President Joe Biden signed into law on August 16 the Inflation Reduction Act, which will deliver $19.5 billion in new conservation funding to support climate-smart agriculture. With approximately $20 billion of the $40 billion designated for rural America through the IRA, the new funding will support conservation programs that are oversubscribed and a main tenet of the Biden administration’s promise to help reduce emissions by 40% in 2030.

"President Biden and Congress have taken an important, historic step towards easing the burden of inflation on the American public and meeting the moment on climate,” says Vilsack. “Agriculture has long been at the forefront of our fight against climate change. From climate-smart agriculture, to supporting healthy forests and conservation, to tax credits, to biofuels, infrastructure and beyond, the Inflation Reduction Act provides USDA with significant additional resources to continue to lead the charge.”

Related: House sends Inflation Reduction Act to President

While visiting Michigan the day ahead of the signing, Vilsack in his comments alongside Senate Agriculture Committee Chairwoman Debbie Stabenow, D-Mich., says that Stabenow played a very critical role in terms of her work advocating for agricultural priorities on the Inflation Reduction Act. “Without her advocacy, I’m pretty sure you would not have seen the level of commitment to conservation, forestry and rural America,” Vilsack says.

Vilsack also adds the additional money dedicated towards farm bill conservation programs can help provide the data for why additional funds are needed in future farm bills to these programs.

Dedicating $19.5 billion to conservation funding means that more producers will have access to conservation assistance that will support healthier land and water, improve the resilience of their operations, support their bottom line, and combat climate change.

While speaking at the event on Monday, Stabenow notes, “We know farmers want to do more, now they’ll have the resources to do it.”

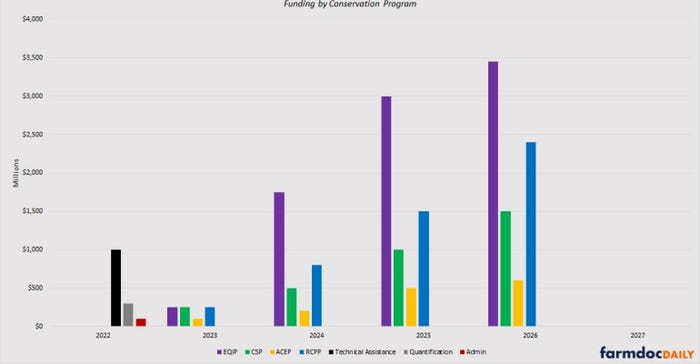

Of the total appropriated amounts, most of the funding (45%) is appropriated to the conservation programs in Title II of the farm bill as authorized in the 2018 Farm Bill. The farm bill conservation programs receive appropriations for fiscal years 2023 through 2026, but all funding remains available through FY2031. IRA 2022 appropriates the most funding to the Environmental Quality Incentives Program, with $8.45 billion (43%) in total funds. The Regional Conservation Partnership Program created by the 2014 Farm Bill is appropriated the next highest total amount, $4.95 billion (25.5%). The Conservation Security Program is appropriated a total of $3.25 billion (17%) and the Agricultural Conservation Easement Program is appropriated $1.4 billion (7%).

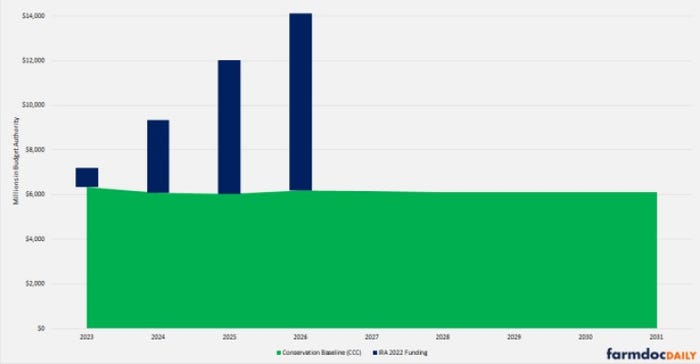

Conservation Title Baseline (CBO Scoring) and Additional Funding

The IRA appropriates $19.5 billion in additional funding, $18.1 of it to the farm bill conservation programs. The IRA funds do not change the existing baseline (Commodity Credit Corporation funding) as authorized in the 2018 Farm Bill, according to a recent overview published by agricultural economists at the University of Illinois.

