While farmers are hard at work harvesting corn and soybeans, there’s another job close at hand – mapping out strategies for profits in 2023.

Tight U.S. stocks give growers a chance to lock in 10% to 15% returns for both crops. But double-digit margins come with risks as well, so it’s crucial to know the downside as well as the potential for gain from selling a year ahead. As the past few years demonstrated clearly, nobody has a good crystal ball for predicting how crazy things can get.

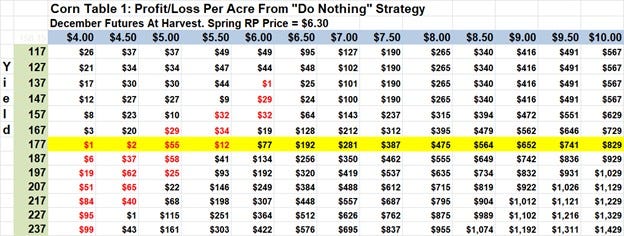

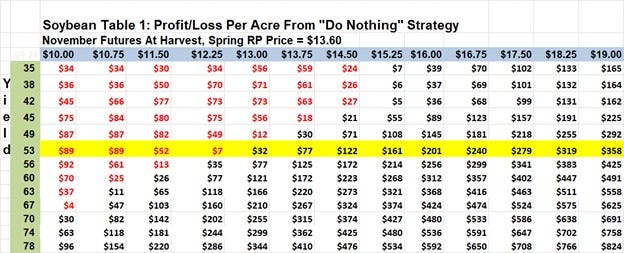

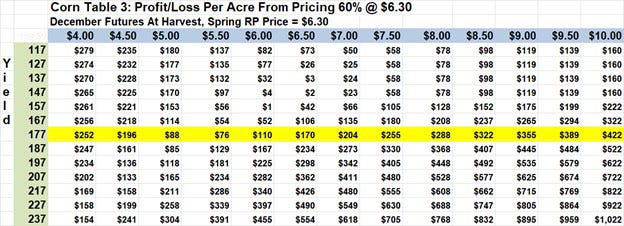

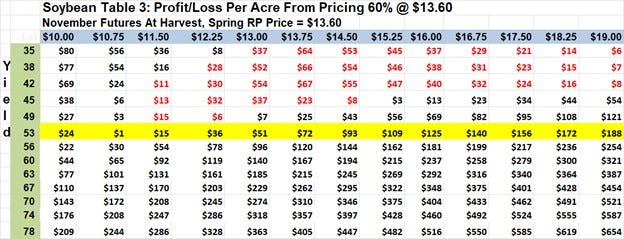

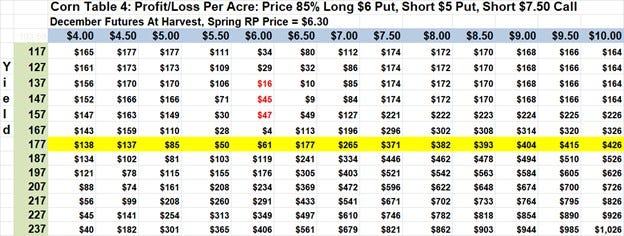

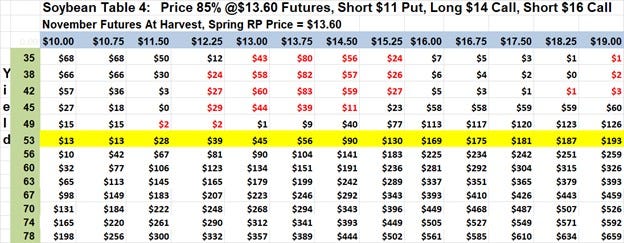

To evaluate sales opportunities, I plugged current cost estimates and 2023 futures into “what if” data tables. This sensitivity analysis projects project profit or loss per acre based on different combinations of harvest prices and yields for various strategies. Selling prices considered were $6.30 December 2023 corn and $13.60 November 2023 soybeans, in the middle of recent trading ranges for both contracts. Harvest basis plugged into the model varied with prices, with stronger markets producing better cash bids.

Local production costs vary widely in any year, so these calculations use national averages prepared by USDA’s Economic Research Service, adjusted for input cost changes since the agency’s last forecast came out in June. National 2023 statistical trend yields of 177.3 bushels and costs of $904 per acre put the total for corn around $5.10 a bushel. Soybean expenses of $606 and yields at 52.5 bpa combined for a cost per bushel around $11.55.

It doesn’t take artificial intelligence to see that current prices are profitable under these conditions – if yields hold up. That’s where the data table shines, showing the good, bad and ugly of any decision depending on how your final production compares to expectations.

Start with a base case of doing nothing, just selling whatever you grow off the combine next fall. Yields and futures prices aren’t the only uncertainty. Basis on bids from buyers for fall 2023 gives a clue about merchandiser expectations if futures or options are used, and can be fixed now for sales on forward cash contracts. Current 2023 basis looks to be 10 to 20 cents weaker than nearby levels at some locations.

Safety nets from government farm programs and crop insurance are also a guess. With markets currently well above reference prices, most growers likely will sign up for ARC in 2023. The corn guarantee could be around $685 an acre with soybeans offering around $430.

