Imagine: You’ve lost your last surviving parent and it’s time for the reading of the Will.

As the attorney reads, you learn you have the option to buy-out your three siblings’ interest in the 400-acre family farm at a 25% discount from appraised price. The farm hasn’t been appraised yet, but similar quality tracts have sold for near $12,000 per acre.

At first, a 25% discount seems fair considering the sweat equity you contributed to the farm operation over the years. However, it won’t take long for one of your siblings to do the math and realize a 25% discount on $12,000 per acre ground quickly adds up to $1.2 million dollars when taken over 400 acres.

Could someone in the family question whether your sweat equity is actually worth $1.2 million?

On the other hand, it won’t take you long to realize a 25% discount on $12,000 per acre ground is still $9,000 per acre! You’re certain your parents didn’t expect you to pay $9,000 per acre, especially for land your dad inherited from his parents for free.

Instead, you believe the price your parents had in mind falls closer to $5,000 per acre. This is where land values were 15 years ago -- the last time your Mom and Dad updated their wills.

Your Mom and Dad probably had good intentions to meet with an attorney to update those wills. Unfortunately, no one knows for sure now, since it was never clearly communicated and just as the last 15 years went by fast, so did the increase in land prices which your parents probably never dreamt of.

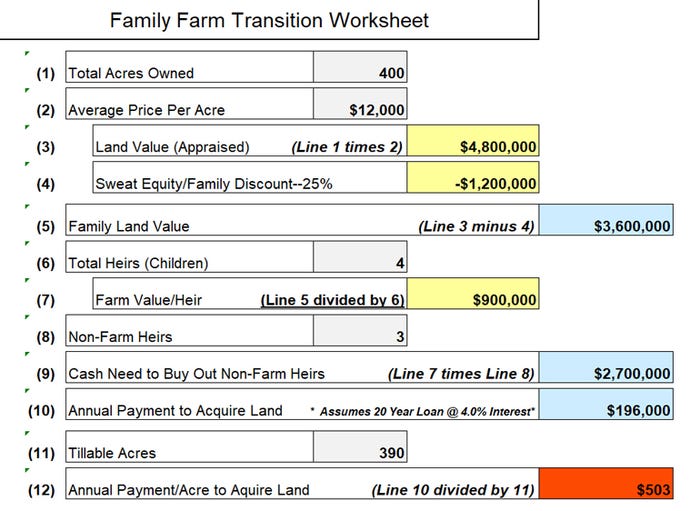

These numbers soak in even further after you meet with your lender and realize the 25% family discount still leaves you an annual payment of nearly $200,000, or $500 per acre to buy-out your three siblings. See the calculation below:

Think about it another way. A 25% discount off of $12,000 per acre is $9,000. Now, take off another 25% for the one-fourth of the farm you inherited. This lowers the price to $6,750 per acre. Who wouldn’t jump at the chance to buy a $12,000 per acre farm for $6,750? But, then you realize you still have to cash flow the purchase at $500/acre!

What you just read is a common dilemma facing many family farms when it comes time to transitioning the land to the next generation. And it’s largely caused by the disconnect occurring between farmland prices and actual farm income.

This predicament threatens the future of many family farms. It’s why we try to increase awareness of various succession planning strategies available for family farms.

The arbitrary 20% or 25% family discount, although very common, may not provide you and your estate plan the flexibility needed to stand the test of time. I’m seeing more families favor other methods for valuing their land, such as for its practical use or a predetermined formula.

I will share some of these for your consideration in a future post. But for now, please take time to understand your own family farm transition numbers and how they may impact the likelihood of a successful transfer.

Would you like a copy of the family farm transition worksheet above? Send me an email at [email protected] and I’d be happy provide a blank copy for your farm.

Downey has been helping farmers and landowners for the last 20 years with their family farm transition, leasing strategies, finances, and general land consultation. He is the co-owner of Next Gen Ag Advocates and an associate of Farm Financial Strategies.

About the Author(s)

You May Also Like