Many farm corporations were created years ago in the 1970s when corporate tax rates were significantly lower than individual income tax levels. This was the right tool to use at the time, and many farm families saved (or deferred) thousands of income tax dollars by doing so. However, at some point, the rubber hits the road as we witness in many family farm transitions.

For one, a common mistake is the perception the value of a corporation is simply the value of the underlying assets it owns. This is rarely the case, as it’s much more difficult to sell corporation stock in the open market versus selling outright parcels of farmland or equipment.

These types of misconceptions can turn into a source of contention when it comes time to sell, transfer or buy-out other family members in the next generation.

Corporation fair market value

One option is to understand how a business valuation specialist may value your farm corporation as a business. This is a process you could implement versus some type of informal or arbitrary method which is often used by some families or their advisors. The process may look like this:

Appraise assets first, then

Deduct for liabilities, then

Deduct for deferred tax liabilities, then

Discount for lack of marketability, then

Discount for lack of control or minority interests

Appraise assets – Yes, the process begins with appraising the assets the corporation owns for their fair market value. For estate tax purposes, this may involve hiring a certified land appraiser to appraise the farmland or an equipment auctioneer to appraise the farm equipment and machinery. This is where some will simply use these values and divide by the total shares of stock to derive at a stock price.

Deferred tax liabilities – Valuing corporation shares will not only take into account the value of the underlying the assets, but also any deferred tax liabilities and debts. Work with your tax advisor to estimate what this deferred tax liability may be when the corporation is liquidated. This may vary depending on whether you have a C-corporation or S-corporation.

Closely held business deductions – Closely held family businesses were not intended to be liquidated because it may trigger significant income tax issues. In fact, some use this to their advantage and purposely keep land in corporations to disincentivize the next generation from selling land.

In closely held family businesses, it is a common restriction for only lineal descendants of the family to be a permitted owner in the farm business. There may also be a process in the stockholder’s agreement to discount the price of stock in the event of family buyouts. A business valuation appraiser will typically apply discounts for these restrictions for lack of marketability and voting control of the individual stock owners. Under current laws, I’ve seen these discounts range from 15% to 60% depending on how restrictive the provisions in the shareholder’s agreement may or may not be.

540-acre farm example

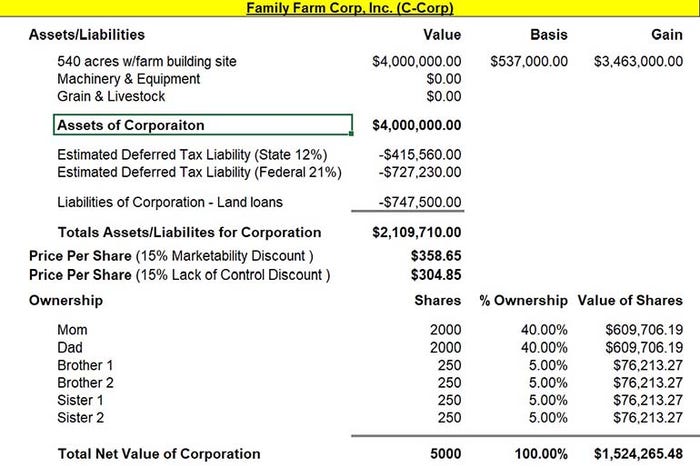

See the image below which illustrates a family I recently worked with who hired a business valuation appraiser to value their farm corporation stock. This is a C-corporation which owned land only. The land has a low cost basis which will trigger capital gains if it is ever transferred out of the corporation or sold. Not everyone realizes the assets inside a corporation do not get a new step-up in basis as they pass through the stockholder’s estate, only the corporation stock does.

You can see the potential dilemma which may occur in the family discussions above if one of the children believes their stock is worth 5% of $4 million of corporate assets owned ($200,000), versus 5% of $1.5 million net value of the corporation ($76,000).

Please take time to review the provisions in your shareholder’s agreement and whether they contain the ownership restrictions and valuation process you believe to be fair for your situation. In absence of such terms, this may invite other family members or their legal advisors to weigh in on their opinion, or even worse leaving – it to a court ruling to determine the value of your corporation.

More and more families are restructuring common-owned land into other land entities as we’ve wrote about before. For the topic of my next article, I will write about another popular question we receive; how to get land out of your corporation.

Downey has been helping farmers and landowners for the last 22 years with their family farm transition, estate planning, leasing strategies, finances, and general land consultation. He is the co-owner of Next Gen Ag Advocates and an associate of Farm Financial Strategies. Reach Mike at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like