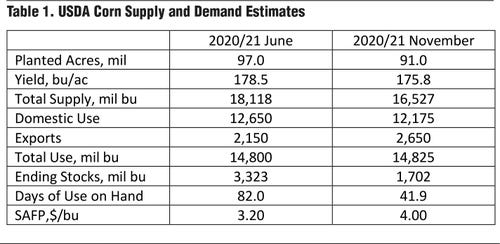

The roller coaster ride that describes many financial and commodity markets in 2020 was evidenced in U.S. feed grains. As late as June, U.S. farmers were expected to plant 97 million acres of corn and USDA was projecting a record high yield. Combined with carryover stocks, the corn supply was estimated to be above 18 billion bushels. And this as the impact of the spreading global pandemic was cutting gasoline demand and the amount of grain needed for ethanol. Corn days of use on hand at the end of the marketing year (a measure of stocks to use) was projected to hit its highest level since the early 1990s and the season-average farm price (SAFP) the lowest since 2006/07 (Table 1).

The roller coaster ride that describes many financial and commodity markets in 2020 was evidenced in U.S. feed grains. As late as June, U.S. farmers were expected to plant 97 million acres of corn and USDA was projecting a record high yield. Combined with carryover stocks, the corn supply was estimated to be above 18 billion bushels. And this as the impact of the spreading global pandemic was cutting gasoline demand and the amount of grain needed for ethanol. Corn days of use on hand at the end of the marketing year (a measure of stocks to use) was projected to hit its highest level since the early 1990s and the season-average farm price (SAFP) the lowest since 2006/07 (Table 1).

Then another spring of difficult planting conditions resulted in over 6 million acres of prevented plantings of corn. Drought conditions expanded over much of western Iowa. A severe windstorm, a ‘derecho,’ left crop and property damage from Nebraska to Ohio. And China started buying corn. China had resumed sorghum imports towards the end of the 2019/20 marketing year after U.S. shipments of sorghum had gone to virtually zero at the height of the trade war. Corn sales to China began to pick up at about the same time. China is not only the largest importer of U.S. sorghum, it is currently the number one importer of U.S. corn as well.

By harvest, production cuts and increased exports had lowered the corn stocks to use ratio to its lowest since 2013/14 and the projected price the highest since that same year.

These factors shape the feed grain outlook for the 2021/22 marketing year: tight stocks, acreage, exports and weather. Tight stocks and resulting higher prices provide incentives to increase feed grain plantings in 2021 but soybean prices are higher too, competing for those acres.

Domestic use has held steady the last several years making exports a more important component of the supply and demand balance sheet and greater influence on prices. Export demand, supported by global economic recovery from the coronavirus pandemic, is likely to remain strong but the U.S. increasingly faces export competition in corn from South America and the Black Sea Region.

Dry conditions last summer reduced grain yields in Ukraine and Russia. Parts of South America were dry at planting last fall, particularly Argentina. Most of Brazil’s corn is planted as a second crop in March and April highlighting weather as a concern in May, June, and July.

The La Niña weather pattern increases the chances of a warmer and drier winter in the southern U.S. This is most likely to impact sorghum production give the concentration of acres in Texas and Kansas. If the U.S. corn yield follows trend line growth projections, it would be higher than the average yield in 2020.

With normal weather, increased acres and steady use estimates mean the stocks to use ratio for U.S. corn and sorghum is likely to be higher in 2021 compared to 2020. That puts downward pressure on prices. But we are going into the new crop year with the tightest stock levels in years. That means 2021, with all its unknowns and uncertainty, could still be a bumpy ride.

2021 Outlook articles:

Source: is Oklahoma State University and Texas A&M University, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like