Last week was a painful one for growers, at least in the pocketbook. Recession fears that pummeled commodity barometers like crude oil and copper spilled over into grain markets weakened by cooler forecasts after the Juneteenth holiday.

The aftermath sent negative technical signals flying. Selling after bearish reversals June 17 created gaps on new crop daily charts, eventually violating trendline support off previous lows in oversold markets. December corn also suffered a bearish moving average crossover.

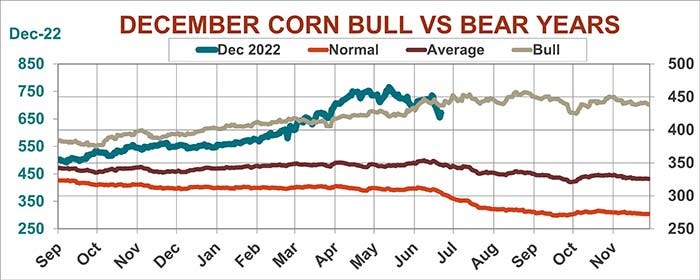

The implications were worst for corn, which faces make-or-break seasonal trend shifts into the end of June. Unless prices muster a rebound soon, failure to confirm new highs on average brings lower prices into the end of summer and harvest.

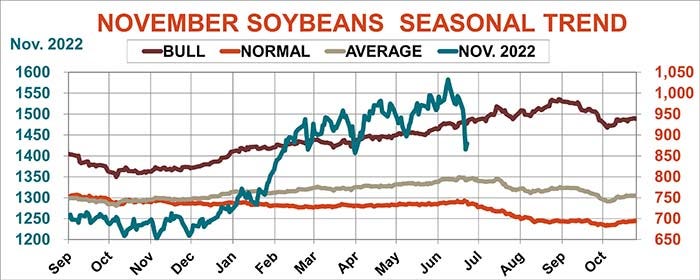

Soybeans can get another kick at the can later in July and August on weather fears, but also need to regroup quickly. Otherwise, the two-year bull market may be history.

If it is, farmers can take consolation from new crop prices that are still attractive. Perhaps more importantly, it’s not too late to book 2023 crop sales to keep the profits running for another year.

To be sure, this can be a big ask. Many producers still have 2021 inventory on hand, and trying to market three crops at once isn’t easy either. Figuring out just what is or isn’t a profitable price is also conjecture, requiring managers to lock in costs for inputs and rents, or take educated guesses.

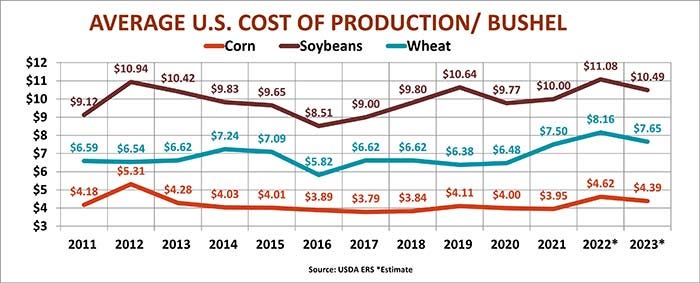

But at least some of the news last week was positive on that front. USDA’s Economic Research Service put out its first forecast of 2023 production costs, projecting expenses down around 2% for both corn and soybeans.

These are broad averages on the heels of double-digit increases for 2022 crops that likely varied quite widely from farm to farm due to extreme moves in fuel and fertilizer. But with that caveat, the outlook for locking in 2023 gains still looks promising.

USDA put the average cost per acre of corn at $793.18, down from $813.47. Based on anticipated trend, or statistically “normal” yields for 2023, this translates into a per-bushel expense of $4.39. USDA’s $554.82 soybean expense per acre, down from $566.97, equates to $10.49 per bushel.

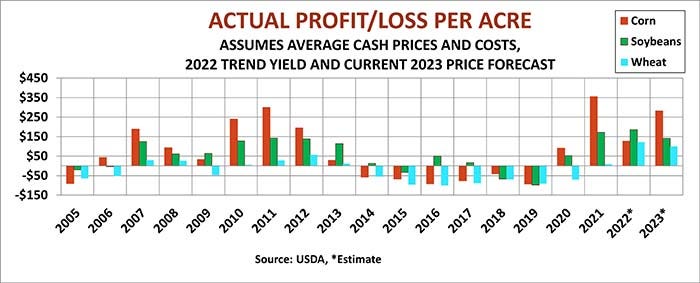

With December 2023 corn above $6 and November 2023 soybeans north of $13.30, profits look good even discounting for cash market basis that’s typically weak this far in advance of harvest.

If yields hold up, triple digit profits could be possible for the three major U.S. crops, and corn profits could show double returns for soybeans and wheat.

Of course, those estimates assume normal yields. But even if yields tumble and futures soar, locking in current prices for harvest 2023 could work for the typical grower. And it certainly might be better than the risk of red ink from doing nothing.

