One of the biggest questions I’ve been asked over the past few weeks is, “When do you think I should sell the rest of the corn in my bin?” If only the answer were as simple as a specific calendar date or certain price point that I could miraculously announce.

As many farmers across the Midwest have taken advantage of this recent rally and have been able to sell $7.00 per bushel cash for corn in their bin, they haven’t yet necessarily sold all the remaining bushels they own.

But now with front month corn futures again knocking on the door of the impressive $8.00 historic high level, the question is starting to be asked, do I sell out the remaining corn in my bin and be happy? Or do I hold out for more?

The question has prompted great conversation of current market fundamentals; tight U.S. ending stocks, the need for perfect weather for the second crop corn in Brazil, trying to figure out what percent of the corn crop in Ukraine will be planted, how many planted corn acres will there be in the United States this spring, and ultimately weather in the United States and around the world this summer.

Talking with clients about the above market fundamentals, we have scenarios planned for reasons why prices could stall out at this current $7.00 cash area for old crop corn, or why prices could continue higher into summer, similar in fashion to more of a traditional, seasonal summer rally.

Seasonal summer rally?

It is only late March, yet corn prices are near historic contract highs. Which begs the question, should you sell now because we are near historic highs, or will there be a potential summer rally? Which could create new contract highs at some point this summer?

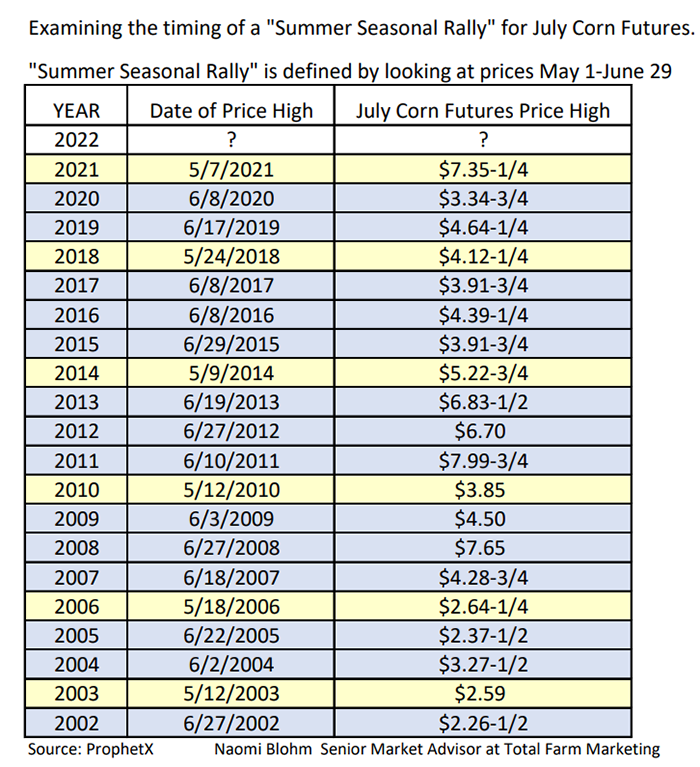

With most grain elevators now bidding off of the July contract, curiosity got the best of me and I went back and looked at twenty years of July corn futures prices to see if there was any sort of clear cut answer to a specific calendar date in which a producer should “sell out” of any remaining old crop corn.

For the purpose of this article, I looked at 20 years of July corn futures prices, and focused on when the high price for July corn futures occurred during the time span of May 1 through June 29.

Why those dates?

Seasonally, summer price rallies have a tendency to occur during May or June. I stopped on June 29, because most years, June 30 is first notice day for the July futures contract as it heads into the delivery period.

Elevators stop bidding cash prices off of the July contract during that time and switch instead to the September contract. So I felt it frivolous to discuss what the price of July corn futures did during the last two weeks of the contract, as farmers would not be offered bids on those values anyway.

Here is the breakdown

Looking at the past twenty years, the July corn futures summer price high occurred in the month of May 6 times. And of those six times, four of the six dates occurred around the May USDA WASDE report.

That means that 14 times out of the last 20 years, the July corn futures summer price high occurred during the month of June. Looking at a breakdown of those fourteen years:

4 out of 14 years that June high occurred around the June USDA WASDE report.

4 out of those 14 years the high occurred around the June 30th Quarterly stocks and final planted acreage report.

6 out of 14 years the high occurred at random times throughout the month of June.

Sorry to burst your bubble, but the bottom line is that there is no miraculous calendar date that will spell out when you should sell the remaining corn in your bin. However, history does strongly suggest that summer seasonal rallies can occur anytime May through June, and the party is usually over after July 4. The only exception to that so far has been 2012 during the drought.

The reality is that farmers will need to balance the calendar dates, price targets on futures charts, along with fundamental news in order to know when to pull the trigger on those final cash sales.

Looking ahead corn futures will need to navigate the noise of potential sudden demand shifts, or production concerns as the U.S. crop is not yet in the ground, planted acres are still uncertain, both spring and summer weather to contend with, along with concerns of inputs like fertilizer or weed killers being available.

July corn futures have solid support at $7.00 for now, yet they have no reason at the moment to climb higher than $8.00. Only if continued struggles occur in Ukraine, or poor weather issues should occur for the second crop Brazil corn or here in the United States, will July futures have a fundamental reason to trade above $8.00. Yet, be aware, the technical swing chart objective potentially points to $10.00 futures.

Reach Naomi Blohm at 800-334-9779, Twitter: @naomiblohm and [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involves significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like