Exports and ethanol have been the driving forces behind high prices to kick off the 2022 calendar year. And with good reason.

Remember – over 35% of the 2021 corn crop will go towards ethanol production and 16% will be shipped to international buyers. Even with cuts to 2021/22 export projections – USDA predicts 328 million fewer bushels will be shipped compared to last year’s record high of 2.75 billion bushels – U.S. corn exports in the current marketing year are likely to be the fourth highest in history.

Peak export season is slated to begin at the end of this month. The season’s length will be largely dependent upon how quickly Brazil can continue planting its second corn crop and how severely current La Niña weather patterns continue to hinder rainfall in South America.

But what about cattle?

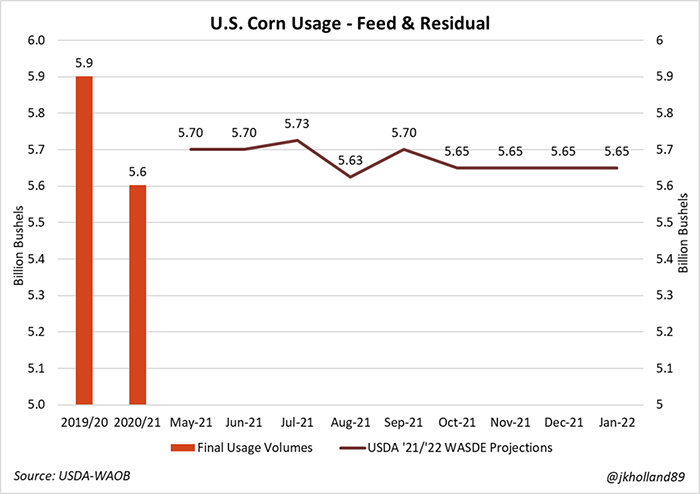

Meanwhile, America’s biggest source of corn usaage – livestock feed – has largely remained a quiet player in these markets. Feed and residual consumption account for over 37% of the 2021 crop’s disappearance but have not generated many headlines in recent months.

To be sure, $6 per bushel corn doesn’t exactly send expansion signals to cattle producers, especially with the Plains and West battling an ongoing drought and limited hay supplies.

Plus, the recent COVID-19 surge and ongoing labor shortages has slowed slaughtering speeds at meat processing facilities. Luckily, rising boxed beef prices could provide enough economic incentive to prevent a repeat of 2020 backlogs.

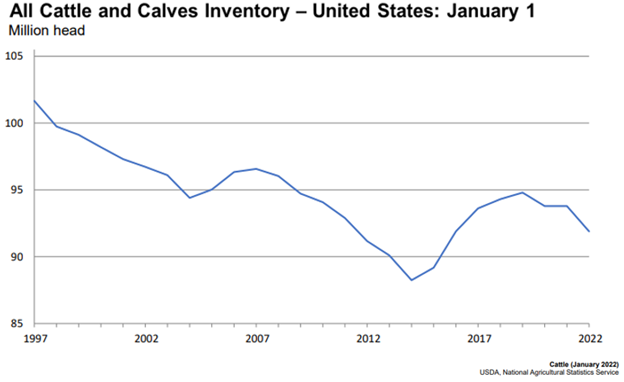

The underlying price dynamics have left the U.S. cattle herd down 2% over the past year at 91.1 million head of cattle and calves as of Jan. 1, according to USDA’s National Agricultural Statistics Service. Tighter margins are making livestock production more challenging, even as futures prices soar to multi-year heights.

A shrinking cattle herd is not exactly a new development. Cattle inventory levels have drifted lower over the past four years, with the Jan. 1 inventory reading marking the lowest cattle inventory in the country since 2015.

Corn usage for livestock feed and residual use in 2021/22 will account for 37% of 2021 corn production volumes – a metric that will hit a four-year low as ethanol and exports rebound in the pandemic economy.

Price dynamics

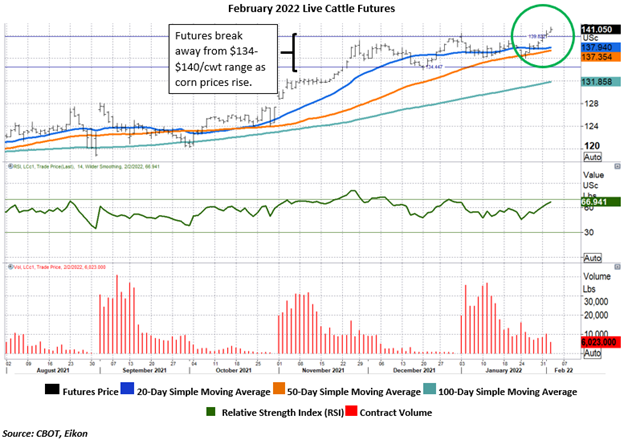

Live cattle futures contracts have largely traded within a $5-$6/cwt range since late November 2021, with the February 2022 contract hovering between $134.50 - $139.78/cwt during the period from Thanksgiving 2021 to yesterday.

