Illinois farmland values were up 18% during the first half of 2022, according to a new survey by the Illinois Society of Professional Farm Managers and Rural Appraisers, released at last week’s Farm Progress Show.

Even so, members of this group expect prices to level out for the remainder of the year. They also expect cash rent values to increase slightly for 2023, but more notably cited a continued increase in the use of variable cash rent lease arrangements. Society members estimate 31% of all Illinois leases are now under a variable type agreement.

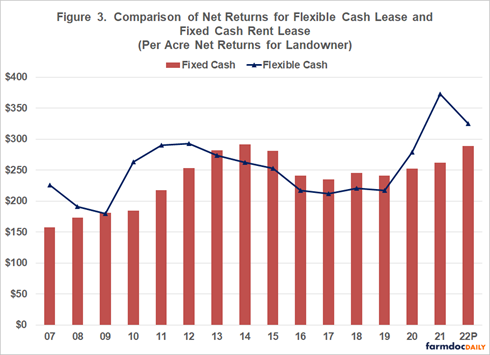

Illinois farmdoc also published, with Purdue University, a study: “Comparing Net Returns for Alternative Leasing Arrangements.” These findings are from a case farm in west-central Indiana, but I believe they are representative for most farms across the Corn Belt.

Cash rent “lag” effect

The chart above illustrates one of the underlying reasons variable cash rent leases are trending higher with what we refer to as the cash rent “lag” effect common with traditional fixed leases. If we were to overlay net farm profits during this time period, this would no doubt show that flexible land leases stay more closely aligned with ups and downs in profitability. This is especially important as extreme price and weather volatility continues in the industry. However, a traditional cash lease tends to lag behind these trends since most fixed rental rates are negotiated after the fact.

Other highlights

The respondents in the Illinois mid-year survey indicate variable cash rent arrangements make negotiations easier as compared to fixed cash rent arrangements. In fact, 80% responded negotiations were easier to much easier. Only 3% reported negotiations were harder.

For variable cash leases, 85% are reported to have a base cash rent regardless of prices, yields, or incomes. A large majority of these have a bonus payment if revenue exceeds a specified revenue level. The Indiana case farm uses a trigger revenue level which factors in both non-land costs plus the base cash rent.

When yield enters the flex rent calculation, actual farm yields are used 90% of the cases.

When price enters the equation, multiple prices at local delivery points is the most common method to establish an average price.

Crop insurance payments and/or government payments are only included in 30% of the leases.

When gross revenue is used to calculate a bonus, the average percentage from Illinois is reported to be 35% for corn and 38% for soybeans.

Adjustments for 2023

One of the advantages we hear producers and landowners say about variable cash rent leases is they significantly reduce the pressure on annual rent negotiations. The respondents to the Illinois study agree, as over 75% indicated they very seldom or only periodically change the terms in these types of leases.

However, 2023 may prove to be one of those periodic years where change may be needed. This is due to the significantly higher input costs and supply chain issues affecting operators profit margins. In particular, variable leases which only flex based on gross revenue should be taken a look at, compared to the Indiana case farm which factors in crop expenses using a calculation of net profits.

We recently did a comparison in Iowa of traditional cash rent trends related to gross revenue, and determined in most geographic areas these percentages range from 27% to 30% for corn, and 37% to 40% for soybeans. These types of adjustments is something we are taking a strong look at with the flexible leases we help facilitate. If our crop input environment returns to a more sense of norm again, then we may adjust them right back to where they were.

We agree one of the advantages of a well-structured variable lease is it makes much of the pressure off year-to-year rent negotiations. But, it is still important to make periodic adjustments as major shifts occur in the industry.

Downey has been helping farmers and landowners for the last 22 years with their family farm transition, estate planning, leasing strategies, finances, and general land consultation. He is the co-owner of Next Gen Ag Advocates and an associate of Farm Financial Strategies. Reach Mike at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

Cash RentAbout the Author(s)

You May Also Like