USDA’s April 2022 WASDE report didn’t really tell markets anything more than they already knew and didn’t generate much additional price movement following the report’s release. In fact, markets are increasingly less concerned with old crop price movement in favor of anticipated changes to 2022/23 pricing.

Corn’s domestic holdup

Corn pared some gains in the immediate aftermath of the report’s release for lack of increased domestic export forecasts, higher Brazilian production, and easing import demand from top global grains buyer, China. But the market bought much of the losses back after as the overall outlook for global corn availability going forward remains constrained amid the ongoing crisis in the Black Sea.

It was a bit of a surprise that USDA was only bullish on ethanol consumption rates and not export paces. To be sure, corn consumption rates for ethanol are strengthening as fuel prices remain high, but after China booked the largest daily flash sales of corn exports since May 2021 this week, I was expecting more of a boost for export paces.

Peak corn export season is about to ramp up, so my hopes may be too premature for April. I was not at all shocked at USDA’s downward revision for feed and residual usage for corn – it’s not easy feeding cattle at $7/bushel at a time when interactions with meat processors continue to be contentious and unpredictable.

USDA’s chairman of the World Agricultural Outlook Board, Mark Jekanowski, explained in USDA’s inaugural livestream briefing that there are more dynamics at play in the cattle market right now that are impacting projected corn usage rates for feed. “This is a little bit of a complicated story,” Jekanowski prefaced.

Drought on the Plains is causing producers to pull more cattle off pastures and into feedlots early this spring. Slaughter rates for cow herds were high over the past month, suggesting that a smaller breeding herd will likely shrink the overall production capacity for the cattle industry in the months ahead.

The anticipated constriction in the cattle industry will likely keep livestock corn consumption capped in the coming months, especially if corn prices remain at record levels. From an economist’s point of view, the fact that one of the country’s largest consumers of corn is poised to scale back demand but corn prices are still rising (thank you, ethanol and exports) is a pretty wild concept to wrap my brain around.

As December 2022 corn futures continue to rise to new contract highs ($7.125/bushel at last glance), the market is desperate for additional 2022 acreage after last week’s Prospective Plantings report signaled a mere 89.5 million acres of corn likely to be planted this spring. Cool and wet weather continues to plague the regions of the Midwest that are prime for adding corn acreage this spring and the longer it lasts, the further the probability of adding corn acres falls.

South American crops and Chinese imports

Revisions to South American crops were among the most widely watched items in today’s report. Corn production (4.57B bu.) in Brazil is now only 26 million bushels smaller than the soybean harvest (4.59B bu.), thanks to favorable winter weather for Brazil’s corn crops.

It is the most even both crops have been relative to one another since 2013. In fact, 2012 was the last time that Brazil harvested more corn than soybean bushels so the narrow gap this year is certainly something to watch.

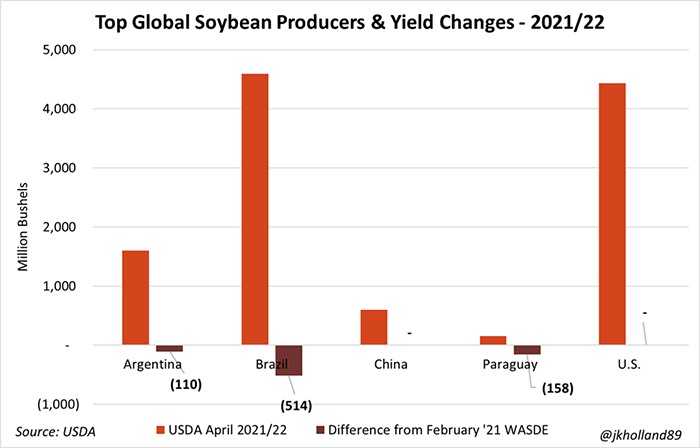

While USDA left Argentine corn and soy crops alone in today’s reports, it took another 114 million bushels of combined soybean production away from Brazil in Paraguay. Since the December 2021 WASDE report, USDA has erased over 1.1 billion bushels of soybean production from Brazil, Argentina and Paraguay’s combined soybean harvests for the year.

USDA’s cuts to Brazil’s soybean export forecasts were even more aggressive than its cuts to harvest totals. The USDA eliminated 101 million bushels of Brazil’s 2021/22 soybean exports, dropping the total volume to 3.04 billion bushels – just a hair above 2020/21 volumes.