The recent rally in the corn market has helped nearby live cattle futures break through the price resistance at the $140/cwt level in the past couple days. At last glance, February 2022 futures prices for live cattle rested at $141.125/cwt on the rising feed costs.

Live prices of $141/cwt are certainly nothing to shrug at. In fact, today’s prices are likely to close at a five-year high. But the rising production costs from increasingly scarce feed stocks after last summer’s drought in the West and Northern Plains create financial challenges for feedlot managers who need to maintain profit margins.

Frigid temperatures in the Upper Midwest are not helping matters any. Cold weather increases net energy and production requirements for what cattle remain. Simply put, the further the temperature drops, the higher volume of protein and roughage feedstuffs are required by the feedlots to maintain economical growth prospects for animals.

With old crop corn futures sitting between $6.17-$6.22/bushel in today’s trading session and nearby soymeal futures well over $425/ton, cattle farmers are becoming increasingly squeezed at the margins to continue feeding their stock without any further price support from cattle markets or processors.

Canadian weather woes = exporting opportunities?

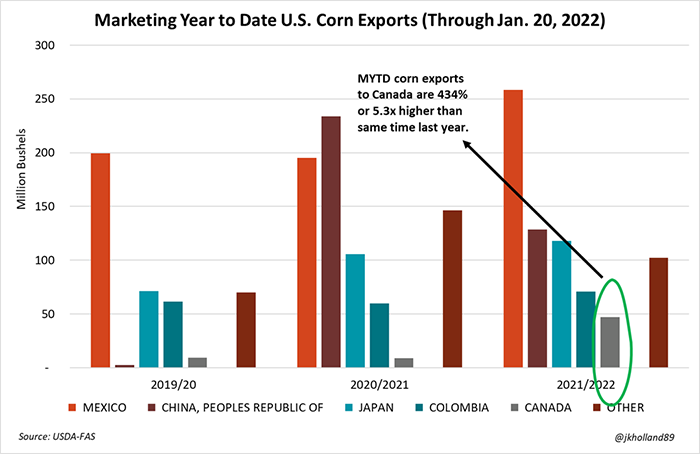

Price and availability aren’t just a problem for American farmers. Cattle producers in Canada also suffered in last summer’s drought, which has left corn and hay feedstuffs scarce in the country’s Alberta province, where most of the nation’s cattle herd subsides.

At the current volume of 46.8 million bushels, marketing year to date U.S. corn shipments to Canada are over five times higher than the same time last year as Canadian livestock producers scramble to source adequate feed supplies to feedlots in Alberta.

"We don't have any buffer. It's scary," Jacob Bueckert, owner of a 20,000-head feedlot near Warner, Alberta, told Reuters. Bueckert estimates that normal feed stocks on hand usually total 14-30 days’ worth. Currently, Bueckert only has five days of feed on hand.

"Excuses aren't going to feed the cattle."

About three-quarters of Canadian feedlots face actual feed shortages if there is any hiccup in the delivery process. And the probability of those occurring amid growing logistical woes is uncomfortably high for many producers.

Rain and flood damage at the critical Vancouver port in British Columbia slowed rail shipments late last year. Plus, Canadian vaccine mandates for truckers and train operators entering from the U.S. are increasing concerns about feed availability. Canada now requires cross-border truck and train drivers to provide proof of vaccination, effective Jan. 15.

The Canadian Pacific Railway has been the primary delivery vehicle for U.S. corn to Canada, providing over 8,100 carloads of U.S. corn and dried distillers grains to Alberta-based feedlots last year. But frigid weather has caused significant delivery delays this year as well as rising freight costs that few feedlots can afford.

A potential rail strike in the U.S. could further delay corn shipments to the north. Two unions consisting of nearly 17,000 Burlington Northern-Santa Fe rail operators are threatening the company with a strike after a new BNSF attendance policy implemented this year was found by workers to be too stringent.

Looking forward

North American corn demand will help offset lower export demand forecasted from China this year. Current marketing year to date outstanding export sales are currently 14% lower than the same time last year.

Late season snowfall and a good start for Brazil’s second corn crop currently being planted will likely provide the best hope of increasing corn usage by cattle in the coming months. On the flip side, if current soybean harvest delays in Brazil delay corn planting, U.S. corn export projections could improve from current forecasts.

Until then, farmers with corn in storage will remain dependent upon ethanol usage for the best basis potential. And with December 2021 volumes surging to the highest level in four years, it may be a safe bet until export and cattle dynamics can find a more profitable equilibrium.

About the Author(s)

You May Also Like