It's hard to believe this weekend will be the final three-day weekend of the summer. My great-grandmother always said the older you get, the faster the years go by. Boy, was she correct.

The only thing which seemed to have moved faster this summer is the trade's ever-changing sentiment from bullish to bearish. As we move into fall, several different storylines will keep volatility high. Inflation is one of them.

Influence of Inflation

As inflation started to ramp up at the beginning of the year, we saw fund money pour into the commodity markets as a way to hedge against inflation. The combination of an influx of inflation hedging and traders adding war premium due to the invasion of the world’s bread basket pushed commodities to near or record prices.

During mid-summer, when the Fed started aggressively raising interest rates to fight inflation, a good portion of the long inflation hedge exited its position. This is because the Fed is the invisible hand that guides the economy and they tend to get the economy to move in the direction they want. Hence, the "Don't Fight the Fed" slogan was born.

The Fed, in essence, is doing everything in its power to curtail demand for goods. They told the investors/speculators how they are working against trades which are in place to be rewarded if commodities prices go higher.

Yield, demand concerns

The Pro Farmer Crop Tour showed some disappointing yield prospects in select areas last week. We saw some of the fund money (which left the grain market) come back as they believed the potentially smaller crop will require higher prices to ration out demand.

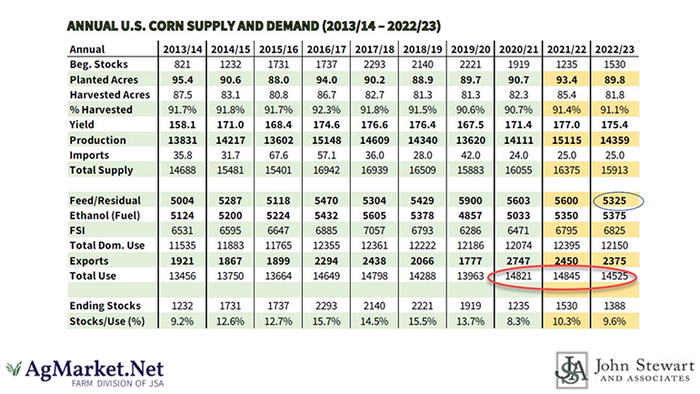

The tricky question at the moment is not necessarily the crop's size, but the demand. On the domestic front, the Feed and Residual demand always seem to be a number which leaves traders scratching their heads and the USDA August balance sheet continued this trend.

USDA is forecasting a significant drop in corn Feed and Residual while forecasting one of the smallest wheat Feed and Residual for next year. This leaves the demand side of Feed and Residual very small compared to the last ten years. The smallest in the previous five years and would also be 216 milion bushels below the prior five-year average.

If further production cuts occur with corn (as we expect there will be), the ability to cut demand by an offsetting amount will be difficult. For wheat, the 13/14 crop year through the 16/17 crop year, the Feed and Residual demand averaged 163 million bushels compared to 80 million bushels projected this year.

On the Macro storyline, Fed chairman Jerome Powell stated Friday how the Fed is far from done raising interest rates (slowing the economy). He even stated the quiet part out loud – how both households and businesses will feel economic pain. When this happens, it will adversely affect demand, which might cause the funds that have recently come back to the commodities markets to exit again.

Large soybean supply

The Pro Farmer Crop Tour suggests the possibility of a record U.S. soybean crop. With the recent late-season rainfall across a good portion of the farm belt, odds have increased that a record could be in the cards.

Brazil is expected to increase soybean acres by 4%. If the weather cooperates, they could also have a record crop. China, the biggest consumer of soybeans, continues to struggle with COVID. It has them continuing to lock down a portion of their society to keep the virus from spreading. On top of that, they are dealing with record drought and heat in a good part of the country, slowing economic activity and leading to a decrease in the importation of commodities, including soybeans. Who will consume all these beans if both countries have a record crop?

Fertilizer shortage

The high price of energy around the world is a storyline as well. Energy could significantly impact prices as the high prices are taking a big bite out of the consumer's disposable budget. It has many countries preparing for an economic recession which would be negative for demand.

Many of our customers have mentioned all offers for nitrogen fertilizer have been pulled this week and no one seems sure when offers will be available and at what price. The high cost of Natura gas has forced some European companies to stop making nitrogen, leading to a shortage. Farm futures just released a survey which found farmers were projected to plant 94.3 million acres of corn next spring, which would be a 5% (4.5 million acre) increase from current USDA estimates for 2022 planted corn acres of 89.8 million acres. Nitrogen availability could significantly impact whether these projected increased acres are planted.

A smaller U.S. and European corn crop this year and potentially fewer acres due to nitrogen shortages could lead to a bullish corn scenario as we move into 2023. Fewer corn acres could lead to more soybean acres which may not be what we need if we end up with a record U.S. and South America crop this year. If this scenario plays out, we will expect downward pressure on soybeans.

If you have questions, don't hesitate to contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT.

Reach Jim at 815-665-0461, [email protected] or on Twitter: @jpmccormick3.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like