Mato Grosso’s “safrinha” crop is mostly established. A whopping 88% of its crop is rated good to excellent, a record. Last year it was 68%.

The crop is far enough along, that if it never rained again this season, (and likely won’t) it will not change its current trajectory. We agree with the most bullish production scenarios in Mato Grosso. Where we differ is with respect to Parana, the second largest producer of safrinha corn, and its production prospects.

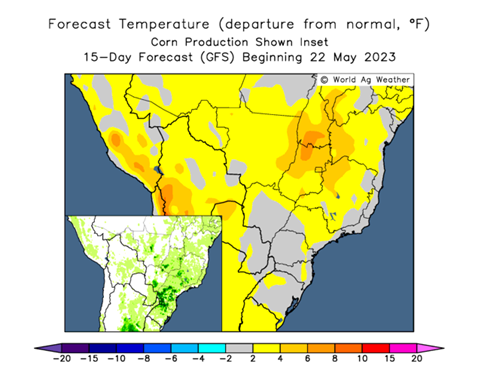

The market is also looking at temperatures, particularly in the state of Parana, as frost risk is not unheard of. Evening temperatures have already been running cold and 15-day forecast shows temperatures running seven degrees F below normal in Southern Brazil. A high percentage of corn in the state of Parana has barely reached tasseling stage and so a frost would be extremely damaging.

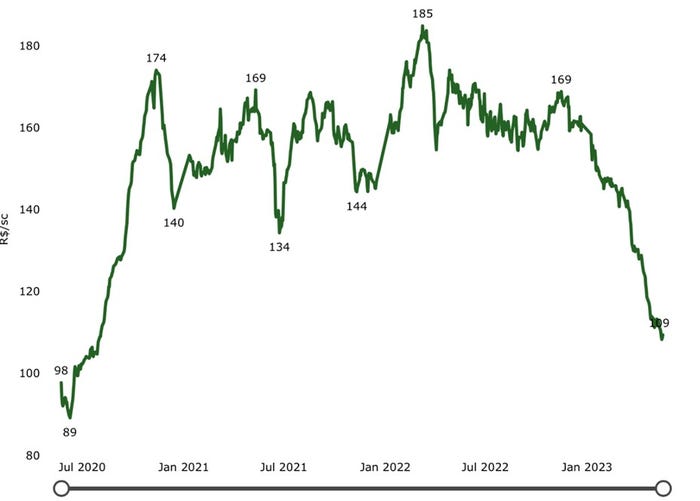

Plunging prices

Cash grain prices have plunged in Brazil, causing panic selling as prices reach or fall below the cost of production. Soybean prices reached $9.80/bu. in Mato Grosso last week, falling to levels not seen since roughly August of 2020. Reportedly 12 MMT of soybeans were sold last week, a large volume for a single week. This was mostly panic selling based on concerns of the market going even lower. This took crop sales to 54%, still below the historical level of 65% for this time of year. That still leaves 71 MMT of Brazilian soybeans to be sold today, compared to only 40 MMT at this time last year. As the market works through this supply, we do see a rebound in prices; however, it will most likely take longer than last year.

Cash soybean prices in Mato Grosso

Farmers that are well-established with little to no debt are still profitable. Farmers that are in heavy growth mode, carrying large debt capital that are developing new land for production, are going to experience financial stress. We estimate cost of production for these producers closer to $11 to $12/bu.

As the soybean harvest has wrapped up, farmers are working on purchasing inputs for next season. One benefit to Brazilian growers is that they have not yet locked in their costs for the 23/24 crop season. They have time to adjust as input costs should come down as profit margins shrink. Most U.S. farmers on the other hand, already have their input costs locked in.

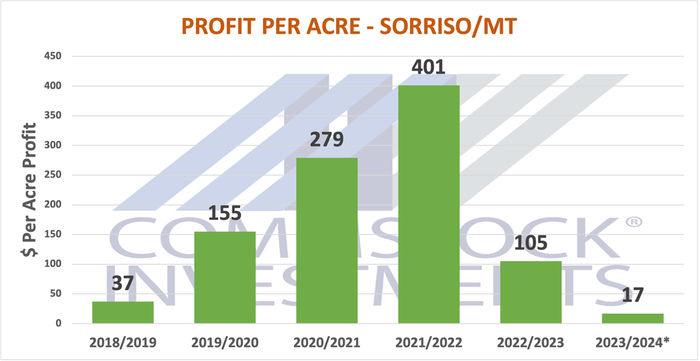

This market collapse will likely make many Brazilian farmers rethink their cropping strategy. While it may not stop the relentless growth of planted area, it should slow it. One projection showed profit forecast for the 23/24 Brazilian soybean crop at a measly $17/acre, not much better than break-even levels.

That is going to ruffle some feathers as soybean production in Brazil has been a license to print money the last four years.

Matthew Kruse is President of Commstock Investments. You can subscribe to their report at www.commstock.com.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

BrazilAbout the Author(s)

You May Also Like