January 30, 2018

How did the 2017 crop year turn out? That is one of the questions I ask as we start in earnest planning for 2018.

On the average, Tennessee had a great year yield wise. New state records were set for corn at 171 bushels per acre and soybeans at 50 bushels per acre. Cotton also came in at the third-highest yield on record at 1,031 pounds per acre. This is also representative of producer’s individual yields, as most farmers have also had very good yields.

The next statement I have been hearing from producers is that while they had great yields, they didn’t make much money. I am still in the process of boiling that statement down to determine whether they mean they didn’t make much money with just the 2017 crop or are they also taken into consideration any shortfalls from previous years.

Indications are that just looking at the 2017 crop year with its income and expenses, it was a profitable year. Many producers in Tennessee had cash-flow shortfalls in 2015 and 2016 and have structured those shortfalls as an amortized payment paid back over several years. There may not have been enough profit to pay those loans back or they may have been paid but very little was left going into 2018.

Some producers were pleasantly surprised with receiving either ARC-CO or PLC USDA payments from the 2016 crop year, and that did help their cash flow. However, the payments were variable from county to county at least for ARC-CO, and some producers were also disappointed in the amount they received as a safety net payment.

As commodity prices have trended downward since the start of the 2014 Farm Bill, I would not expect the ARC-CO payments to be as much as they have been for corn, soybeans and wheat. The Price Loss Coverage, or PLC, payments may come more into play as the current farm bill ends. Whether it is ARC-CO or PLC payments, they will be difficult to estimate for planning purposes.

What is concerning and the question I hear from producers is what will I do when I don’t make record yields? Along with that is also the issue of equipment replacement as producers have been deferring new equipment purchases the last few years. So regardless at how you look at producer’s net returns, it is going to be another year in which producers will have to pay strict attention to details in their operation.

A recent article in the Delta Farm Press Judicious spending recommended for Delta cotton highlights some keys to eking out a profit for cotton, but can also apply to other crops. While agriculture is an industry that has embraced and adapted technology in its production, it is also an industry that can benefit from concentrating and focusing on the basics of production. Whether precision ag or technology is used in fine tuning or improving on these basics of production are not as critical as making sure the basics of production and management are right.

Looking at where we are as we start 2018 can be a beginning point for producer’s decision making for the year. I like to look at the basic income and expenses for each possible crop that can be grown on an individual farm. Granted better decisions can be made if this is examined as a part of a whole farm financial plan, but valuable information can be gleaned by just looking at the budgets.

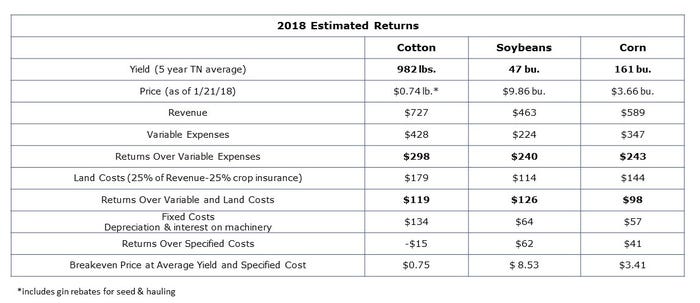

Using the University of Tennessee 2018 Field Crop Budgets as a guide along with Tennessee 2013-2017 average yields and current price offering for harvest delivery I can construct the following table. This comparison is looking at cotton, corn, and soybeans. Please note the price of cotton is estimated at 69 cents per pound for lint plus a 5-cent rebate for seed and hauling from the gin. That rebate is variable and is subject to change from year to year.

From a decision-making standpoint, the numbers I look at the most are Returns Over Variable Expenses for producers with their own land or cash rent ground and Returns Over Variable and Land Costs for producers with share rent land (25 percent in this comparison). Fixed Costs which are also equipment ownership cost are important in the overall viability of an operation.

However, unless equipment changes are being made to raise one crop over another, they don’t affect the crop decision-making process.

At the listed yields, prices and cost, producers who can raise cotton, corn and soybeans might give a slight nod to cotton on ground that is their own or is cash rented and be indifferent between corn and soybeans. On share-rent ground, the nod may go to soybeans although there is not much difference between soybeans and cotton. Corn comes in a close third. If I plug in a 10-percent reduction in revenue from either yield or price or both, the ranking stays the same for the own- or cash-rent farm, but there is a little more separation to the advantage of soybeans in a share-rent situation. A 10-percent increase in revenue gives more separation to cotton compared to corn and soybeans for owned- or cash-rent ground and a little more separation to cotton and soybeans compared to corn for share rent.

Since these crops do have times during the growing season that weather and environment can affect the crops differently, it may be prudent to have some level of diversification at least to assist in managing production risk. Other issues producers should consider in the crop selection process include timeliness of planting, spraying capacity and harvesting capability. Capital requirements of each crop, and a producer’s borrowing capacity should also be considered.

In Tennessee for more on crop budgeting or whole farm financial planning, contact your local Extension office or call the MANAGEment Information Line at 1-800-345-0561.

About the Author(s)

You May Also Like