A nice soaking in cold water may feel pretty good in a couple of months when summer temperatures rise. But the bracing bucket USDA tossed at corn and soybean growers on May 12 was anything but refreshing for markets badly in need of a reset.

Of course, it’s wrong to blame the messenger for bad news – something I know all too well after spending 50 years in the media business. Government statisticians and economists don’t spend their time like evil scientists trying to devise new ways to punish prices, despite all the conspiracy theories over the years saying just that.

But anyone hoping for bullish numbers from the May World Agricultural Supply and Demand Estimates suffered a “ball don’t lie” moment. You can quibble with the agency’s forecasts but the bottom line for both 2022 and 2023 crop prices was bearish, pretty much as expected.

USDA’s first monthly forecasts for the 2023 marketing year around the world don’t rule out potential for rallies this summer and fall. But barring some serious disruptions from weather, war or other events, bulls have some heavy lifting to do.

So here’s a look at what USDA said, and how the market could respond following a break to new lows on the board last week.

Double trouble

Corn traders got a double dose of bearish news. USDA raised its forecast of expected old crop inventories leftover at the end of the marketing year Aug. 31 by 75 million bushels to 1.417 billion. The only change on the balance sheet was a 75-million bushel cut to exports.

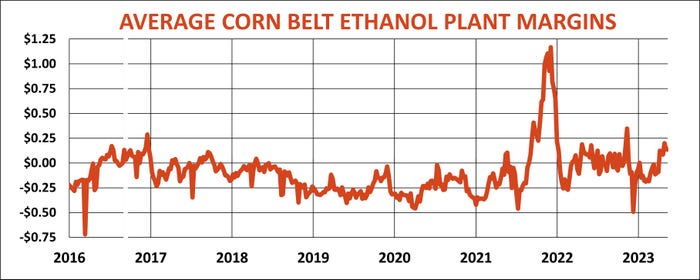

My own model left carryout little changed. The pace of exports, while slowing as China cancels previous purchases, could still be better than the new forecast. Ethanol demand is also starting to improve, thanks to a reversal in profit margins at Midwest plants that started in April and still appears to be going strong headed into the peak summer driving season. This could offset somewhat weaker feed usage to keep the ratio of ending stocks to total usage around 10%.

Still, nearly three-quarters of the way through the marketing year, there’s no compelling story to lift old crop prices on their own. That job likely must be done by new crop. “Aye, there’s the rub,” as Hamlet said, because it’s hard to be bullish on 2023-2024 markets based on these numbers alone.

USDA put new crop carryout at 2.222 billion bushels, setting its average cash price forecast at $4.80. Both represented somewhat dramatic, but not unexpected turnarounds from its last take on 2023-2024 conditions released at the February outlook conference. That forecast had carryout at 1.887 billion bushels while putting the average cash price at $5.60.

Almost all the increase in stocks came from larger expected supplies. This May report uses acreage from March 31 Prospective Plantings, which was around 1 million more than February’s outlook. And the government continues to use its 181.5 bushels per acre yield that assumes normal growing season weather and planting conditions.

The USDA yield is around 4 bpa more than produced by the statistical trend over the past 20 years. USDA officials say they use the higher weather-adjusted trend because this formula gives them the potential to cut the yield before its first survey of growers in August if early summer weather is adverse, say with very slow planting progress or hot/dry conditions. But some folks think this fine point gets lost in the headlines, in this case a record crop of 15.265 billion bushels. Moreover, USDA kept its forecast of demand virtually unchanged from February, despite the increase in supply. Demand would improve from the current marketing year after the recovery in production, but not nearly enough so absorb all the increase in bushels.

Soybean exports fade

The soybean numbers were also not surprising, though some in the trade weren’t ready for results. Old crop leftover supplies at the end of the marketing year Aug. 31 went up 5 million bushels to 215 million bushels due to a slight increase in expected imports, but the damage came with new crop.

USDA made no change to its forecast of production at 4.510 billion bushels, but increased imports slightly and cut its forecast of exports by 50 million bushels due to unrelenting competition from South America. Indeed, at the Ag Secretary’s briefing Friday, officials noted how domestic consumption of soybeans thanks to biodiesel is now the man driver of demand. Crush is taking over that mantel from exports, with Chinese demand expected to grow only slowly as its shrinking population ages and its economy tries to recover from COVID lockdowns.

All in all, projected new crop U.S. ending stocks went up 40 million bushels to 355 million from the February outlook, dropping the average U.S. cash price 80 cents to $12.10.

