While soybean prices had a significant price setback early this week, the trend overall remains higher for soybean futures. The market has been in a slow upward channel on daily charts since mid-October.

Tight ending stocks in the U.S. and a parched Argentina soybean crop keep the market overall supported, while a large Brazil crop keeps the rallies in check.

Thinking of the New Year and being mindful of the tweaks that will likely occur on next week's January 12 USDA WASDE report, I got curious about soybean demand.

Overall soybean demand

The December 2022 USDA report said that for the 2022/23 crop year, there were 4.346 billion bushels of soybeans grown in this country.

On the demand side, essentially half of the soybeans we grow are exported, and the other half are used for soybean crush. (Specifically, 2.045 billion bushels are slated for export demand while 2.245 billion bushels are to be used for crush.)

U.S. export demand for soybeans has been relatively decent. Cumulative inspections (soybeans that have actually left the country) year-to-date are at 28,617,907 metric tons, which is actually close to 51% of the USDA's forecast for the 2022-23 marketing year versus the five-year average of 49.9%. In other words, we are on target to meet the USDA’s projected goal.

And the soybean crush demand has been fantastic, with demand for renewable diesel expected to grow by leaps and bounds.

Soybean crush plant growth

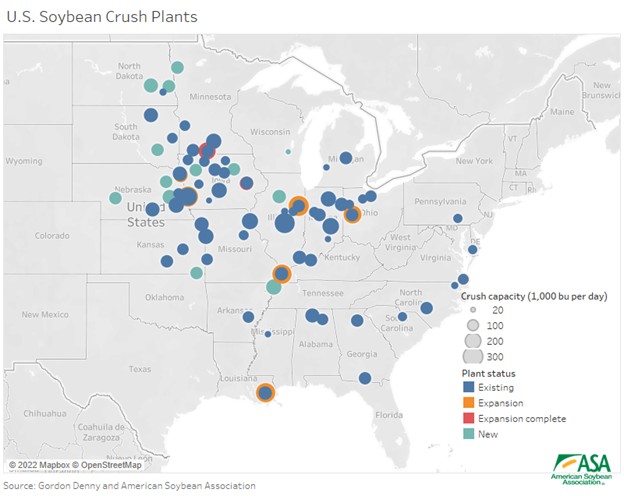

According to the American Soybean Association in November of 2022, “It is estimated that there are 60 soy crush plants currently operating in the United States. These 60 plants can use around 2.2 billion bushels per year…To date, there have been announcements for 23 plant expansions, which would add about 750 million bushels per year in crush capacity…Of the 23 crush plant announcements, 13 are for new plants and 10 are for expansion of current plants, at least two of which have been completed.”

Current soybean crush demand

Wow! The U.S. currently has 60 soybean crush facilities that are using approximately 2.2 billion bushels of soybeans annually.

I looked back at USDA reports since May of 2022 when USDA first reported on production and demand estimates for the 2022/23 crop year, just to understand how current crush demand ebbs and flows monthly.

After all, we have been hearing about this increased crush demand coming in the future, so I wanted a baseline to see how the USDA has been reporting crush demand so far. Here are the results:

December USDA report - 2,245 million bushels of soybeans used for crush

November USDA report - 2,245 million bushels of soybeans used for crush

October USDA report - 2,235 million bushels of soybeans used for crush

September USDA report - 2,225 million bushels of soybeans used for crush

August USDA report - 2,245 million bushels of soybeans used for crush

July USDA report - 2,245 million bushels of soybeans used for crush

June USDA report - 2,255 million bushels of soybeans used for crush

May USDA report - 2,255 million bushels of soybeans used for crush

Overall, the average for the past eight months for soybeans used for crushing for the 2022/23 crop year is 2.243 billion bushels. That meets the demand for current needs.

Estimating future soybean demand for the crush

The 23 plant expansions, which would add about 750 million bushels per year in crush capacity, are expected to be completed between now and 2025.

Now, here is some very simple math. To gain an additional 750 million bushels of soybean production, American farmers would have to plant an additional 14 million acres of soybeans, assuming 53.5 bushels per acre nationwide yield. According to the most recent USDA report, farmers planted 87.5 million acres of soybeans in the spring of 2022, with yield estimated at 50.2 bpa.

Eye-popping and jaw-dropping for sure. The reality is that by 2025, soybeans used for the crush will be close to 3 billion bushels. That also means that by 2025, U.S. soybean acres would need to be close to 101 million planted acres to account for the combined demand for crush and exports. (This is, of course, assuming export demand remains near 2 billion bushels annually. U.S. export demand will likely change in the coming years as South American production continues to increase and will be competing with the U.S.)

The reality

USDA will not add all of that demand at once into the upcoming 2023/24 balance sheet scheduled to come out in May of 2023. However, they may start to allude to it at their annual USDA Outlook Forum in Washington D.C. on Feb. 23- 24.

The USDA has a tendency to take baby steps in updating demand or production numbers, and my guess is that they will be slow to increase demand for crush.

Likely, for each production year between now and 2025, the USDA will slowly add 200 million bushels of demand annually for crush. After all, it takes time to build a plant, and there is always the risk that a plant actually does not come to fruition and that those additional acres may not be needed.

Regardless, the soybean demand story for American farmers looks to be friendly for the long term. Keep in mind, just because the demand story is friendly, does not mean that soybean prices need to stay at higher lofty price levels. There will be price peaks and valleys in the future, as there have been in the past.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like