The world is suddenly dealing with a grim set of circumstances not seen since WWII. Is that an overstatement? No.

Without provocation Russian president Vladimir Putin attacked Ukraine overnight, threatening all surrounding areas of Europe. Although many cautioned this was a possibility, very few expected him to take things this far. Historically he has used diversion tactics to gain political status in the world. But his diversion tactics would result in him backing down when he gets what he wants. This appears to be a full-out attack. This may have a significant impact on food, fuel, and shipping sectors.

Inflation and cost of living have already been pushed to modern historical high levels of 7%. Wage increases have not kept up with inflation, therefore disposable income has been declining -- one of the first threats to an economy that has bubbled. Government spending and borrowing worldwide has broken every debt record relative to GDP after COVID-related lending by world and central banks injected ridiculous amounts of liquidity into their economies.

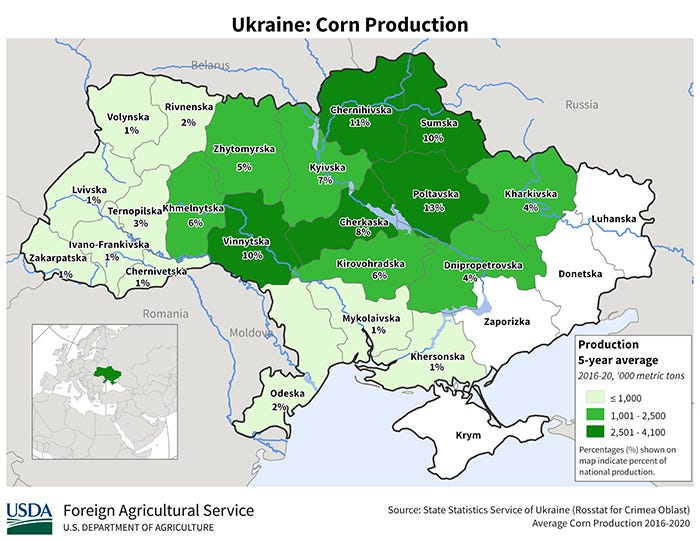

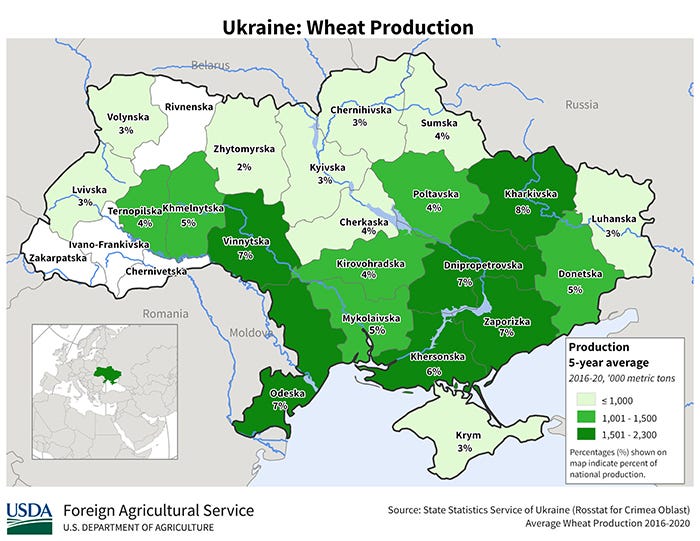

Ukraine is a major corn, wheat exporter

Now a military threat to a region that provides 17% of the world corn exports and 30% of the world wheat exports causes buyers to scramble for inventory in an already dysfunctional supply chain.

Meanwhile in South America

Adding to the above-mentioned dynamics, the market is trying to determine supply losses experienced in South America. As we have mentioned in earlier blogs, USDA estimates Brazil bean production at 134 million metric ton. If Brazilian soybean production falls below 130 million metric tons, the math changes as the supply retreats below what is believed to be “fixed” or non-discretionary demand.

To explain this better, when USDA reduced world soybean production by 9 mmt last month, it also was able to reduce demand by 5 mmt along with other adjustments that only caused carryover decline by 2.5 mmt. But you can only cut demand by so many tons. For example, if the price of gas goes to $5 per gallon, I will probably quit driving to go see my great uncle every Sunday, but I will always go to work. This example shows that there is a point where we can reduce discretionary demand, but getting to work is non-discretionary; I will buy that gas no matter what. This is when demand becomes inelastic.

The world is getting close to that level when it comes to food. Thus further cuts that estimate supply below discretionary demand levels if we are met with demand that is desperate to get inventory bought.

Fear-driven market

The USDA annual outlook conference this week, and may shed some light on the long-term supply outlook. But there is no doubt that the short-term supply outlook in the next 6 to 12 months needs more acres and ideal yields to prevent a fear-driven market.

One other thing to mention: If we do see an inelastic and fear-drive demand market, don’t rule out government intervention. Governments are already planning to release energy reserves around the world. For food, it may only take one or two governments to cut biofuel use to assure adequate food supplies.

That decision would change everything, for many years.

Manage your risk

How do you manage your risk in a marketplace that has become emotional, impossible to quantitatively price value due to inflation, and puts you in a situation where if you don’t manage downside, you could lose money-- and if you do and miss out on another $2/bu. move, you’re uncompetitive?

Make sure you focus on the long term

Focus on profit per acre – not price

Use tools that lock in a floor and leave the upside open for you to further gain

Limit or reduces margin call exposure

Realize that placing cash contracts might create more exposure than regulated tools as some grain companies may struggle to meet margin calls on a large book of business.

Focus on multi-year strategy if the market is at extreme prices. Based on a quick look at history, high prices last one to four years and extreme highs are usually followed by 4 to 6 year valleys.

Stay focused on the bottom line and pray for wisdom. Those of us who remember the inflationary 70’s and the deflationary 80’s have experience at this. Wisdom and focus might keep you out of trouble. One foolish choice could have huge consequences.

This is a market that will have a big impact on your future. It will require you to plan, not retreat and hope it all works out.

Also, check out this recent interview will Bill Biedermann discussing risk management during turbulent times:

As always, feel free to call us as we have an incredible team of consultants that can help you find the right tool to protect your price exposure.

Contact Biedermann at (o) 815-893-7443 or (c) 815-404-1917.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like