My models puts carryout at 367 million bushels, with the average cash price at $11.87 – both within spitting distance of USDA, so I can’t argue much with the agency analysis. And I’m still a bit concerned about old crop demand – both exports and crush could turn out a little weaker than USDA forecasts.

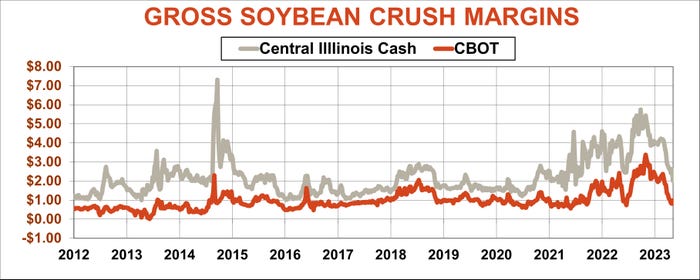

Despite all the talk about biodiesel, crush to date isn’t showing any sustained boom. Processing plant margins collapsed this spring near the bottom of their range in recent years, hardly an endorsement of stronger demand.

Rallies aren’t impossible

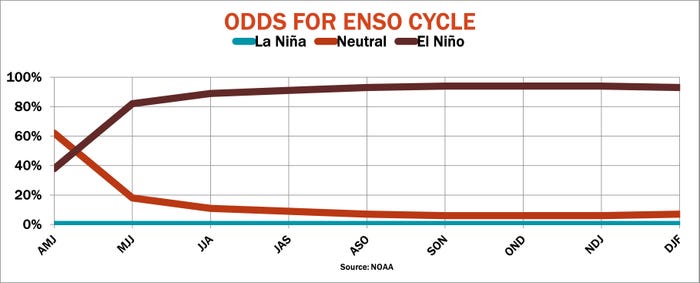

Another piece of news from last week is one reason for modest expectations. U.S. weather forecasters raised their odds of a June-August El Nino to 89%. While the warming of the equatorial Pacific isn’t always good for U.S. corn and soybean yields, the phenomenon translates into corn yields about 5% above normal. Soybean yields get less of a boost, but run more than 2% above normal during El Nino summers.

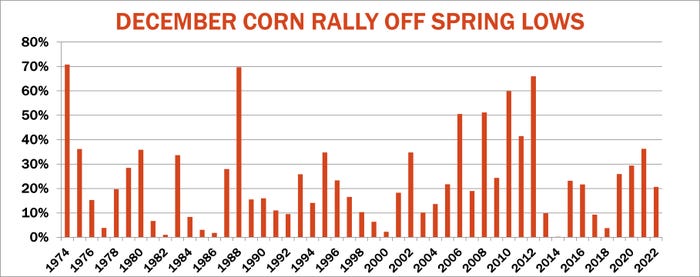

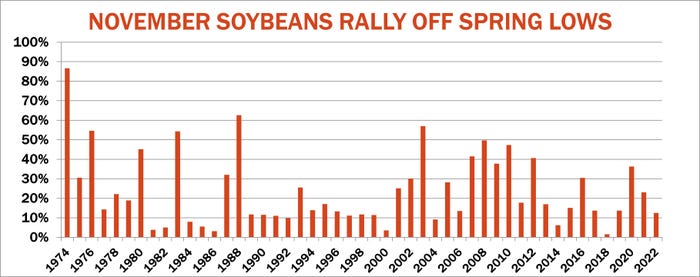

Yet even in years of good production, new crop corn and soybean futures tend to stage some type of summer rally off spring lows.

November soybeans typically could be expected to rally 20% or more off spring lows, based on El Nino yield expectations and USDA’s May WASDE forecast. If last week’s lows hold, surges near $15 could still be in the cards. Those are average rally targets, however, and accounting for statistical error could mean just $13 may be possible too.

For December corn the looming El Nino could still bring rallies of 16% off spring lows. Again, if Friday’s lows hold, that puts at target at $5.90. USDA’s May WASDE suggests gains to $5.50 to $6.30. But if the lows don’t hold, getting December corn back above $5 could be a challenge.

In Dante’s Inferno, those entering the gates of Hell were greeted with a message that may sound like the bottom line of this USDA report: “Abandon all hope, ye who enter here!” The news isn’t that bad. There’s still some potential for rallies, though expectations should be conservative at best.

Knorr writes from Chicago, Ill. Email him at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like