The cotton market continues its remarkable gyrations. Starting in mid-August, cotton futures declined substantially from 120 to 70 cents. For those who have lost track, this is the second 50-cent slump in five months. And it ended in dramatic fashion with a 3-cent limit down settlement Friday, Oct. 28.

The first Monday in November saw cotton futures little changed, reminiscent of a coiling spring. Then the market took off like a rocket, gapping up the 3-cent limit on Tuesday, continued 4 cents limit up on Wednesday, and again on Thursday. Friday, Nov. 4, the Dec’22 contract settled up 3.93 cents at 86.93 cents per pound.

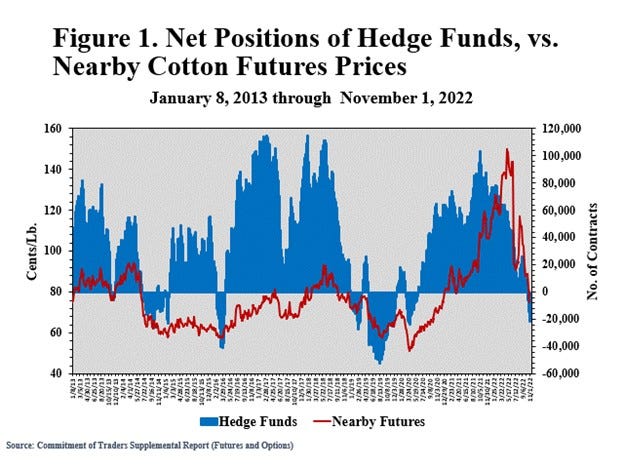

The explanation for this bounce is short covering. As of Tuesday, Nov. 1, the hedge fund speculators had built an outright short position of 52,319 contracts, the largest such position since April 2020. This recent speculative position appears on the righthand side of Figure 1 as a downward blue spike.

The early November price rally was driven by short speculators rushing to buy back their positions. Why? The combination of bullish Chinese economic news (i.e., relaxing their COVID restrictions), technical buy signals, and "limit up" market reactions (with even higher prices reflected in the options market) induced speculative shorts to buy back their positions. First Notice Day for the Dec’22 contract is Nov. 23. Any remaining discrepancy between undervalued cotton futures relative to cash cotton prices should be eliminated, and the result is that remaining speculative shorts may get squeezed as they try to exit their position. This may support prices even more, at least until the expiration of the Dec’22 contract.

See, WHEAT SCOOPS: Enough wheat to feed the world... maybe

It remains to be seen where the new equilibrium price level will be when the short covering and squeeze dynamics are passed. Back in April of 2020, the hedge fund net short position (downward blue spike) came and went in about eight weeks, but the resulting price rally continued, fed by fundamental forces like pandemic recovery and supply concerns. The current demand situation appears uncertain to me. The 2022/23 supply picture could get tighter, but it remains to be seen. Maybe the uncertainty will keep the roller coaster rolling.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/.

About the Author(s)

You May Also Like