Crop insurance details won’t be known until spring guarantees are set in February, but it looks like corn coverage could cost a little more, with soybeans a little less than 2022. My base case assumes 85% revenue protection, though growers in areas with more variable production view that as too costly to be practical.

Revenue-based systems like RP and ARC typically pay off under extremes for yields and low prices. Most years they won’t come into play for most farms, but are worth including in your analysis.

With all those caveats in mind, here’s what my tables project for sales a year ahead of harvest.

What, me worry?

Table 1 shows results from doing nothing now and selling off the combine next fall. You don’t need your reading glasses to see more black ink on the corn grid and more red on soybeans'. Yet while today’s prices are profitable with normal yields, lower prices or yields could bring losses. ARC and RP mitigate losses for terrible yields and prices. But even good yields create losses if prices fall back to levels from a few years ago. If you aren’t ready to sell, make sure you can stand the pain if bad times return.

Let ‘er rip

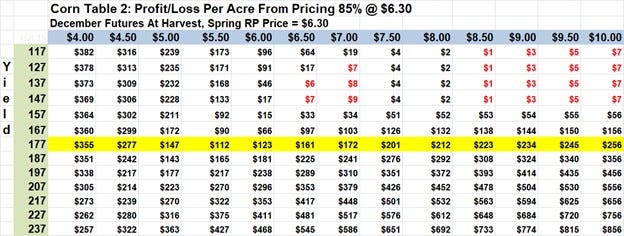

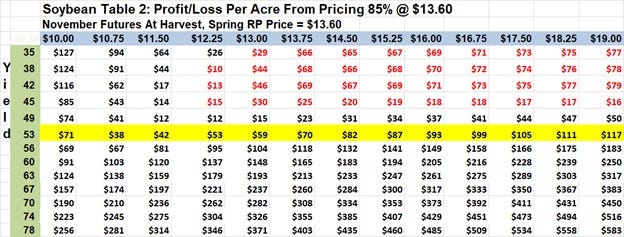

Growers worried about another bear market, or farms facing financial stress, may consider aggressive forward pricing so they can live to fight another day when good times return. Pricing 85% looks profitable until rising futures offset the impact of falling yields on revenue, eliminating potential protection from the government program.

Even if they do, $6.30 corn on the board would keep losses to $10 an acre, even under extreme conditions.

Soybeans show less room for error. Losses come faster because margins dip into the red with yield losses of 10% or more, unless the market tanks enough to trigger payments from ARC and RP. Losing $75 an acre pricing 85% isn’t impossible if the worst does happen. To paraphrase Dirty Harry’s memorable quote: “Do you feel lucky, punk?”

Hold on, Tiger

Instead of all or nothing, take a look at what happens with a somewhat less extreme approach. Pricing a healthy portion of next year’s crop early could bring some peace of mind without swinging for the fences.

Avoiding losses altogether may even be possible with this tactic for corn, as Table 3 shows. Locking in a price on 60% of the crop looks like the sweet spot, keeping some upside open but keeping red ink off the grid.

A 60% sale won’t work as well for soybeans, but still removes the threat of losses if yields hold up, while keeping some of your powder dry.

Solving the options puzzle

Using options always sounds like a great idea – at first. Paying a premium up front for the right but not the obligation to sell futures at a predetermined strike price locks in a floor while allowing upside if markets move higher. Pricing with a put also relieves some of the worry about not having bushels to deliver from a short crop.

The “but?” Options can be expensive, especially in high-priced volatile markets. And premiums on options with a year or more until expiration include a hefty charge for time value that could be lost in the long run.

Near-the-money puts for December 2023 trade around 45 cents a bushel while similar options on November soybean run around 75 cents, costs that weigh on profits.

One potential alternative for those with sufficient experience trading options is to combine different tools. This mix-and-match approach allows fine tuning of strategies to provide the appropriate protection desired.

Predicting the outcomes of options trades adds yet another layer of uncertainty to any projection. Not only can futures markets change dramatically, but implied volatilities that influence premiums can also vary widely. And, like using futures, writing options to earn premium value creates margin exposure if the market moves against your position.

Table 4 shows one of the myriad of examples for each crop. Pricing 85% of corn by paying for most of the cost of a $6 corn put by selling a $5 put and $7.50 call leaves some loss exposure if prices are flat and yields fall.

The soybean strategy is a little different, using a bull call spread to protect a covered put. This combines selling 85% futures with a short $11 put, then buying a $14 call and selling a $14 call. Like the other examples, the soybean position contains more loss potential than corn but still provides a profit if yields hold up.

Consider costs

Before making sales, be sure to consider what could happen to your cost of production. Some of your costs may be known, if land rents or mortgage payments are locked in. Other expenses, including operating interest, fuel and fertilizer, may be highly uncertain.

Fertilizer could continue to be especially volatile, depending on fallout from the war in Ukraine. Production in Europe hobbled by high natural gas costs is slowly coming back on line, but the world’s supply chain is vulnerable, from overseas plants and mines to the drought-drained Mississippi River. Fall application may be ready to go, but spring inventories are another matter altogether. Hoping peace will break out all over may be good for the soul. But betting it will could be bad for your bottom line if you don’t line up the nutrients you’ll need.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like