To test that hypothesis I put together sensitivity analysis using Excel spreadsheet’s data table function varying both prices and yields.

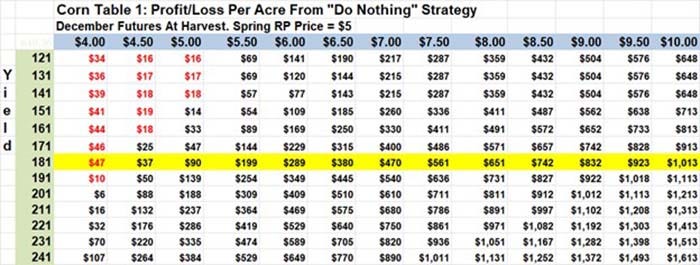

Even without protection from crop insurance or the government program, corn profit per acre generally holds up even without hedges as long as futures hold above $5 and yields don’t suffer too much at harvest. Adding Revenue Protection and ARC lowers “wait and see” risk even more, though it doesn’t eliminate it, as Table 1 shows.

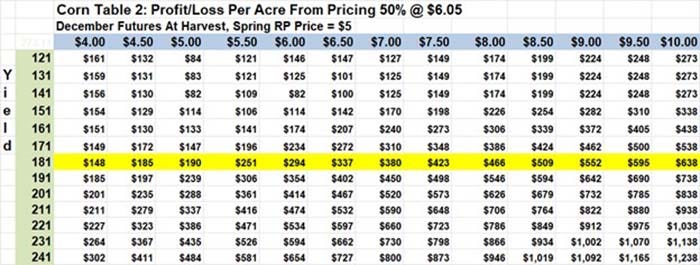

The safety net from crop insurance and especially ARC can’t be pin-pointed yet. But based on what we know now, this downside projection really shines for those who hedge. Pricing 50% of expected production at $6.05 December 2023 eliminates losses from the data table, with minimum profit per acre above $80, and most scenarios provided much more than that, as illustrated by Table 2.

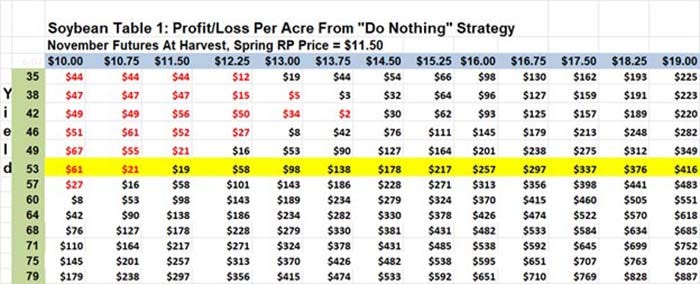

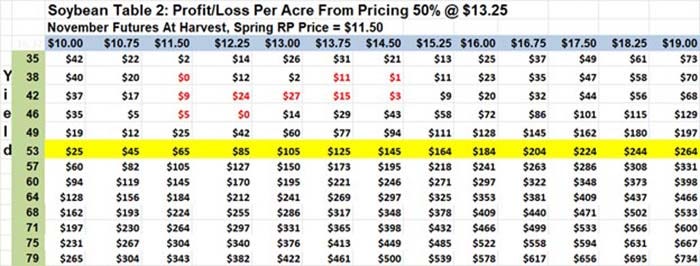

The patterns for soybeans are similar. Doing nothing risks losses if yields and prices break, as per Table ! for soybeans. A 50% hedge at $13.25 November 2023 futures doesn’t eliminate this risk but it does lower it, proving upside for unsold bushels if prices rally later this summer.

Watch June report for clues

In the meantime, while traders mull weather forecasts they’re also bracing for USDA’s June 30 reports on grain stocks and acreage, either of which could roil markets.

The June 1 stocks data will show on how tight old crop 2021 supplies may get this summer. For corn, this could be due to shifts in feed consumption, while dwindling old soybean crop inventories could be less than anticipated – or not – if final production was different that estimated in January. The government doesn’t update that until Sept. 1 when final marketing year carryout is published, but the June numbers may provide clues.

USDA’s June acreage won’t catch all the double crop soybeans planted, but will be closely watched for both crops. Normally, these updates show slightly less corn ground and more soybeans, but swings often hinge on planting conditions and spring price rallies to “buy” acres. The fourth slowest May 15 corn progress on record projects a corn acreage drop of 2.75 million. But that loss may have been offset by the $1.5625 rally in futures, which could result in a gain of 600,000 acres – and some traders fear even more of an increase.

Similar trends are in play for soybeans. Slow planting may mean 335,000 lost acres from March intentions. But the $1.755 rally off spring lows could add 1.5 million more acres to the record 91 million prospective plantings total.

So, while waiting for the big data dump, run through your 2023 numbers to see if hedging some of next year’s price risk makes sense for your business.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like