Planting season is just a few weeks away from switching into full gear across much of the U.S. Heartland. While 2022 acreage estimates were not available at press time in early March, there are plenty of other factors growers need to keep an eye on as planting progress continues.

Liberty and Roundup supplies are likely to remain tight this spring, so be wary that ag retailers may be changing inventory management strategies to keep sprayers moving in the coming weeks. Proactive and timely communication with ag retailers could help ease supply chain distress but keeping alternative spraying strategies back of mind will help growers adapt quickly, if needed.

Farmers may need to hunt for available pre-blends, resort to conventional applications, or load up on pre-emergence treatments and go back and spot spray problem areas to combat the higher costs and availability issues this spring. Penciling out a quick analysis of how each scenario could play out on your farm could be advantageous this spring because it’s not certain how the chemical supply – or cost – situation will play out.

Forward thinking

Looking to harvest, farmers may be searching to fuel products for some form of price relief. Liquid natural gas (LNG) used for fall drying fuel typically sees a price dip in the spring as temperatures warm and heating demand lessens.

But as international banking sanctions have constrained energy supplies out of Russia and into the European Union, U.S. LNG exports have stepped in to fill that void. In December 2021, the U.S. bested Qatar to become the world’s largest LNG exporter, supplying nearly half of the LNG shipments into Europe in January 2022.

The Russian-Ukrainian conflict could potentially dampen spring LNG price decreases if it continues through the rest of the year. At press time in early March, LNG futures prices traded a dollar or so higher than December 2021 price lows at $4.70 per million metric British Thermal Unit.

While that price point is considerably less than October 2021 highs, which climbed over $6.30/MMBtu, if tensions do not ease in the Black Sea and Europe continues to snap up any available LNG inventory from the U.S., growers may face stiff competition for pricing early fall dryer fuel this spring.

Drought concerns

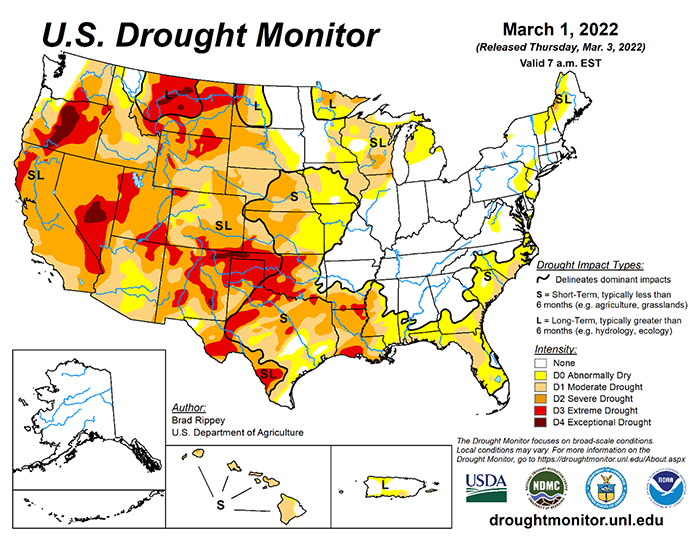

For growers west of the Mississippi River, the ongoing drought is hardly a novel concept in 2022. But as planting progress moves full steam ahead, there are significant considerations growers need to keep in mind as the planters continue to roll.

As of early March, 91% of land in the High Plains was classified in abnormally dry (D0) to extreme drought (D3) condition. Drought also gripped the Midwest, with over 45% of acreage in abnormally dry (D0) to severe drought (D2) ratings.

These conditions could delay or stunt corn and soybean planting progress across the U.S. Heartland. At just shy of 1 million acres, prevent plant acreages for both crops tallied the lowest volume in 2021 since 2012, when another historic drought gripped the nation. USDA projects 2022 acreage estimates assuming normal weather conditions but based on the dry weather patterns this winter it’s likely that 2022 weather will shape up to be anything but normal.

