Author’s note: USDA kicks off its annual Agricultural Outlook Forum tomorrow morning (2/24/22) at 7am CST. USDA’s 2022 Commodity Outlook reports will be released to the public at that time also.

In the meantime, here is what you can expect from tomorrow’s sessions, which will feature USDA’s first look at 2022/23 corn, soybean, and wheat production and demand forecasts. Keep in mind that these are unofficial balance sheet forecasts, which means that National Agricultural Statistics Service surveys were not used to calculate acreage.

Rather, USDA will use economic models and forecasting to calculate tomorrow’s figures. These are not the preferred methods USDA uses to forecast balance sheet estimates, thus why they are deemed unofficial.

Overall, average analyst guesses point to a smaller corn crop in 2022 compared to a year prior. Soybean and wheat acreage are likely to grow at the expense of 2022 corn acres.

Also, keep in mind that other grain and oilseed crops are likely to compete for row crop acreage in 2022. Cotton, rapeseed (canola), oats, and spring wheat are also offering lucrative returns for farmers in the coming year and could easily steal away primary crop acreage in areas where fertilizer costs are high, input access is not always readily available, or primary crop markets are far away.

Internal estimates

Our team at Farm Futures ran a survey in late December 2021 that gathered farmers’ planting intentions for the 2022 growing cycle. The results found farmers to be increasingly price sensitive to soaring input costs, which largely remain double to triple times the same values a year ago.

Farm Futures estimates 2022 corn acres will register at 90.4 million while an estimated 92.4 million acres of soybeans will be planted this spring. The total of both crops – if realized – would best 2021 planted acreage as a new record high. It would be the third time in history and the first time since 2018 that soybean acres will be greater than those of corn.

Our estimates for soybean acreage and production reflect tightening profit margins at the farmgate for competing corn acres, thus are at the higher end of the analysts’ spectrum. Rising concerns about chemical and fertilizer supplies in recent weeks, especially amid escalating tensions in the Russian-Ukrainian conflict, could further squeeze farm-level profits and potentially delay planting operations.

Price ratio analysis

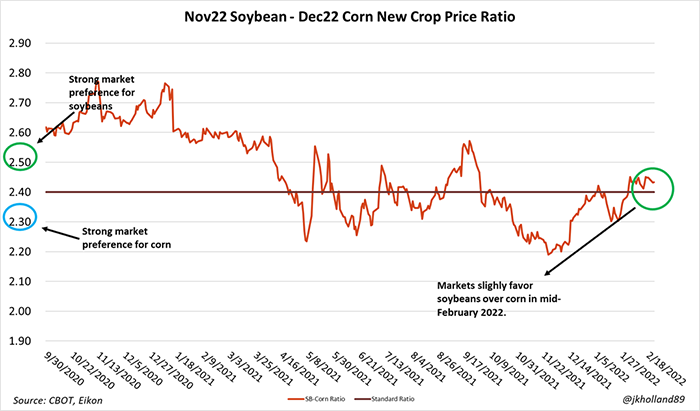

Pre-report analyst estimates for tomorrow’s outlook vary widely. The new crop price ratio, often used to help producers make crop revenue insurance decisions ahead of the planting season, stood at 2.43 this afternoon (2/23/2022). This suggests that while futures markets slightly favor soybeans over corn in 2022, there is not enough of a premium priced into either market to justify one crop over the other.

But as soybeans struggle to maintain a hold on acreage forecasts, corn futures could reward growers for more acreage in 2022, especially if South American crop losses are not as severe as markets have currently priced in.

The new crop price ratio is derived by dividing November 2022 soybean futures prices into December 2022 corn futures prices. At a value greater than 2.4, markets favor soybeans while values lower than 2.4 favor corn acres. More specifically, values at or beyond 2.5 or 2.3 indicate strong market preferences for one crop over the other.

New demand forecasts

USDA will provide updated demand forecasts in tomorrow’s sessions for the coming 2022/23 marketing year. USDA’s Office of the Chief Economist issued its annual Baseline Projections report last fall, which provide the agency’s long-term forecasts for U.S. and global agricultural production and consumption.

These values are primarily used for budget planning purposes on Capitol Hill, not just for traders and farmers. The latest baseline values for 2022/23 are now slightly outdated but tomorrow’s report will shed more light on where the agency thinks these long-term forecasts are headed.

The latest figures point to higher export values for row crops in the 2022/23 season compared to the current marketing year, though likely not at the level of 2020/21 volumes. Domestic usage for all three crops is expected to rise per the Baseline Projections in 2022/23.

The big question is whether or not the increased demand will last as stocks remain tight and prices surge to record highs. In the long run, USDA expects grain supplies to moderate over the next 10 years to more comfortable stock volumes as incremental production gains are realized.

But supplies remain tight in the short run. Just how tight the situation will stay will be better understood after tomorrow morning’s reports.

Buckle up for a wild year

The wide range of pre-report trade guesses suggests that volatile market conditions are making this spring’s acreage forecasts more difficult than usual. But even if markets remain skeptical of tomorrow’s 2022 production estimates from USDA, the demand and usage forecasts will at least provide a hint at long-term consumption patterns in the coming year.

To be sure, a lot of time remains between now and planting. And of course, weather will always have the final say in 2022 acreage allocations. Tomorrow’s figures will be the last best guess about acreage intentions before USDA-NASS releases its March 31 Prospective Plantings report.

USDA’s Annual Outlook Forum will be held virtually from Thursday, February 24 through Friday, February 25. Registration and participation is free, so if you are interested in joining, check out the AOF website here.

Our team will be providing live coverage of the conference, so be sure to check out our website and social feeds throughout those days for the latest insights and analysis!

About the Author(s)

You May Also Like