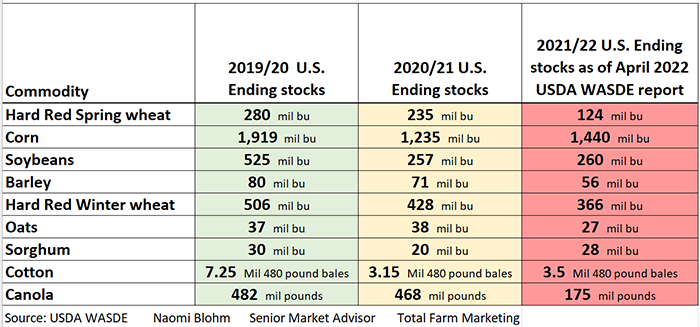

Last fall I alerted you to the fact that there were nine U.S. grain and oilseed commodities which had ending stock supplies substantially reduced from just two years prior. While it is normal to have cuts to ending stocks here and there throughout history, it is not normal to have nine commodities with tight ending stocks all at the same time.

Corn, soybeans, winter wheat, spring wheat, canola, cotton, barley, oats and sorghum all have tight ending stock supplies due to a combination of strong demand over the past two years and imperfect crop growing conditions last year.

When ending stocks get smaller, or are perceived to be getting smaller, commodity prices rally.

Understanding the reality of tight ending stocks (of especially corn and soybeans in the United States) heading into 2022 was key to then be able to balance the global supply and demand picture.

Global ending stocks of corn and soybeans were also trending lower into 2022.

Being aware of this information was paramount to comprehend how necessary it was for South America to have perfect weather January through February as their corn and soybeans were in the heart of production.

The world needed abundant production of South American corn and soybean crops. We now know this was not the case with South American soybean supplies nearly 15% lower than expectations; this justified the price spike higher for grains during late January and early February. This also resulted in global ending stocks of corn and soybeans being adjusted lower as well in subsequent USDA reports.

Looking at the northern hemisphere, the world needs Europe, Canada, the United States, China and Russia to have large crops this summer during the growing season.

However, cue the threat of a large portion of Ukraine's crops not getting planted, and the world is teetering on the edge of dramatically lower ending stocks into 2023.

Therefore, the pressure is on for the United States to have a record crop of nine grain and oilseed commodities this upcoming production season. Every weather forecast, satellite imagery, and USDA report will be scrutinized from now through summer.

The May USDA WASDE report, scheduled for May 12, 2022, will have the next update on the 2021/22 crop year, but also will show the first glimpse of the 2022/23 data sheet. It will be interesting to note how global demand and supplies will be accounted for with the ongoing war in Ukraine. Right now trade is assuming that two thirds of that Ukraine crop will be planted; if that ends up not being the case, then the world will continue to turn its attention to the U.S. and other northern hemisphere crop areas to make sure that perfect growing conditions exist.

There is no room for error this year for crop production. None. Not here in the United States or around the world.

Reach Naomi Blohm at 800-334-9779, on Twitter @naomiblohm, or email [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like