The United States exports about 16% of its corn production, 48% of its soybeans, 52% of its wheat, 75% of its sorghum, and 95% of its cotton. Those are big numbers. So it’s important that producers and users of these commodities fully understand how to accurately monitor exports.

Late morning every Monday, the USDA issues its Export Inspections Report. All food and fiber products grown in the U.S. that are loaded and ready to ship to a foreign country must be inspected by USDA to certify what it is and what quantity is on that train, barge, or ship. Without the USDA certificate of inspection, that load cannot leave our borders.

The purpose of the inspection is a matter of national security to assure we do not nearly exhaust our supplies of affordable food and fiber without the market participants and the government knowing it.

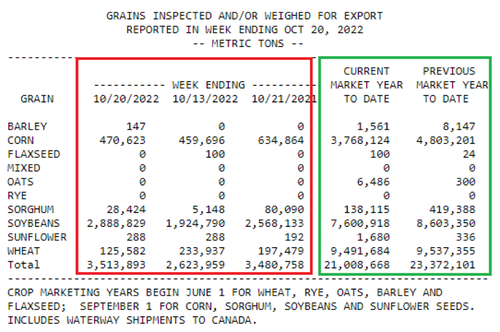

Below is the Weekly Export Inspections report from USDA issued Monday, 24 October 2022. The numbers are for the current marketing year. The beginning date for each commodity’s marketing year is under the chart.

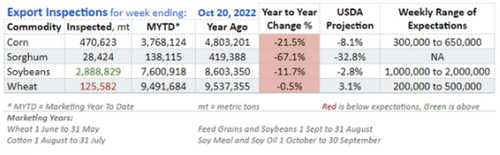

The magnitude of the market impact is determined by what was expected for each commodity versus what the actual quantity was inspected. Many market reporting services (Reuters, Bloomberg, etc) do a survey of market analysts and report the range of estimates and the average estimate the day before the report is issued.

The numbers in the red box are the ones which will impact the market immediately and most likely for only a matter of minutes. Speculative traders are most interested the numbers in the red box. They are usually looking for short term profitable trade opportunities.

Producers and users of commodities are more interested in the numbers in the green box, which have very little impact the day the report is issued. Those numbers are far more important for the long-term price outlook.

Since carryover (how much is left at the end of the marketing year) is the most important market factor above all else, the most important export number is the year-to-date exports compared to what the USDA projects for each commodity. Since the expected numbers for each weekly report are not on the USDA report and the exports the USDA projects for the marketing year is only issued once a month, we issue our version of weekly export inspections. It includes the actual export inspections versus what was expected for that day and what export inspections year-to-date are compared to USDA projections from the monthly Supply and Demand Report. Take a look at our report and note the difference from the USDA report above:

What’s it telling you?

Nothing ever happens in an economy until somebody sells something, and so it is with exporting commodities. Next week, I will explain the weekly Export Sales Report so you can easily use it as a price outlook tool.

Wright is an Ohio-based grain marketing consultant. Contact him at (937) 605-1061 or [email protected]. Read more insights at www.wrightonthemarket.com.

No one associated with Wright on the Market is a cash grain broker nor a futures market broker. All information presented is researched and believed to be true and correct, but nothing is 100% in this business.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like