There has been plenty of debate over USDA’s Prospective Plantings report released last week, and most of it focuses on the much smaller-than-expected corn acreage estimate.

The March Intentions estimate for 2022 showed a change in acres from the Ag Outlook Forum and also the average trade guess. Corn came in surprisingly lower at 89.490 million acres, versus both estimates of 92 million acres. This represents nearly 2.5 million acres less than what was expected.

Soybeans surprised the market with an estimate of 90.955 million acres planted, nearly three million acres higher than the 88 million acres projected by the USDA's Ag Outlook Forum and two million acres higher than the 88.9 average trade guess estimate. Wheat dropped slightly to 47.351 million acres, which was just over half a million acres less than the Ag Outlook Forum at 48 million acres and the average trade estimate of 47.9 million.

Annual debate

Each year USDA’s March report spurs a spirited debate and 2022 was no different. Some believe that the dramatic weakening of the soybean-corn ratio following the report may result in an increase in final corn acreage compared to the current projection of 89.5 million acres. Rather than joining the argument, pay attention to the relationship between the soybean planting intentions estimate and the final total; Consider potential factors that could influence eventual corn and soybean 2022 acreage.

While final soybean acreage was above intentions compared to 2016-2018, there have been many times since 2000 when the reverse was true. What are the driving forces that affect those changes? Weather conditions at planting time are certainly at or near the top of that list.

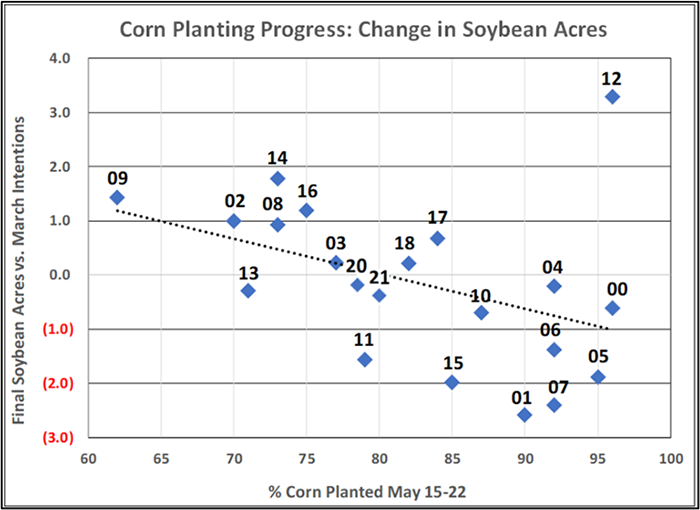

To quantify that impact, the chart examines corn planting progress by mid-May and the corresponding change in final soybean acres. It’s not a perfect fit but the relationship over time does suggest that the higher the percentage of corn that is planted, the more likely it is that soybean acreage will be near unchanged or lower. For example, in 2021 corn planting was at 80% and final corn acreage exceeded March intentions by 2.2 million acres. Conversely, final soybean acreage in 2021 was 0.4 million acres below the March intentions projection.

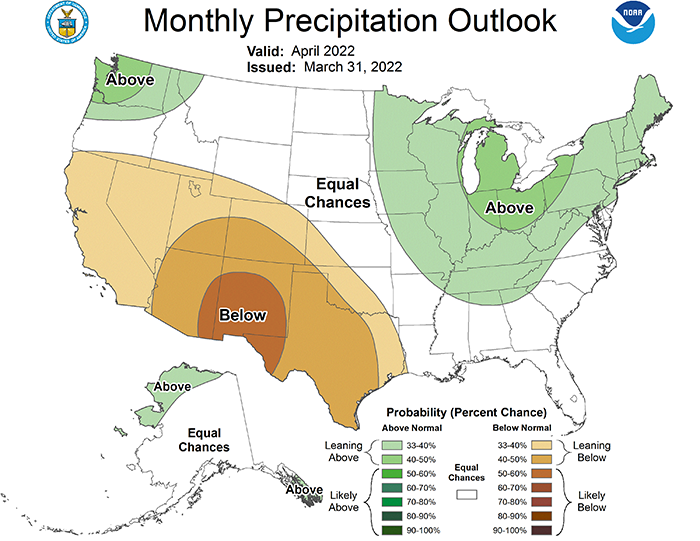

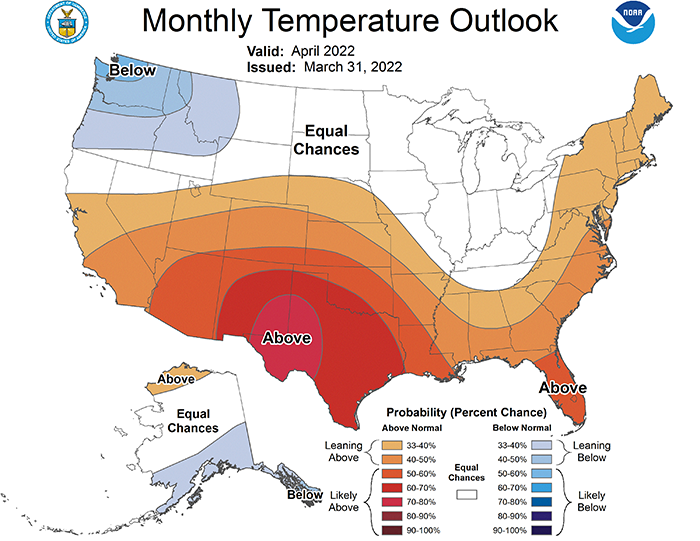

Each year is different, but history suggests there is room for change from initial estimates for both corn and beans. As the historically wet spring in 2019 demonstrated, there will undoubtedly be some surprises in weather and planting conditions over the next 6-8 weeks. The National Weather Service released the weather forecast for April on Thursday, showing a cool and wet corn belt through the month. Will this delay corn planting and keep soybean planting in line with the intentions report, despite the advantageous price to plant corn over beans?

Regardless, it’s important to stay focused and remain in close contact with your Advance Trading advisor to continue to manage risk for both crops in 2022/23, while maintaining flexibility to participate in market strength.

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like