The August WASDE report is always a big one. While the USDA no longer gets in the field to count ears, it’s generally the first adjustment in yield the market gets to see. With some adjustments on Friday, the market seemed to shift its focus from those production estimates to what it had been trading for several days-weather. As we sort out the complexity of handicapping this 2022 crop, what happens in the next couple of weeks will likely drive market action.

August report recap

Let’s start with the report. The main data most look for immediately is of course yield. With the average trade guess for corn yields at 175.9, USDA coming in at 175.4 was a non-event. While many look toward a tough August in much of the western Corn Belt to limit yields even more, we must remember the yield data was taken as of Aug. 1.

The soybean yield may have been as much of a surprise as anything in the report. With the average trade guess at 51.1 bushels per acre, a 51.9 yield was certainly towards the upper end of the range of guesses. Given August is the all-important month for bean production, a warmer, drier bias has been anything but welcome. While this number was a bit rich for some, beans rebounded nicely with some surmising the trade might expect yield reductions in subsequent reports.

As far as U.S. and world stocks are concerned, there were no big surprises there either. With both corn and beans coming in within the range of guesses and close to the average trade guess, there simply wasn’t anything exciting enough to steer the market in any one direction.

Market response

So, the big question many asked is why did these markets rally on a day when the numbers weren’t bullish? We must look at how the market has reacted over the last couple of weeks. For December corn, we’ve seen eight straight higher closes, while November beans have rallied 85 cents over those same eight sessions.

The biggest reason for the move from my vantage point is weather. While heat is expected in August, long periods without rain make the situation worse. Given most of Nebraska is currently in some stage of drought while Iowa’s drought monitor looks more ominous by the day, traders are coming to the realization this crop isn’t finishing like they’d prefer.

Last year, we saw a huge drop in prices from the August report to the September report, and this was after a much more bullish report than we received this year. Corn yield was slashed over 4 bu/acre while beans were cut to a sub-50 bu crop. Given the blasé numbers from this year, one might argue similar price action is within the realm of possibilities.

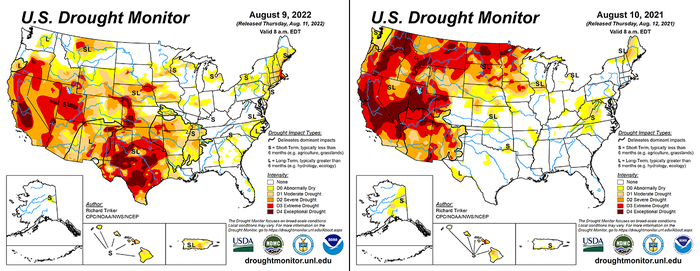

However, I’d point out that in 2021 the crop experienced much better weather than this 2022 crop has has to endure. Below is the drought monitor comparison of the two years, and it’s plain to see the difference, particularly in the western Corn Belt. My contention due to current weather and forecasts is price action is likely to differ from 2021 due to the likelihood this 2022 crop won’t finish in near as good of conditions.

As a producer, the way we use this information varies greatly. While it’s much easier to make a mistake in marketing if you’ve received ample July/August rain, those who haven’t must approach this market in a different fashion. While prices are historically quite attractive, be cautious as to make assumptions on market direction based on what has happened a year ago or any other year. Every year is different-and from my viewpoint, we’re far from knowing everything we need to know about the 2022 crop.

I hope Mother Nature treats you right the rest of this summer.

Feel free to reach out to me or anyone on the AgMarket team. We’d love to hear from you.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like