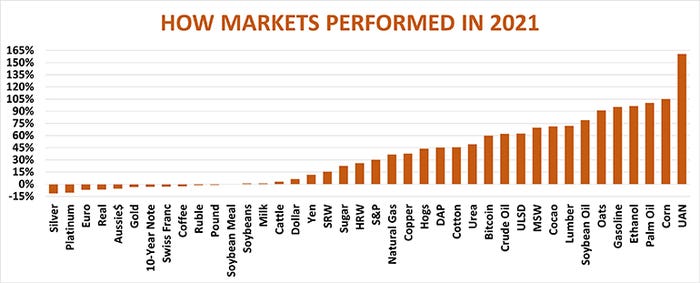

Nobody knows how markets will fare in 2022. But a look back at the year just completed could offer some perspective, and perhaps a few clues on what to watch over the next 12 months.

With 2021 in the books I looked at how various assets performed. The methodology for this analysis provides one of the key factors that can affect gains and losses.

The study included 40 different commodities and financial instruments. Such yardsticks are commonplace this time of year, in part because lack of others news makes this type of story an easy take. But figuring performance isn’t quite so simple, one reason why the numbers listed here likely will be different than those reported elsewhere.

Take one example close to the hearts of farmers: corn. Some reviews put the crop’s prices up around 20%, others put the gains at 35%. My verdict: Corn futures more than doubled, the second best performance of any of the assets studied.

The nearby corn futures chart, rolled before delivery, rose 22%. Gains by the current nearby contract, Mach 2022, totaled 35%. Neither of these numbers reflects what actually happened to a corn trader during a tumultuous year.

The March 2022 contract, for example, tracks 2021 crop corn, a marketing year that didn’t begin until Sept. 1. As a result, focusing on this contract alone missed the big rally posted by “old crop” 2020 corn during the calendar year.

Nearby futures also don’t offer a realist assessment from a trader’s perspective. The nearby rolling methodology simply transitions the prices from one contract to the next before delivery or last trading day. Most years this doesn’t create too much distortion. But in 2021 nearby contracts at times traded for huge premiums to the next deferred as end users employed bull spreads to cover risk of rising prices and strengthening basis.

This was most evident during the roll from July 2021 corn futures to September 2021. July closed at a premium of $1.2075 premium to September on first notice day. A trader buying nearby futures and rolling them netted these profits.

Adjusting for rolls

Taking the gains – and losses – from these rolls into account is a process called back-adjusting.

Most of the time, of course, deferred futures contracts trade at a premium to nearbys, due to the cost of storing commodities. This carry developed in soybeans more than it did in corn in the fall of 2021. So, while nearby soybeans did trade at a premium to deferreds at times last year, the spreads weren’t enough to make as much of a difference as with corn. Nearby soybean futures rose 2% during the year, compared to 10% on the back-adjusted chart.

In the energy market backwardation is the term for markets with the nearby trading at premium to deferreds, which occurred during the big surge in crude oil in 2021. Not surprisingly, then, back-adjusted crude futures rose 62% in 2021, some 7% more than by comparing nearby contracts alone without the adjustments for rolls.

Spreads between contracts work differently in financial markets like stocks and bonds. Instead of incurring carrying charges, these assets generate dividends and interest. Deferred contracts as a result trade at a discount to the nearby, reflecting the income investors holding the contracts will receive.

Stocks on average don’t pay big dividends these days and interest rates, though rising, are still quite low by historical comparisons. Still, the earnings do add a little to performance. Total returns by the S&P 500 Index rose 30%, around 2% more than the index itself. Holders of the benchmark 10-Year Treasury Note lost 3.4%, not the 5.7% indicated on the nearby chart, because interest payments offset some of the losses.

Rate hikes fuel dollar

Interest rates remain one of Wall Street’s biggest concerns as 2022 begins, after inflation heated up to its highest level in 30 years, in part due to soaring commodity prices. But these trends had a mixed impact on some markets.

Rising interest rates helped boost the dollar 6% in 2021, attracting investors looking for safe returns offered by U.S. Treasuries. Most other currencies weakened against the greenback. The exception was the Japanese Yen, which benefited from safe-haven buying despite negative interest rates there.

Some inflation-sensitive commodities denominated in dollars suffered in response to the dollar’s move. Gold, silver and platinum all lost ground, but one metal was a winner. Copper gained 38%, hitting an all-time high on strong demand and supply chain disruptions. And some dollar-sensitive contracts, including wheat, showed a positive correlation to the dollar, also ending the year with gains following the surge in Minneapolis futures.

Perhaps befitting an unusual year, the biggest winner in the financial space was Bitcoin. Despite slumping 71% from its highs by year end, the digital phenomenon still ended 60% higher overall.

Though Bitcoin was one of the most volatile assets last year, the leader in that category was a painful one for farmers. Fertilizer costs were among the biggest gainers, with urea swaps at the Gulf up 49% and DAP rising 45%. Even those rallies paled by comparison to UAN, which ended the year 161% higher at the Gulf for 32% swaps.

Of course, what happens one year doesn’t necessarily continue to the next. There was no correlation at all between 2021 and 2020 results for the 40 assets studied. But crop contracts did manage gains in both years. That perhaps raises a little hope that those futures can make it three in a row.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like