It’s no secret that the 2014 farm bill mandated farmers to use conservation practices on their farm or risk losing their program benefits. If farmers have highly erodible land (HEL) enrolled in a program, they are required to use soil conservation systems on their fields. The same goes for wetland conservation.

A report by the USDA, “ Conservation Compliance: How Farmer Incentives are Changing in the Crop Insurance Era,” found that conservation compliance is effective in reducing soil erosion and conserving wetlands when the incentive (the farm program benefits that could be lost due to noncompliance) exceeds the cost of meeting soil and conservation requirements.

Two questions

The report looked at two questions: Has highly erodible land compliance (HELC) requirements affected soil erosion over the past 30 years? Soil erosion was sharply reduced on cropland subject to HELC and not subject to HELC. How much soil erosion reduction can be attributed directly to HELC?

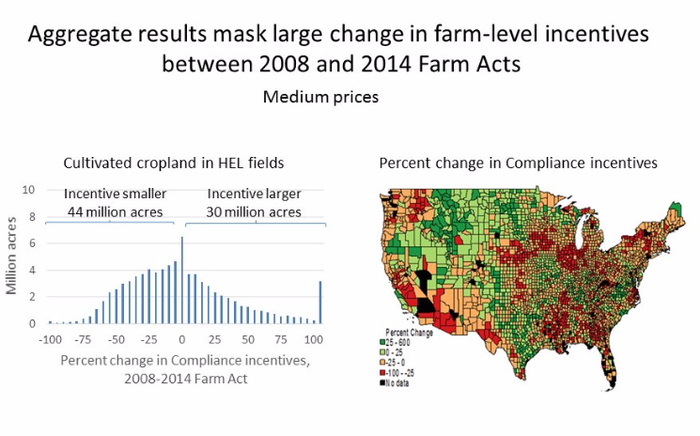

And the second question: how did the 2014 Farm Act change incentives for meeting conservation compliance requirements? The 2014 Act ended direct payments, re-linked crop insurance premium subsidies to compliance, and created several new commodity and crop insurance programs. In aggregate, farm program benefits under the 2014 Act could be as high or higher than under the 2008 Farm Act; but for individual farms, the shift toward a crop insurance-oriented policy could increase or decrease compliance incentives.

Study results

The study found that between 1982 and 1997, soil erosion reductions for highly erodible cropland for water were significantly larger in fields subject to highly erodible land compliance (39 percent, or 6.6 tons per acre) than those not subject to HELC (24 percent, or 3.9 tons per acre). For cropland highly erodible for wind, the difference was smaller: a reduction of 3.8 tons per acre. Soil erosion rates on highly erodible cultivated cropland were largely unchanged between 1997 and 2012.

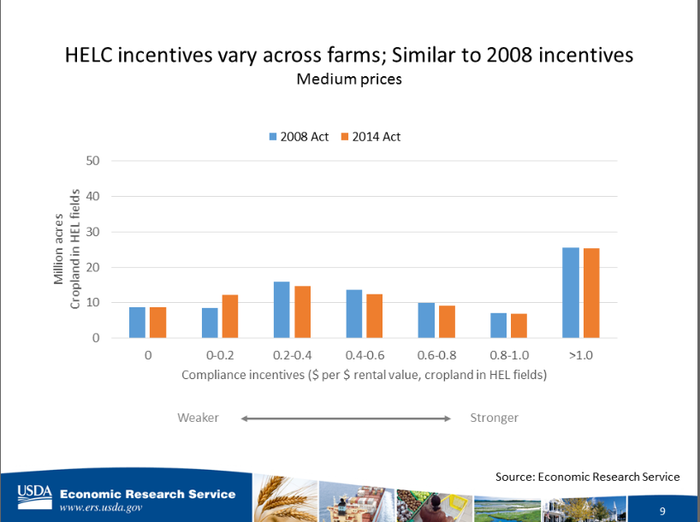

Basically, the study found that the rate of compliance incentives varies among farms. It is not constant because it depends on the cost of complying with the standards varies from farm to farm.

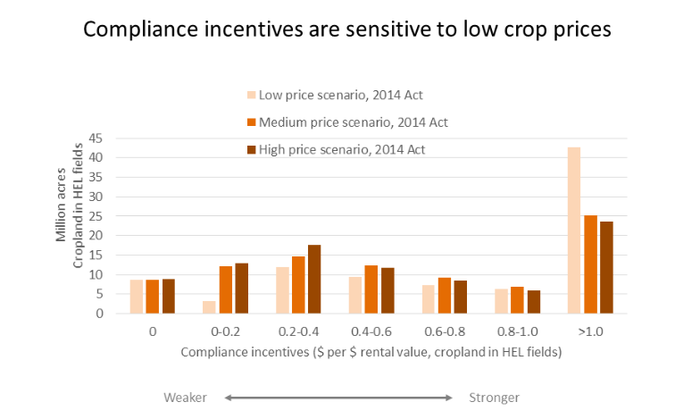

In addition, compliance incentives (receiving farm program benefits) also depend on crop prices. Most commodity payments are triggered by low prices or low revenue. Crop insurance premium subsidies, on the other hand, rise with crop prices because higher prices increase the value of the insured crop.

Three price scenarios

The study used three crop price scenarios: a high price (2013), medium price (2010) and low price (2004) range. Roger Claassen, one of the lead researchers, said incentives don’t increase when prices are high but do drop when prices are low.

Severing the link between conservation compliance and crop insurance premium subsidies would mean a 65-percent increase in the amount of highly erodible land on farms where compliance incentives are relatively low. The change in compliance incentives is much larger when crop prices (and premium subsidies) are high and much smaller when crop prices are low.

National results, however, hide big changes in farm-level compliance incentives. For example, in the medium-price scenario, 27 million acres of cropland in HEL fields are located on farms where compliance incentives are at least 25 percent lower than they would have been under the 2008 Act (portions of the Corn Belt).

On the other end of the spectrum, roughly 18 million acres (20 percent) of cropland in HEL fields are on farms where compliance incentives are at least 25 percent higher than they would have been under the 2008 Act (for example, much of the Northern Plains).

Less compliance incentive would hit more farms if crop insurance and compliance were not linked. For example, in a medium-price scenario, compliance incentives would drop 50% or more on less than 10 million HEL acres with both insurance and compliance linked. If decoupled, more than 40 million HEL acres would suffer a 50% or more decline in compliance incentives.

About the Author(s)

You May Also Like