Warm and dry weather is likely to persist in the South and Southwest over the next month, according to NOAA’s latest 30-day weather forecast issued earlier this week. Meanwhile, the Eastern Corn Belt is likely to enjoy above average precipitation chances that will likely help improve soil conditions leading up to planting activities by late March and early April.

The best chances the Plains and Upper Midwest will see for drought relief leading into planting season will likely be over the next two weeks, according to NOAA’s most recent 6- to 10-day and 8- to 14-day outlooks.

Related: What’s the potential for planting delays?

Grain markets will likely resume price responsiveness to weather forecasts in the coming weeks, especially if planting activities are delayed. Moisture is growing increasingly critical to starting these crops off on a high note, but in its absence, growers can take solace in growing price prospects.

Export potential

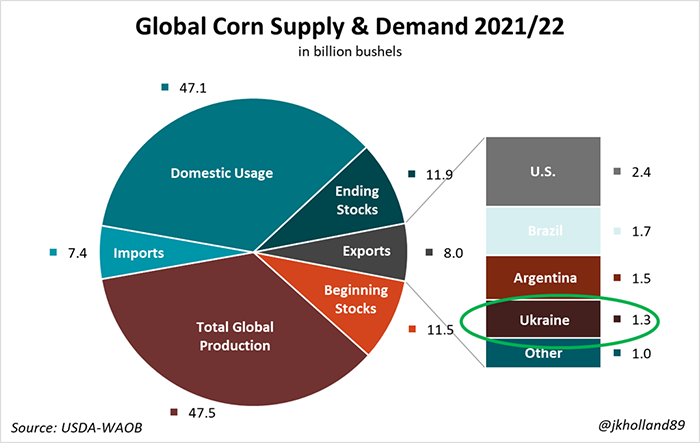

Planting season in Ukraine mirrors that of the U.S. Ukraine is the world’s fourth largest corn exporter, accounting for 16% of global corn exports in 2021/22. Ukraine also produces 33% of the world’s sunflower oil supplies and owns 30% of global sunflower oil export flows. Sunflower oil is the fourth largest-produced edible oil in the world, trailing palm, soybean, and rapeseed oil.

Ukrainian export terminals in the Black Sea closed to combat Russian troops at the end of February. Around the same time, Russian Black Sea wheat shipments stalled as western countries cut off Russia’s access to the dollar, effectively cutting off Black Sea grain and oilseed shipments from the rest of the world.

And with top palm oil producer Indonesia restricting exports, the sixth tightest global soyoil supplies in history as South American soybeans blistered this winter, and the tightest global rapeseed oil supplies since the 2008/09 marketing year, the added pressure in the global edible oils market has played an underappreciated role in pricing dynamics in the soybean market.

As Ukrainian citizens battle Russian forces, grain export flows and production activities in the Black Sea could take a back seat this spring. Amid tight South American corn and soybean supplies following La Niña-induced drought damage, U.S. corn and soybean exporters could benefit from a busier than usual spring and summer shipping season especially if Ukrainian crops are not able to be planted this spring.

And the prices are right for U.S. farmers to capitalize. As of Thursday morning (3/3), May 2022 corn futures contract prices were trading at $7.56/bushel after rising nearly 19% over the past two weeks. That value marks a nine-year high for corn futures prices.

Soybean price rises have more to do with tight Latin American soy supplies and dwindling global edible oil stocks, but the Ukrainian-Russian conflict has had an impact, nonetheless. In the last week, May 2022 soybean futures contract prices have risen nearly 7% to settle about a dime below the $17/bushel benchmark.

Soybeans could see additional price appreciation as American stocks become cheaper and more attractive than Brazilian supplies, which are currently in peak export activity. USDA reported a large daily flash sale of old crop soybeans to China yesterday morning, totaling five cargoes, that are believed to be a result of more affordable U.S. supplies and narrowing Chinese crush margins.

There may be volatile price flows ahead for corn and soybean growers this year, but the growing conflict in the Black Sea could translate to even more lucrative returns for U.S. growers than were previously expected in 2022.

About the Author(s)

You May Also Like