Sure you’re focused on harvest 2021. But it’s time to get serious about marketing opportunities for next year’s corn and soybeans.

Not that figuring out what to do in 2022 is easy. Soaring costs for fertilizer and other inputs along with higher cash rents confront a price outlook that’s just as uncertain. If farmers follow through on initial plans to boost acreage found by Farm Futures recent survey, supplies and surpluses are likely to build through the end of the 2022 marketing year 24 months from now. But weather and the ability of the global economy to recover from the COVID-19 pandemic will also play a role in determining whether the future is one of boom or bust or in-between.

The good news: Early crop budgets project profits for both corn and soybeans at current prices. Whether that early potential holds is another story, due to shifting dynamics both in the U.S. and around the world because increased acreage, good yields, and demand constraints could put margins into the red.

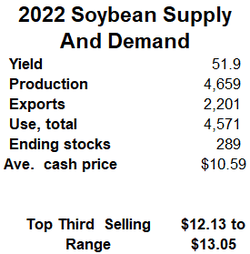

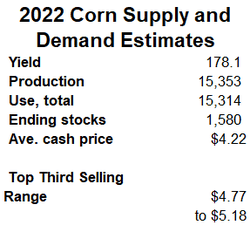

My way-too-early 2022 forecast puts the average cash prices for corn at $4.22, a dollar or more less than growers could receive for this year’s harvest. Soybean prices could be down more than $2, but still come in at $10.59. If achieved with normal yields, those prices would be at break-even levels for growers who want to cover the full economic costs forecast by USDA. Those content with cash-flowing production and living expenses would make modest returns compared to windfalls received after the 2021 bull market.

Of course, forecasts made so far in advance are accompanied by plenty of ifs, ands and buts. Here are my assumptions.

Large U.S. supplies loom

Supplies for 2022 start with what’s leftover at the end of the 2021 marketing year on Aug. 31. 2022. USDA Sept. 10 projected 184 million bushels of soybeans would be on hand headed into harvest next fall, a figure that’s in line with my own forecast. This assumes the 2021 crop doesn’t get much bigger and demand forecasts hold.

The government’s balance sheet for 2021 corn put ending stocks at 1.408 billion bushels. I’m around 100 million bushels higher because exports and feed usage may not be as strong as anticipated.

The rest of domestic supplies come from imports, which should stay minimal, and production. With normal corn yields of 178.1 bushels per acre, the 2022 planting intentions of 94.3 million acres found by Farm Futures translates into a crop of 15.353 billion, a record if achieved. Total supply of 16.8 billion bushels would be just under records set in 2016 and 2017, when surpluses were much larger.

Soybean supplies would also be ample. Farm Futures’ planting intentions of 90.8 million acres and normal yields of 51.9 bpa would generate a record 4.659-billion bushel crop, with total supplies of 4.87 billion. That would be just below the level that swamped the market in 2018-19, as the trade war with China and plunging exports generated a record surplus.

Demand looks strong

China looms large in demand forecasts for both corn and soybeans as the government there tries to control food price inflation at the same time it tamps down reliance on imports.

Soybeans are the most vulnerable because export demand is a much larger percentage of total usage than for corn. Customs data out over the weekend from China showed its total 2020 crop imports up 6% on the year. But the pace fell off dramatically this summer, down more than 6% year-on-year.

How much competition the U.S. faces for that market depends in part on production in Brazil. With normal weather and ever-increasing acreage, in South America and emerging producing countries too, U.S. exports should hold up, though not reach records set for 2020 crop sales. With strong domestic crush, U.S. ending stocks could be up 100 million bushels to around 289 million, ample, but not burden enough to completely sink prices, which could average $10.59 in the cash market, compared to the $12.90 USDA forecasts for the 2021 crop.

World corn tightness eases

Exports make up a smaller portion of U.S. corn demand, but are often the swing factor because livestock feeding and usage to make ethanol normally are fairly stable. In addition to modest growth in those sources of domestic demand, exports of 2022 crop corn could be strong, though still fall a little short of the record set in 2020-2021.

