The final production numbers of the year came out this week, and for the first time in a while, there were no shocking numbers which resulted in a relatively muted reaction.

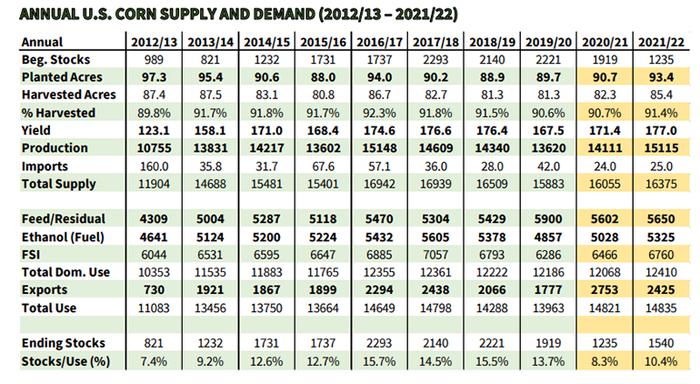

One of the bigger surprises was USDA raising the 21/22 corn carryout to 1.540 bb (billion bushels) verse their 1.493 bb December estimate. They did this by raising production by 53 mb (million bushels), lowering exports by 75 mb, and increasing ethanol by 75 mb.

The increase in production was due to USDA raising harvested acreage by 300,000 acres.

The demand revisions align with expectations as the ethanol crush has been running very well while exports have been lacking. The two bright spots in exports have been Mexico and Canada. Demand bulls are optimistic that China will be back into the market buying soon. The market will need to see export demand or continued weather problems in South America; otherwise, it could leak lower until the spring acreage battle heats up. Reports that China's AG minister has lowered estimated 21/22 corn consumption to 287.7 MMT (million metric tons), down from the previous estimate of 290.7 MMT, due to slowing demand from both the feed sector and industrial users, should be a concern for demand bulls.

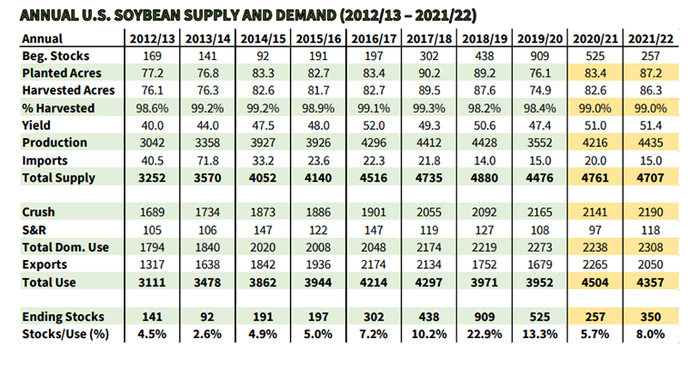

Like the corn numbers, the soybean report carried minimal surprises. The USDA chose to leave demand alone but increased the national yield by .2 bpa (bushels per acre) to 51.4 bpa while cutting harvested acres by 100,000. The net result was an ending stock increase of 10 mb which was in line with the trade's thoughts.

South America’s weather woes

On the world front, USDA was more aggressive in cutting South American production estimates than most in the trade thought they would. Brazil's output was cut 5 MMT to 139 MMT. Argentina's production was cut 3 MMT, putting production at 46.5 MMT. With these aggressive cuts world ending stocks came in at 95.2 MMT. The cut in domestic soybean demand is a concern, but we could see demand come back to the U.S. if the Brazil crop continues to shrink. Each bushel of lost production opens the door for U.S. exports to fill, so the next few months will be critical in deterring the soybean market's next direction.

This year's winter wheat acres are projected to be the highest since 2016. Wheat seeded area for 2022 is expected to total 34.4 million acres, up 2% (740,000 acres) from 2021. The breakdown by class is Hard Red Winter, 23.8 million acres (up 306,000); Soft Red Winter, 7.07 million acres (up 422,000); and White Winter, 3.56 million acres (up 54,000).

Corn debate

The increase in winter wheat acres adds to the debate of how many acres of corn producers will plant this spring. We will need to plant a minimum of 90 million acres of corn to meet this bare minimum demand expectation if we want to give ourselves some wiggle room. We typically harvest 92.5 % of what we plant, which equals 83.25 million acres. If we take this acreage number times this year's record national yield of 177 bpa, it gives us a total production of 14,735 million bushels which is 100 mb below the current demand estimate for this year's crop.

If demand increases year on year, which typically happens, or we don't produce another record national yield, we will be producing less than we consume for the third time in the past four years.

With the holidays past us and the final production numbers of the 2021 crop in the books, we encourage producers to revisit old-crop grain and the new crop marketing plans. There's a ton of profit on the table, and now is time to develop a plan to lock in these margins if you have not done so. We encourage you to stay flexible but realize your risks and manage them.

As always, feel free to contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT. We are here to help.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

Read more about:

WASDEAbout the Author(s)

You May Also Like