Over the weekend Vladimir Putin announced Russia would not extend the Export Grain Corridor agreement with Ukraine, which had allowed larger amounts of the latter’s corn and wheat production to reach the world market.

Putin’s position is that not enough of the grain exports are going to those drought-stricken, underdeveloped nations which are badly in need of food supplies. The Russian government says that only 3% of food exported under a U.N.-brokered deal to release grain from blockaded Ukrainian ports has gone to the poorest countries, and that Western countries account for half of all shipments.

Latest data from the UN showed that the European Union accounted for 47% of total grain and oilseed shipments, with Spain and Turkey being the top two destinations.

Meanwhile war restrictions imposed upon Russia for its unprovoked attack on Ukraine prevent Russian fertilizer supplies from reaching the world market. According to one source, Moscow said suspension of the grain export agreement was the result of Ukraine attacking the Russian Black Sea vessel fleet last week.

U.S. corn export impact

That being said, could the implications of the suspension prove beneficial to U.S. corn exports? According to USDA, the current U.S. corn balance sheet has exports forecast at 2.150 bbu and ending stocks of 1.172 bbu. The latter, when domestic corn use is added in, equates to an 8.3% stocks-to-use ratio, which provides slightly less cushion than this past year’s 9.2% ratio.

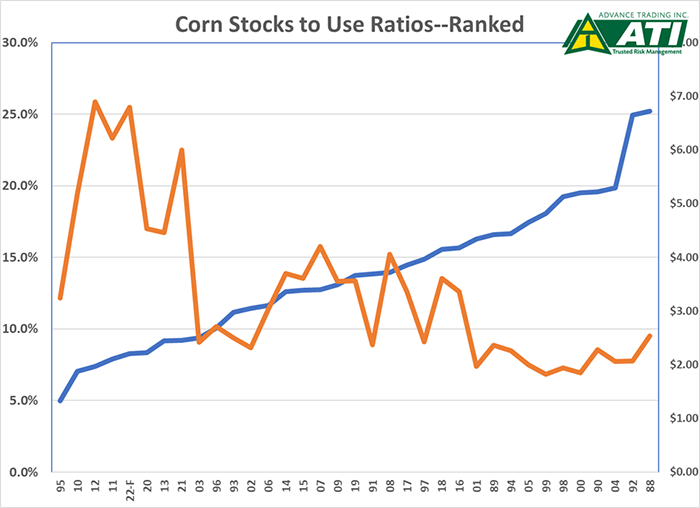

To put that into perspective, the 22-23 expected ratio, if realized, would be the 5th tightest of the past 35 years, going all the way back to the drought of ’88 when the average U.S. corn yield fell 28 bushels (29%) to just 84.6 bpa. And the current average producer price forecast of $6.80 per bushel is just a dime below the 35-year high achieved when 2012/13’s 7.4% ratio resulted in a $6.90 farm price. See graph below.

How will the export agreement suspension impact Ukraine exports?

USDA is forecasting 22-23 shipments of 15.5 MMT; others in the trade estimate exports as high as 24-25 million. On average, during the November-April period Ukraine exports about 120 mbu of corn per month. Once the invasion began and from March through July, monthly shipments plummeted to 45 million (before the agreement took effect in July) and have since peaked at 85 million in September.

The USDA’s latest forecast works out to monthly shipments of approximately 1.3 MMT/50 mbu.

The what-if questions

If one adopts USDA’s number, which on a monthly basis is very near the post invasion, pre-agreement pace and Ukraine is still able to export by rail as well as through the smaller ports along the Danube River, then the suspension’s impact on world trade is fairly minimal. If the world grain trade had a 24-25 MMT export figure factored in for 22-23, the non-renewal of the agreement would suggest 9-10 MMT (320-390) of demand would have to be directed to other origins, namely the U.S.

Add to that (1) the European corn crop continues to shrink (likely half of their needed imports were expected to be originated from Ukraine and most of the rest from Brazil; now the first portion could be in jeopardy). (2) China had been expected to buy 2-4 MMT of corn from Ukraine; most in the trade believe the Brazil-China agreement will be finalized by the end of 2022, China could be in severe competition with Europe for Brazilian corn. (3) Finally, the Argentine corn crop is NOT being planted in particularly good fashion and the 3-4 MMT increase in that country’s exports, which is forecast, may not be achieved.

The bottom line

The U.S. corn balance sheet is approaching “precarious” when viewed over the last 35 years. While we are reluctant to say prices are headed higher, there is enough uncertainty between Ukraine’s export potential, the EU’s corn needs, and the less-than-favorable start to the Argentine planting season, to suggest the situation could be highly beneficial and profitable in marketing this year’s corn crop.

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like