July 5, 2022

Since the authorization of Renewable Fuels Standard, U.S. ethanol production capacity has grown from 4.4 billion gallons per year in 2005 to 17.5 billion gallons in 2021, with the total number of U.S. ethanol plants increasing from 81 to 201, according to 2021 statistics from the U.S. Energy Information Administration.

With the introduction of the new ethanol plants and expansion of the few existing ethanol plants, the corn market landscape was transformed across the Midwest, and production grew from 11.1 billion bushels in 2005 to 15.1 billion bushels in 2021, according to the USDA National Agricultural Statistics Service.

In this article, our objective is to calculate the value local ethanol production brings to the diversely located corn grower. We achieve this by considering the possible net prices received by the corn grower, with net price being the posted corn bid from the grain buyer less transportation cost.

Based on farm location, each corn grower is in unique proximity to several grain buyers. As transportation costs to the buyers are different for each farm location, each corn grower is subject to a different set of net prices achievable at grain elevators and ethanol plants. For a corn grower interested in improving their bottom line, delivery destination should be thoughtfully considered.

Nebraska data

Data comes from Nebraska, the nation’s second-leading ethanol producer and third-leading corn producer. Net farm price is comprised of grain bid and transportation cost, with all figures expressed on a dollars-per-bushel basis. Bid postings from grain elevators and ethanol plants within Nebraska are used, while transportation costs are based on rental truck rate.

The range of this study takes course over 13 years, from 2009-2021, and for the purpose of this article, we will focus on the harvest sale. Our analysis includes corn bids from six ethanol plants and 18 elevator locations.

We evaluate four farm location conditions, with each being unique in their proximity between elevator and ethanol plant. The four conditions are near the ethanol plant, in between the ethanol plant and grain elevator, near the grain elevator, and beyond the grain elevator.

With each “region” consisting of three elevators and one ethanol plant, each farm has four net price offerings available at harvesttime. The difference between net price achieved at the ethanol plant and highest net price achieved at the grain elevators represents the value the individual farm location derives from ethanol production.

Benefits of ethanol

Results suggest ethanol’s value to corn growers to be positive on average across all four farm locations, although we do observe a large range in values. This is expected, as ethanol plants across regions will vary in their grain bid competitiveness.

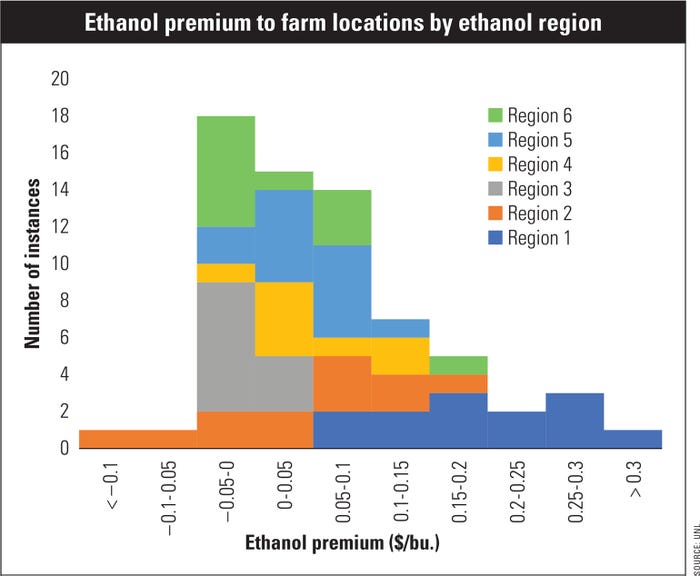

Figure 1 shows how ethanol premium to growers varies by ethanol plant region, where ethanol premium represents the net price advantage of the ethanol plant over grain elevators. Each data point represents the average ethanol premium received by farms at harvest. In 47 of 67 yearly observations, the average farm location achieved a greater price by delivering to the ethanol plant.

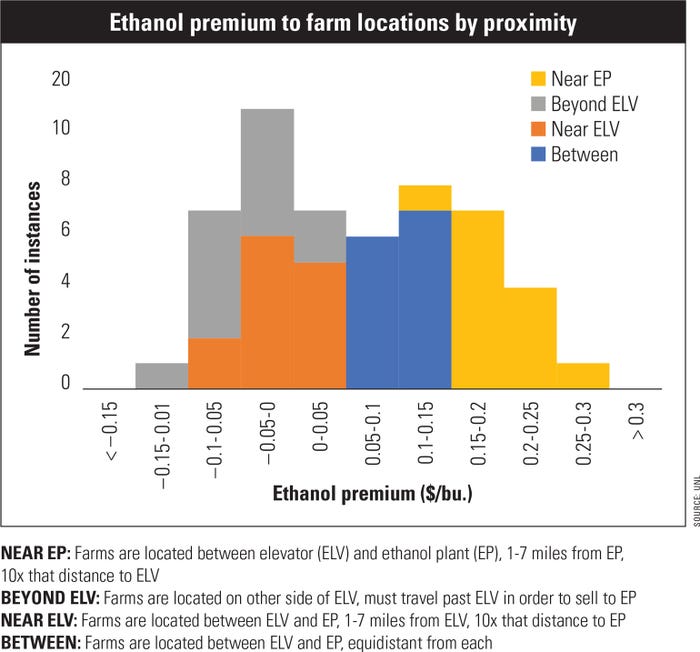

Figure 2 displays ethanol premiums associated with each farm location. For the average ethanol region, growers located near the plant achieve as much as $0.26 per bushel more at the ethanol plant than at any of the elevators, with those farms located between the elevator and ethanol plant also enjoying positive ethanol premiums.

For those producers located near or beyond the grain elevator, a higher price is more often achieved by delivering to the elevator, on average. In a few cases, however, corn growers are better off driving past their local elevator, selling to the ethanol plant farther down the road.

Overall, our findings suggest most corn producers derive positive value from having an ethanol plant located within their region. Depending on a farm’s location, ethanol premiums range from -$0.11 per bushel to $0.26 per bushel, with an overall average of $0.06 per bushel.

Due to the role of transportation costs, those operations located closer to the ethanol plant see the greatest price differential between the plant and the next-best buyer, while those farm operations located farther away occasionally observe a small benefit to delivering to the ethanol plant.

Other considerations, such as wait time and discount schedules, should be considered by the corn producer when determining delivery destination, but are beyond the scope of this article.

Harthoorn is a graduate student, and Walters and Brooks are both associate professors, all in the Department of Agricultural Economics at the University of Nebraska-Lincoln.

You May Also Like