If this scenario plays out, corn carryout could rise to 1.58 billion bushels at the end of the 2022 marketing year. Whether that happens and what it means for prices could depend on the world outlook for corn in what’s become an increasing fragmented market.

Global supply and demand appear to play an increasing role in U.S. price levels, which previously hinged mostly on stocks here. The number of days of world feed grain supplies Sept. 1, 2021 was projected down 23% from the burdensome levels reached in 2016. This tightness could ease a little for the 2021 marketing year depending on production in the Southern Hemisphere in coming months, with the surplus growing more rapidly for the 2022 marketing year if high prices lure more acres into production around the world.

That would lower prices ultimately but also encourage demand, especially if the global economy recovers to boost food consumption. This could keep the U.S. surplus from becoming too burdensome, at least in the short term. Average U.S. cash corn prices for the 2022 crop could run around $4.22, down but not out completely.

Production costs soar

Assuming normal yields, $4.22 corn and $10.59 soybeans would be profitable, depending on what happens with costs. USDA June 22 estimated the tab for an acre of corn at $712 with soybeans at $513, which translates into a cost per bushel of $4 for corn and $9.90 for soybeans. USDA costs tend to be higher than those used by farmers due to the way it accounts for machinery expenses. But the government’s forecasts also only showed negligible overall changes from 2021, which seem unlikely.

The University of Illinois projected cash rents could be up $10 and farm energy bills could be higher too. But the real killer is fertilizer. While USDA actually projected lower fertilizer costs for soybeans and only a $6 per acre increase for corn, the nutrient market exploded this summer and continues to move higher.

The average price for NPK needed on an acre of corn is up $40 since June, with the total bill some $90 higher year-on-year for fall application. Just as the market seemed like it could be topping, Hurricane Ida shuttered ammonia and urea plants at the Gulf while turning off imports. Nitrogen costs shot higher again last week on news European producers were cutting back output due to soaring natural gas prices, with various tariffs and sanctions on potash, phosphates and UAN affecting those markets as well.

Even after factoring in lower machinery costs, the damage from fertilizer could take the average costs for 2022 corn to $3.90, with soybeans at $9.60.

Bottom line: More corn or beans?

While November 2022 soybeans and December 2022 corn futures are down on harvest pressure, both markets would be profitable at last week’s closes of $5.03 and $12.5575 based on these costs and average basis assumptions. Returns would be down from record levels anticipated for 2021 crops, but still top $100 an acre, with corn beating soybeans by around $20 an acre.

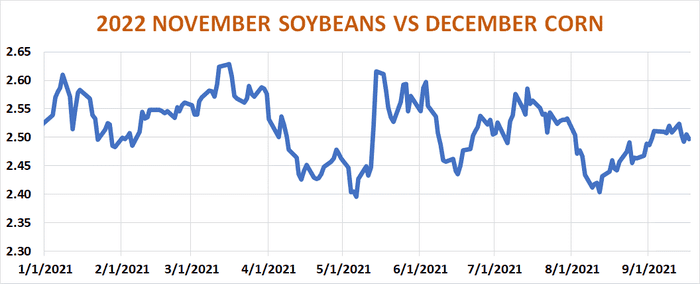

With the lower prices implied by rising 2022 surpluses, revenues would be lower, but still return $59 per acre for corn and $52 for soybeans. This relative balance can also be seen in the ratio of 2022 crop soybean to corn futures, which is in the middle of its trading range for the year and running a little above average in favor of soybeans.

Shortages and high prices could discourage fertilizer applications this fall, while traders watch a dry start to soybean seeding in Brazil. This uncertainty could help support 2022 prices this winter unless the market’s psychology turns abruptly more bearish. As we’ve learned all-too-often in recent years, that possibility can’t be ruled out, just another factor making the 2022 outlook hard to predict. Current futures prices are within my forecast for the top third of their expected selling ranges, so make sure you can afford to wait for a rally to buy acres if you hold off on starting sales for next year’s production.

About the Author(s)

You May Also Like