The markets continue to focus on the Russian-Ukraine war, with U.S. military experts estimating the war could last several months. If this were to happen, the 2022 Ukrainian planting season would mostly likely be severely impaired.

The ideal window for their country’s barley planting begins now. Planting for corn, soybeans and sunflowers are just a few weeks away.

Some have speculated that the land will still get farmed regardless of the war. This seems unlikely considering the nature of the war and reports on low availability of inputs like diesel fuel.

Even if Ukrainian farmers could produce a decent crop, there is no assurance it can be exported freely. Massive infrastructure damage has already taken place at several ports. Waterways have been mined to keep Russian ships from landing. Not that that matters, as shipping companies have ceased sending any and all vessels to this region.

Ukrainian exodus

Furthermore, there is a massive exodus of Ukrainian people. Over 2 million people have fled the country in the last two weeks alone. That is nearly 5% of the population. It would be like if everyone in the state of Nebraska just upped and left the U.S. in two weeks. The supply chain needs people to keep things going, and the people are leaving.

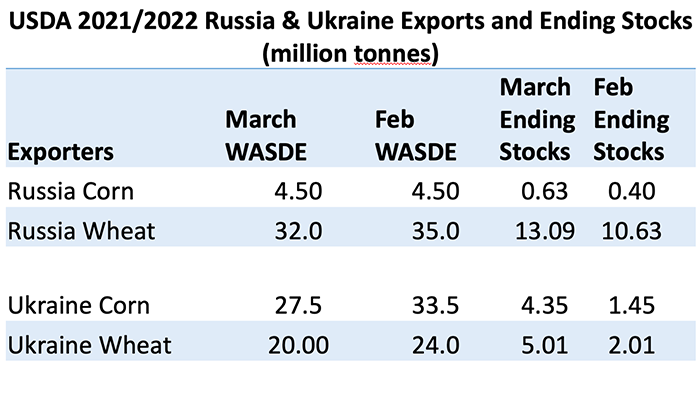

Prior to the war, USDA had been projecting 24 MMT of wheat and 33.5 MMT of corn being exported from the Ukraine. In Wednesday’s March update, USDA lowered corn exports by 6 MMT to 27.5 MMT. Additionally, it lowered wheat exports by 4 MMT to 20 MMT. USDA also reduced Russian wheat exports by 3 MMT for a combined 7 MMT.

We see this as only the beginning. Excluding Russia, Ukraine’s export gap in corn amounts to over 1.3 billion bushels.

That is what is at stake. The rest of the world will be spending the next several months or more trying to determine where they are going to find that corn.

Who will fill void?

The United States, Argentina and Brazil are the only significant corn exporters beside Ukraine that can significantly fill this void. USDA made an initial attempt to reconcile this in their March update by increasing corn exports by 75 million. Exports will likely need to be revised upwards of 400 million before the agency can realistically argue it has compensated for the Ukraine export fallout. This would send U.S. corn stocks back down to 1 – 1.1 billion bushels or almost pipeline supply.

In the case of wheat, USDA actually decreased American wheat exports in its March report, despite nearly 30% of the world’s wheat market being taken offline due to the pending Russian aggression.

Additionally, USDA raised wheat’s ending stocks by 5 million bushels.

We understand that things can be difficult to assess through the “fog of war,” but it appears to me USDA didn’t even try.

Brazil losses

CONAB, Brazil’s ag department, released its March update Thursday morning. This report also ignored the Ukraine export gap by leaving corn projections unchanged at 35 MMT. That is based off of a production of 112.3 MMT. Brazil’s first crop corn lost a third of its yield to drought, and the size of the second corn crop is yet to be determined.

The market will be very sensitive to any dry weather in Mato Grosso. Brazil has reportedly begun selling corn for export shipment in the month of April/May, a period when corn exports are near zero. With Brazil helping to fill the corn export void left by Ukraine, the country’s corn exports could also rise an additional 300 million bushels.

Matthew Kruse is President of Commstock Investments. He can be reached at 712-227-1110.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like