The market volatility we have seen the past few months may be just the coming attraction for what could come this summer. This is happening as the world wrestles with a potential food crisis, which seems unheard of only a few years ago.

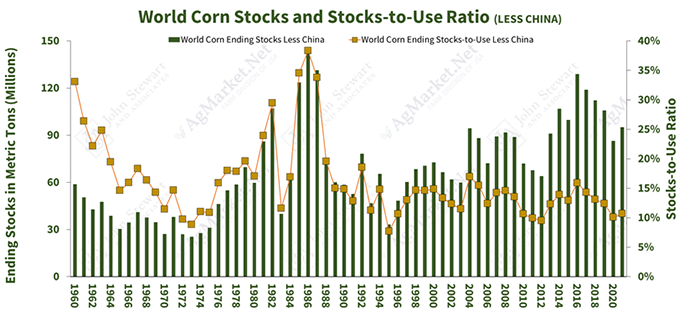

World corn stocks-to-use ratios have fallen from 33.1% at the end of 2016 to a projected 25.8%. If you take China out of the equation, as it currently does not sell reserve stocks, that number drops to 10.7%, the second tightest in 9 years. Just three years ago, world beans stocks-to-use sat at 33.5%. It’s now projected to fall to 24.8%. Take China out of the equation and it falls to 22.5%, the lowest level since 2000.

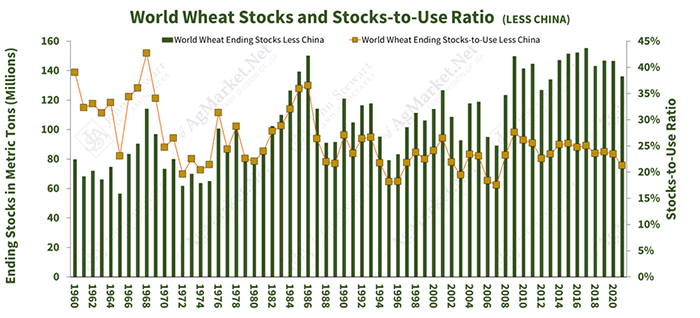

The world wheat stocks situation isn't much better. Just two years ago, world stocks-to-use was sitting at 40% and is currently projected to fall to 35.3%. If we take China out of the calculation, stocks-to-use falls to 21.3%, the lowest stock since 2007.

The world corn and wheat situation could be much tighter than this data suggests as Ukraine sits on stocks importers cannot receive. If the Ukraine Black Sea ports remain closed, current estimates are up to 20 million metric tons of 21/22 crop year corn and wheat production may not get shipped any time soon.

This year's Ukraine production is anticipated to fall due to the Russian invasion and tightening usable supplies. The latest estimates are corn production could fall to 23.1 million metric tons, down from 37.6 million metric tons in 2021. The wheat harvest is estimated to come in at 18.2 million metric tons, down from 30.3 million metric tons in 2021.

Where is U.S. wheat?

The odds of the U.S. adding wheat bushels to the world ending stocks seems unlikely. In the latest WASDE estimate, USDA projected U.S. ending stocks at 678 million bushels, down from last year's 845 million bushels ending stock number. USDA achieved this number by using a national yield of 44.3 bushels per acre. The latest crop ratings would suggest this number is too high. The latest U.S. Drought Monitor and the current forecast does not give us much hope to see a drastic improvement in crop ratings any time soon.

The corn ending stocks situation will also tighten if the USDA acreage survey is correct. If we take the expected planted acreage of 89.5 million acres, then fine-tune for the statistical harvested adjustment, we end up with a harvested acreage of 81.58 million acres. Take this number and multiply it by a trend yield of 178 (this is one bushel better than last year). It gives you a total production of 14,522 billion bushels. This is 413 million bushels below the current 21-22 total use estimate of 14,935 billion bushels. This total use number could easily be 100 million bushels to 200 million bushels too low due to the expanded E-85 ethanol production and anticipated exports that have not been accounted for due to the unavailability of Ukraine corn. And it assumes no yield-damaging weather hiccups.

For argument's sake, we will keep the USDA's current 21/22 ending stock estimate of 1,440 billion bushels and carry that into the 2022/23 marketing year’s balance sheet. When you add the carry in bushels with the anticipated production for the upcoming year at 14,522 billion bushels, it gives us a total supply of 15,987 billion bushels. (Twenty-five million bushels came from imports). If demand is unchanged from last year at 14,935 billion bushels, ending stocks will drop to a shade above a billion bushels and leave the U.S. with stocks-to-use of 7%.

Uncomfortably tight

As you can see, the balance sheet is anticipated to get uncomfortably tight (even with record yields). When we look at the U.S. Drought Monitor and add in fertilizer costs, it seems like the odds favor that the national corn yield could easily come in below trend.

The question then becomes: how high will prices need to go to ration demand? This is as we will be producing a lot less than we are currently consuming. Rationing food demand tends to be challenging as it is relatively inelastic. You can live without the new TV but you need food to survive.

Investor money is flooding the commodity markets as a way to hedge inflation due to inflation readings not seen in 40 years. Also, the U.S. could have a significant production problem on top of the world’s already tightening supply situation. Those factors alone could set up a possible summer rally many of us may not forget.

Read this AgMarket.Net blog post from last week for recommendations on how to lock in profits and prepare for volatility this summer. Contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like