six cents, the difference between current and typical levels, may not be enough to wager on storage, but basis appreciation could be stronger for 2021 crop inventory.

There’s a statistically significant correlation between basis and fundamentals, as measured by the ratio of year-end stocks-to-use. USDA currently projects carryout at around 10% of usage, a tighter than normal figure. The chart above shows this relationship. It’s important to note that stocks to usage accounts for only 41% of variance in July basis over the past 15 years – those other variables could mess up the math for sure. But this tool suggests average corn basis could be positive for growers who stay with their positions by the time the elevator calls ahead of July delivery, increasing potential for hedges to pay off.

Soybean strategy

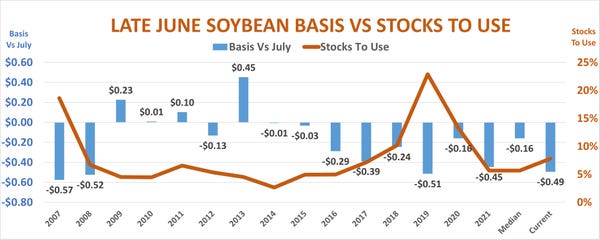

The environment for soybeans is different. Demand is decent, though not at the record levels witnessed for the 2020 crop. The projected stocks-to-use ratio for the oilseed is forecast to increase to 7.8%, which is actually a little above the 15-year median of 5.7%. That could be one reason why nearby basis for soybeans is weaker than average while carry is wider, because the stocks-to-use ratio accounts for a third of the variance in July bids.

July futures closed at 28 cents above nearby January last week, three cents more than interest and handling costs for soybeans, which are running around 4.2 cents a month. This put average basis vs July at 49 cents. USDA’s current forecast for year-end stocks to use suggests that basis could be near or even a little stronger than average by the time July soybean hedges approach delivery.

Long-term soybean hedges don’t normally pay off, but the upheavals of trade wars altered the calculations for 2018 and 2019 crops. Whether the pandemic’s disruptions change the scenario again likely depends on South American production and Chinese demand for imports. Data out over the weekend from China’s customs regime showed total October soybean imports down 26% from September and 41% below year-ago levels. Imports from the U.S. picked up from typically slow summer readings but were still the weakest since the morass of the trade war in 2018.

Changes in U.S. acreage for 2022 could also come into play. Soaring fertilizer costs could shift more ground out of corn, making old crop corn more valuable while giving end users confidence to buy soybeans on a hand-to-mouth basis.

Fertilizer costs jumped again last week with nitrogen products leading the charge. December contracts for ammonia at the Gulf settled at a record $898 dollars a short ton, up $150 from November levels. That took the typical fertilizer bill for an acre of corn to nearly $215, also likely an all-time high.

Rolling or spotting hedges isn’t the only alternative for growers. Those who are bullish could sell inventory and buy futures or options if they need cash or think basis won’t appreciate enough to pay off. Basis and minimum price contracts accomplish the same objectives without margin exposure. But any long positions could result in a lower net price if markets don’t continue their fall rally into winter and spring.

About the Author(s)

You May Also Like