November 29, 2022

“It had long since come to my attention that people of accomplishment rarely sat back and let things happen to them. They went out and happened to things.” – Leonardo da Vinci - artist, inventor, scientist

What are some characteristics of people who make things happen?

They are not satisfied with the status quo. They dream about the future and keep these dreams in the forefront of their minds.

They set realistic goals and have laser-like focus on achieving these goals.

They create opportunities. They don’t wait for opportunities to show up.

They are resilient as problems and challenges show up.

They face fears head on.

They are constantly trying to improve themselves.

They surround themselves with others who will help them improve. This can include accountability partners or peers who excel in their own line of work.

They have a healthy sense of urgency.

They are consistent.

They have a high say-do ratio.

As I look through this list of characteristics, I can see how many growers excel in these areas as they relate to the production side of agriculture. It’s often impressive to see growers develop and execute a plan to get the most out of their crops. You can tell how optimizing their yield is at the forefront of their mind. Often you see their yields are significantly better than their peers who don’t excel in these characteristics.

Take the lead on marketing

Is the marketing and related balance sheet side of the business approached in a similar way?

We are facing inflation and other economic pressures that are driving our cost of production higher than we have seen for several years, if not the highest we have seen period. While we are seeing these high input costs, we are also entering the third year of a bull market. For the 2023 crop, corn prices are still above $6 and soybean prices are just shy of $14 per bushel. This sustained period of high prices can often let us lose that healthy sense of urgency to act.

Let’s take a trip down memory lane to look at a few years where high prices have unraveled.

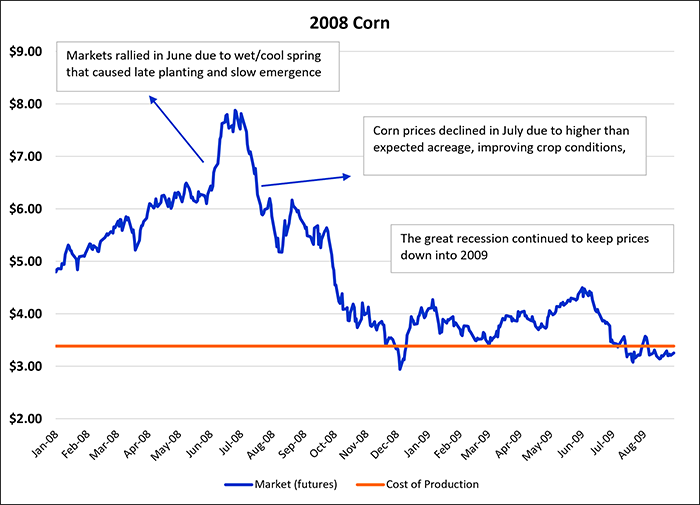

2008 Corn – Prices rallied to nearly $8 per bushel before crashing to $3 post-harvest.

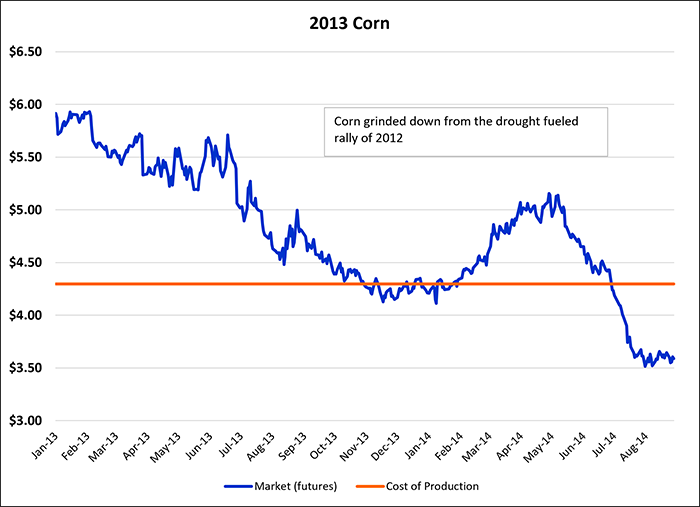

2013 Corn – Prices on the 2013 crop were nearly $6 per bushels following the 2012 drought then declined below $4 in the summer of 2014.

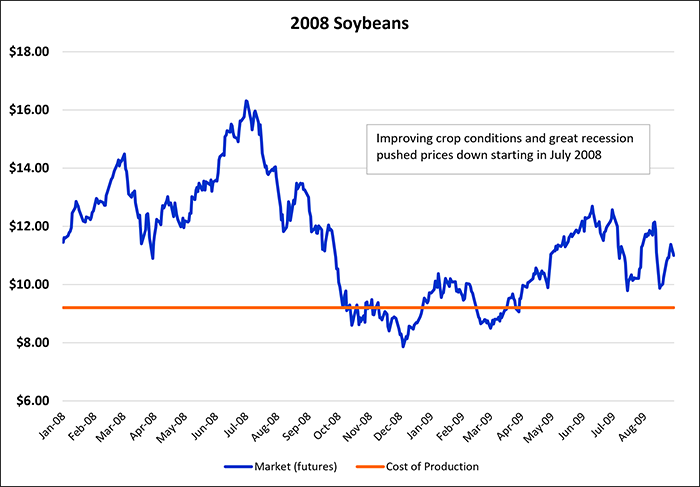

2008 Soybeans – Prices rallied to over $16 in the summer and then hit $8 per bushel in December.

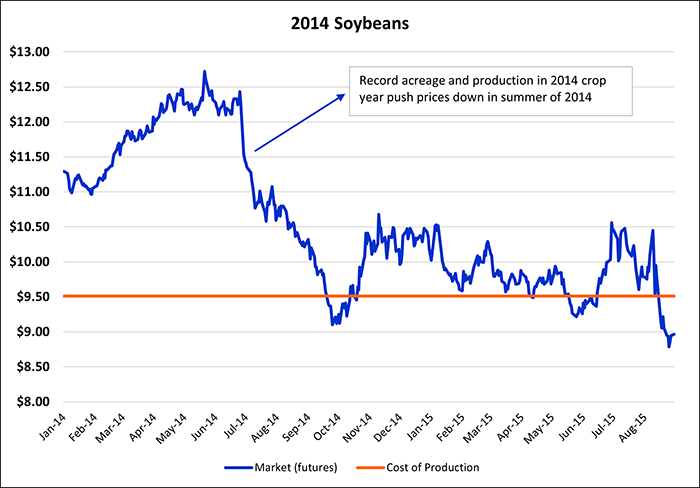

2014 Soybeans – Prices went over $12.50 per bushel and then fell to nearly $9.00 per bushel towards harvest.

What will 2023 bring?

As for the future? No one really knows. The more important question is what are you going to do to “HAPPEN TO” 2023 rather than letting the events of 2023 happen to you? Here are some ideas to get you started:

Create opportunities to have another profitable year and to retain the balance sheet improvements you have made in the past 2-3 years.

Don’t wait. History has taught us that prices are unpredictable. Don’t let opportunities to secure price levels slip away. By all means, keep flexibility if they go higher but don’t allow them to drift lower without taking action.

Look for those resources that will help you be consistent in your marketing approach. They should also be a resource to help you learn, grow and improve on your skillsets. They can also help you navigate through your fears….fear of pricing too early or fear of missing out of market opportunities.

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like