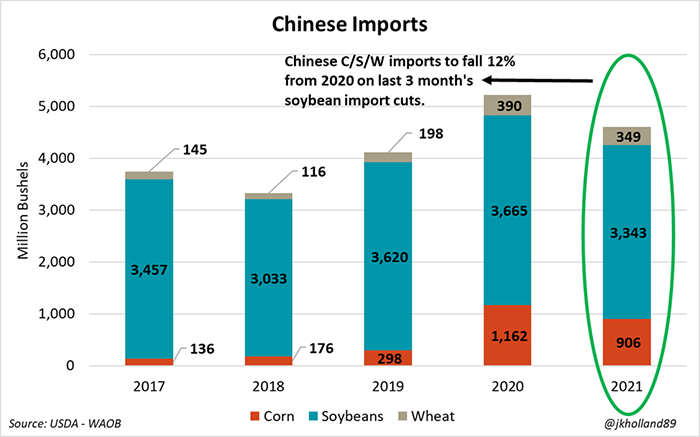

To that end, USDA also slashed Chinese corn and soybean imports for the 2021/22 season. While a USDA attaché report released last week suggests that China’s feed grain demand for livestock will increase in 2022/23, it seems that the country is attempting to ward off high prices as long as possible for the time being.

About 118 million bushels of corn imports and 110 million bushels of soybean imports were cut from China’s forecasts for the remainder of the year. The reduction in corn import volume was a direct reflection of shuttered Ukrainian export terminals, as Ukrainian corn was previously a staple for Chinese buyers.

It was the third cut USDA made to Chinese soybean imports in the same number of months. The markets clearly do not expect this trend to last long though, as new crop corn and soybean futures continued to rally higher after today’s reports.

Bullish soybean signals

Rapid loading soybean export loading volumes to China over the past eight weeks led USDA to increase soybean export forecasts today for the second time in the past two months. Prior to that, USDA had left soybean export estimates largely ignored through much of the peak soybean export season last fall.

But the boost is more than warranted now. During the last eight weeks, soybean export loading paces to top buyer China have risen 121% over volumes from the same time last year. This is significant because the time period typically represents peak Brazilian exporting periods – and downtime for U.S. soybean exports.

Domestic usage appears to be largely limited by high prices at the moment. September through February 2022 soy crush rates are trending fractionally below (0.4%) year-ago rates, so I’m inclined to believe that growers are going to need to rely on export markets for any hopes of further spring and summer rallies for the soybean market.

More wheat shakeups

USDA cut Ukraine, U.S., and European Union wheat exports. Ukraine’s exports remain out of commission for obvious reasons related to Russia’s military occupation. U.S. export cuts are due largely because U.S. wheat prices are currently too high to compete against Indian and Australian crops currently priced more favorably by the market. E.U. reductions are due to slower exporting rates.

South American wheat exports saw an uptick based on availability and being priced at a more competitive level relative to U.S. stocks. Russian wheat export shipments are back up and running for buyers willing to pay extra, so USDA’s revisions also reflected that dynamic today.

Global importing demand saw additional cuts, falling by 99 million bushels from last month’s estimates as top global buyers increasingly struggle to afford wheat purchases at current price levels. The Middle East, Japan, and Southeast Asia regions accounted for the lion’s share of the cuts.

Parting thoughts

There were a lot of short-term adjustments made to 2021/22 domestic and global grain and oilseed stocks in today’s reports. I think we will see more price action when 2022/23 forecasts are released next month. It will provide a clearer outlook of the longer-term impacts of Russia’s war on Ukraine which will give markets a bit more stability in terms of price discovery.

One of the biggest factors I think received little attention in today’s reports was USDA’s upward revision of Russia’s wheat exports for the 2021/22 marketing year. We know that Russia is continuing to ship wheat volumes despite international banking sanctions making payment logistics more challenging.

But Russia has wheat stocks available to ship. In a world of tightening grain supplies, I don’t think it is reasonable to expect that those bushels will stay off markets for much longer, especially if the upcoming harvest in the Northern Hemisphere sees any sort of hiccup.

Buyers may have to pay extra for Russian bushels going forward, with few having the luxury of alternative and affordable options amid current market conditions. The U.N.’s Food and Agriculture Organization reported on Friday morning that global food prices rose 13% from February to March to unprecedented levels.

High prices and constrained availability are likely to have the harshest impacts on poor nations most reliant on large global producers for food. But for countries that can easily produce supplies, their growers are likely to be richly rewarded if the current economic conditions continue to prevail.

About the Author(s)

You May Also Like