August 23, 2022

This week local and national crop tours are taking place. These reports will give traders a preview on what to expect once the combines begin to harvest the U.S. corn and soybean crop.

Despite these tours, predicting yield can be very difficult. There are certainly benefits to estimating your crops’ potential, but what is your margin for error? Maybe 5%, 10% 20%? With ending stocks-to-use estimates for corn at 9.6% and soybeans at 5.7%, any margins for error can significantly move the markets up or down as harvest progresses.

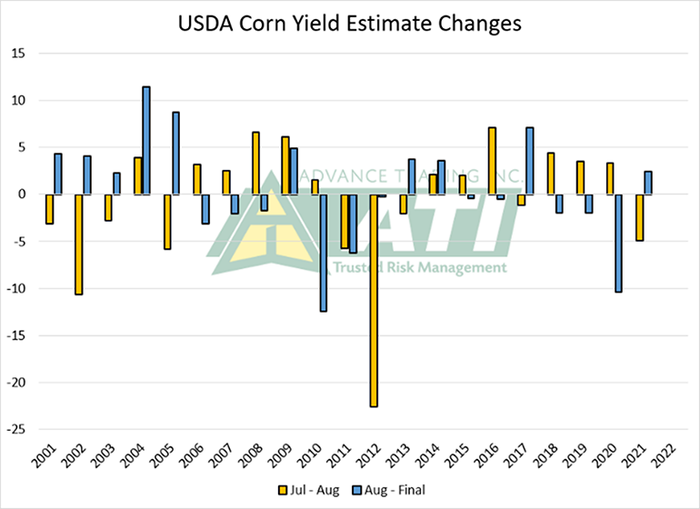

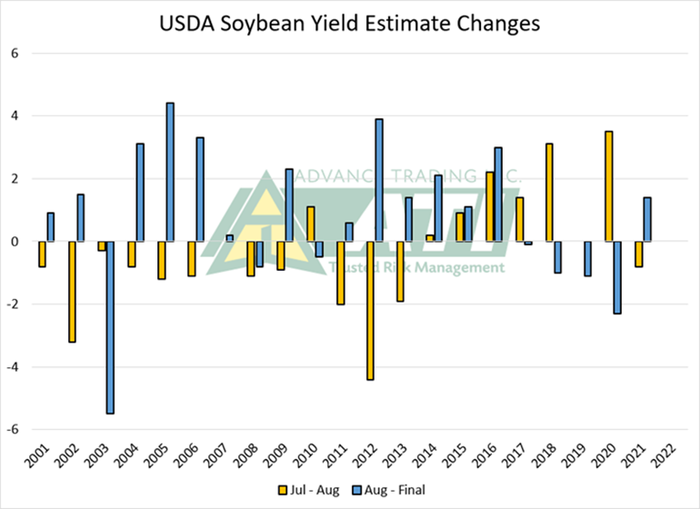

I’m sure we have all heard the old saying “short crops get shorter” or “large crops get larger” but recently that has not been the case. Since 2018 the final yields for both corn and soybeans have changed course from the July to August USDA reports, compared to the final yield. In years that the crop “grew” from July to Aug, the final yields ended lower than the August estimate. Last year (2021) both corn and soybeans were seen to be “shorter” from July to August, yet “grew” between August and when the final yield was released in January.

Even a small deviation from the USDA’s 2022 projected corn yield of 175.4 bu/acre and soybean 51.9 bu/acre estimates could spark a rally in prices, yet producers want to be careful not to get tunnel vision as we finish the 2022 growing season.

Bigger crops down south

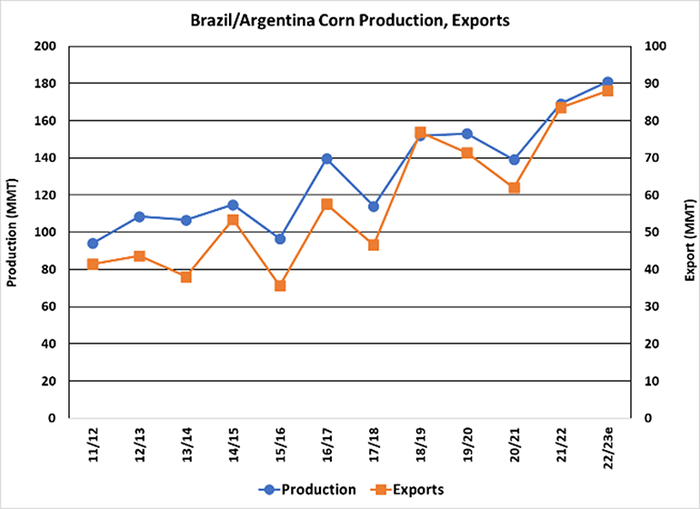

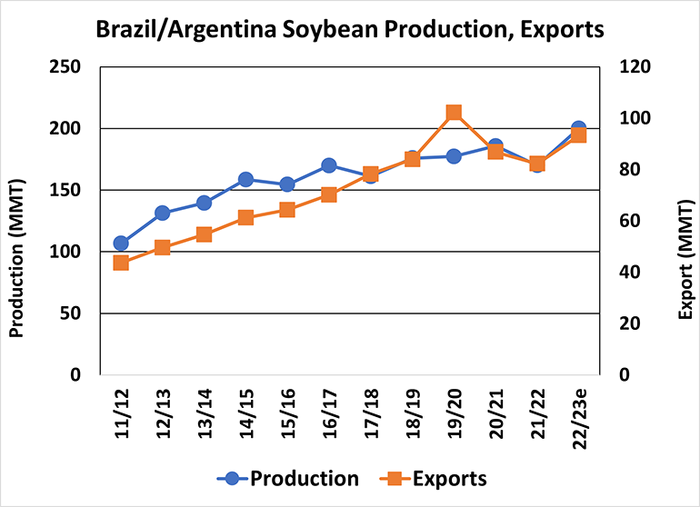

While the U.S. farmer harvests crops, producers in the southern hemisphere will begin planting their own new crop. Elevated prices are expected to have encouraged an increase in corn and soybean planting, resulting in a significant production increase for both crops. Brazil and Argentina combined are expected to increase corn production by an estimated 472 million bushels (12 MMT) and boost soybean production by a staggering 1.1 billion bushels (30MMT).

If these estimates come to fruition it would result in severe competition for U.S. corn and soybean exports from the spring of 2023 through the remainder of the marketing year. A decline in the national corn and soybean yields could initially spark a rally in the grains only to be offset by lower demand from exports upon favorable Brazil and Argentina crops.

Don’t through in the towel just yet. Production trends for the South America crop are expected to grow, but the 2022 growing season has not even begun in Brazil or Argentina. Last January dry weather boosted soybeans to a near $5 per bu. rally, proving the market’s bias can change quickly. It is not out of the question that a similar weather pattern this year in Brazil or Argentina can trim production estimates dramatically. With the southern Hemisphere increasing production, markets are always six months away from a “new” crop so keep your marketing plan flexible.

A consistent strategy

With so many variables in the marketplace today, what is the best plan to help navigate a continuously changing global balance sheet? One consistent strategy is for a producer to utilize call options when selling one’s grain. As a hedger, when you sell grain, you simultaneously purchase a call option. Last year this strategy paid dividends when selling grain at harvest while maintaining upside into the spring. If supply disruptions continue to support a market rally and prices move higher, a call will increase in value. In the event the call expires without any value, a producer can find security in the fact that they had sold the grain in a higher market.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like