Tomorrow’s World Agricultural Supply and Demand Estimates report from USDA’s World Agricultural Outlook Board will be widely watched for its anticipated increase in corn and soybean supplies after what was previously believed to be a historically tight supply situation.

Does that mean a bear market is just around the corner? Not necessarily, even if prices ease in tomorrow’s report. Here are a few factors guiding our analysis ahead of the report’s release and what farmers need to watch for as they gear up to make marketing moves following harvest.

USDA releases the WASDE and Crop Production reports at 11am CST. For live coverage and analysis, tune into FarmFutures.com or @FarmFutures for the latest insights.

Supply updates

Yield improvements are likely to highlight supply revisions in tomorrow’s WASDE and Crop Production reports. Despite a turbulent growing season, in which many market watchers anticipated a third straight year of crop shortfalls, farmers across the Heartland have been pleasantly surprised at yield outcomes.

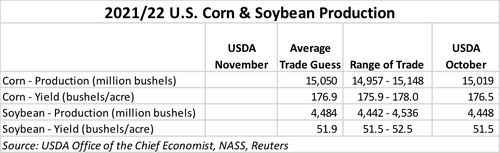

Based on average trade guesses, tomorrow’s WASDE report could see corn yields increase 0.2% past the current 2021 estimate of 176.9 bushels per acre (bpa). This new projection of 176.9 would top 2017 yields (176.6 bpa) as the largest on record, simultaneously adding up to 31 million bushels to 2021 corn production projections.

That would keep the 2021 corn crop at the second largest on record at about 15.05 billion bushels, behind only 2016’s crop (15.15B bu.).

Soybeans yields are likely to see a more significant increase, with traders expected a 0.8% increase from current projections of 51.5 bpa. An expected 2021 soybean yield reading tomorrow of 51.9 bpa would tie 2016 for the top U.S. yield on record.

That also means that around 36 million bushels of soybeans will be added to 2021/22 supplies. At an average trade guess of 4.48 billion bushels, any upward adjustment will continue to allow the 2021 crop to remain the largest on record.

The uptick in supplies is intuitively bearish for prices. But amid several recent market developments, soybeans may have more reason to worry about downward price pressure than corn.

Demand factors

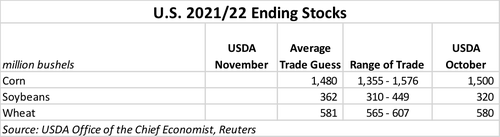

Corn demand prospects continue to improve early in the 2021/22 marketing year. Based on average trade estimates, USDA could add around 50 million bushels to 2021/22 usage forecasts, keeping 2021/22 corn ending stocks at the tenth tightest on record. After dropping feed and residual usage rates in last month’s WASDE, the WAOB may be more likely to add usage volumes to ethanol targets.

There’s good reason to think this is the case. A rough estimate from U.S. Energy Information Administration (EIA) data suggests at least 487.9 million bushels of corn were used for ethanol production in October 2021, up 12% from September.

High fuel prices amid a global energy crunch have increased demand for the more cheaply produced fuel additive over the past month and the ethanol industry has not delayed in responding to market incentives. Weekly output has increased over 21% over the past five weeks, so it seems likely WAOB will focus the usage increases on ethanol targets tomorrow.

Ethanol usage may offset higher corn supplies, but soybeans are likely going to be another story.

Markets expect over 40 million bushels will be added to 2021/22 ending stocks. Of course, most of that will come from yield upgrades. But a fractional volume will likely also be pulled from soybean export targets when WAOB releases updated soybean usage forecasts tomorrow.

It’s no secret that the world’s largest soybean buyer, China, is not importing as many soybeans this year. Chinese customs data reported overnight that October 2021 soybean imports into China were 41% lower than a year prior.

But it’s not just China. High soybean prices are pressuring crush margins around the globe. As of October 29, marketing year to date total U.S. soybean export commitments were 47% lower than the same time a year ago.

And despite worries about record tight ending soybean stocks a few months ago, this year’s harvest as well as higher revisions to stocks data means that U.S. soybean stocks are not as tight as those of corn. That leaves soybean futures prices more susceptible to price losses in tomorrow’s report than corn and wheat.

New crop price ratios for 2022 soybeans and corn currently favor corn acreage in 2022. Bearish pressure is certainly afoot for the soy complex, but it will likely be limited thanks to tight global edible oil supplies and stiff acreage competition with corn, wheat, and other crops in the coming months.

Domestic wheat usage and supply estimates are largely expected to remain unchanged in tomorrow’s reports. Marketing year to date outstanding export sales to China are nearly a third lower than the same time a year ago.

A look around the world

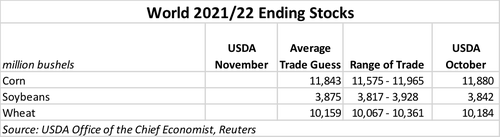

I will be keeping a close eye on China’s import paces in tomorrow’s report. As mentioned earlier and in previous analyses, China’s import paces have been falling over the past couple months.

A USDA attaché stationed in Beijing estimated last week that China’s 2021/22 soybean imports are likely to hold steady at 3.71 billion bushels. Despite lower recent soy imports, lower global rapeseed supplies could help boost China’s interest in soybeans in the coming months.

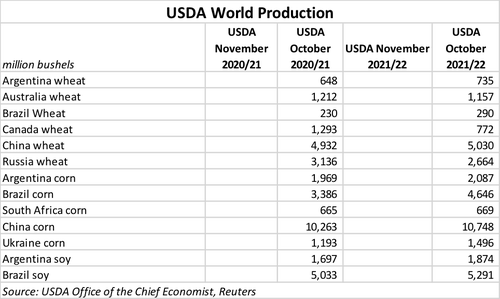

Recent rains in Brazil and Argentina have helped ease supply pressures on the global corn and soybean complex. The freshly planted crops still have a way to go before final totals are calculated early next year, but any significant change in USDA forecasts tomorrow could send ripples through the markets.

Global wheat movement will play a significant role in price action for the U.S. wheat complex tomorrow. Steady demand from top global wheat buyer, Egypt, in recent weeks due to a growing population has helped drive up prices amidst tight global supplies.

A USDA attaché projects Egyptian wheat imports in 2021/22 will increase over the prior year’s import volumes. However, the post‘s projections are still well below USDA’s current target of 477.6 million bushels, leaving the Egyptian wheat import target unlikely to be changed.

Another USDA attaché in Algeria cites crop failures this summer as justification for a 20-million-bushel increase in the northern African country’s import forecast. Algeria is the world’s sixth largest wheat importer, though it could unseat Bangladesh for fifth place if WAOB raises its import projection.

Beneficial rains in South America could help wheat production forecasts for the region. India has a surplus of wheat and lower freight costs than the Black Sea, which could attract Asian wheat buyers. Australia is expected to harvest another bumper crop, all of which could also help ease supply pressures on the wheat complex but lower global prices.

About the Author(s)

You May Also Like