The analysis notes while these funds are for farm bill conservation programs, they are designated for agricultural conservation practices that “directly improve soil carbon, reduce nitrogen losses, or reduce, capture, avoid, or sequester carbon dioxide, methane, or nitrous oxide emissions, associated with agricultural production.” Existing conservation programs funded through the normal CCC funds remain available for all practices previously authorized. Only the new or additional IRA 2022 funds are limited to climate-smart agricultural practices.

Related: Inflation Reduction Act passes with ag climate investments

IRA 2022 also provides a boost in funding for conservation technical assistance of $1 billion that is available through 2031, the FarmDoc analysis adds. It also provides $300 million for “a program to quantify carbon sequestration and carbon dioxide, methane, and nitrous oxide emissions” by NRCS through collecting “field-based data to assess the carbon sequestration and reduction” in greenhouse gas emissions associated with farming and conservation practices. Finally, it provides $100 million for administrative costs.

Long-term conservation commitment

The additional conservation funds allocated under the IRA will provide consistent funding and builds on the desire for those in agriculture to build on their environmental and conservation-focused efforts.

USDA announced at the end of July that it received a total of $2 billion in submissions for the second funding pool for the Partnerships for Climate-Smart Commodities, with offers to match $1.3 billion in non-federal dollars. This builds on the more than $18 billion in submissions USDA received for the first funding pool, which closed in May.

The second funding pool was for applications from $250,000 to $4,999,999 and emphasizes the enrollment of small and underserved producers, or monitoring, reporting and verification activities developed at minority-serving institutions.

The first funding pool included over 450 proposals ranging from $5 million to $100 million each. The applications came from over 350 entities and covered every state in the nation, as well as tribal lands, the District of Columbia and Puerto Rico. First-round proposals requested more than $18 billion and offered to match with more than $8 billion in nonfederal dollars.

USDA is in the process of evaluating the applications for completeness and will rank them based on the technical criteria provided in the funding opportunity. Selections for both rounds of funding are expected to be announced later this summer.

“Once we make these projects available, we know with EQIP and CSP resources now bulked up with the impact that's going to have, hopefully positive impact on the farm bill, that we can really justify continued long-term investment,” Vilsack says in conservation and the funding of climate-smart agricultural practices.

Vilsack is optimistic that in the next 10 years these investments will start to have a meaningful impact for climate goals and farmers’ conservation goals. “We have the data. We have the resources, and we have the commitment. We haven't had all of them at the same time,” Vilsack says.

Move away from cost-share to reasonable return

Rural Investment to Protect our Environment (RIPE), a producer-led nonprofit advancing a unique, bipartisan climate policy plan, welcomed the $20 billion commitment from Congress, but also urged legislators to evaluate whether they should shift funds away from a cost-share model in favor of payments that provide producers with a reasonable return for conservation.

RIPE advocates for the implementation of the research-backed RIPE100 policy, which would allow farmers and ranchers to earn payments that reflect the benefits they deliver to soil health, water, air and climate combined, with a price floor above implementation cost, economic risks and future climate policy costs.

While the IRA offers significant funding to working land conservation programs, most producers will not seek to use them because the payment terms are limited to cost-share requirements.

Farmers and ranchers want to invest in conservation practices, but a cost-share model leaves them to bear risks without a market opportunity. Most producers are unable to assume those costs and struggle with the enrollment process in current conservation programs.

“No one expects clean energy companies to invest at a cost-share, so why are farmers expected to?” asks RIPE Executive Director Aliza Drewes. “We believe that new funds intended for climate-smart agriculture should set payment levels to cover the full cost of practice implementation, potential climate policy costs such as increased input costs like fuel and fertilizer and address economic losses during the transition to new practices. Senior policymakers in both parties have told us they are open to this pathway, but they need to hear from producers that this is what they want.”

About the Author(s)

You May Also Like