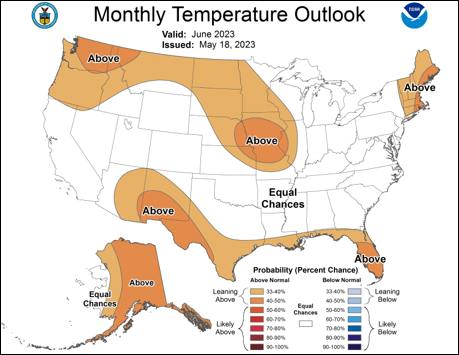

The National Weather Service this week forecast warmer to much warmer than normal temperatures during June for most of the western Corn Belt and Northern Plains. Some contend this is just the start of a pattern that will eventually evolve into a hot, potentially dry summer that would result in below-trend yields for corn and soybeans.

Crop Progress and the threat of Prevent Plant acres are making headlines as well. Crop Progress through Sunday of this week showed corn at 81% planted nationwide. This is ahead of the 5-year average, but North Dakota is only 32% planted. For them, this is their slowest planting pace for this time of year with much of their planting progress made in the last week. Prevent plant will be a consideration for the region beginning this Thursday.

Soybean planting progress is 66% complete nationwide and is ahead of pace. It is possible the missing corn acres may switch to soybeans, though the recent price breaks may prevent that move.

How many acres will be Prevent Plant across North Dakota, South Dakota, and Minnesota? Our research team believes it could be 700,000 acres. We will know more by next week’s report, due to be released Tuesday, May 30 after Memorial Day is observed.

The fact, however, is that it is impossible to accurately forecast weather and production at this point in the growing season. There are simply too many unknowns. Given the current uncertainty, let’s review three time-honored principles that accompany weather markets:

Price can exceed expectations—both to the upside and downside

There are some projections that the corn and soybean markets have already peaked. As a student of the market, you understand this critical fact: We simply don’t know what the high will be since price prediction—in this case, anticipating the behavior of a weather market—is impossible. It’s also important to remember that price can exceed expectations, both to the upside and downside. In this type of environment, it’s critical to exercise discipline to manage price risk.

Increased price volatility—and opportunity—is seen

Increased price volatility can be viewed with fear, or as opportunity. We strongly believe that increased price volatility should always be viewed as opportunity.

Execution is key to managing a weather market event

It’s one thing to acknowledge that price prediction is impossible and price volatility should be viewed as opportunity. It’s another to do something about it—that is, design and execute a risk management strategy. By executing a well-thought-out marketing plan, you are taking control of the situation as opposed to acting on a whim that can lead to less-than-desirable results.

Weather-related production concerns can present attractive pricing opportunities. Such events are often quite volatile, however, underscoring the importance of developing and implementing a disciplined approach to risk management. As always, your Advance Trading advisor is ready to help implement a customized marketing strategy for your operation.

.png?width=700&auto=webp&quality=80&disable=upscale)

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like