Thanks to higher priced grain and parched pasture conditions, cattle producers were forced to liquidate the herd at a rapid pace in 2022. Because of this liquidation, the reality of tighter beef and cattle supplies will keep both live cattle and feeder cattle futures fundamentally supported at historic loftier price levels for the remainder of 2023.

However, both markets cannot continue to go straight up for weeks at a time. This market is technically overbought, and due for a simple price correction in the coming weeks.

Feeder cattle

After the USDA Cattle Inventory report, feeder cattle futures posted a strong rally, supported by the tight supply picture and decreased beef cow herd. The March contract rallied nearly $10 from its January low, but the momentum may be starting to slip.

The fundamentals are still very supportive in the cattle market overall, but price action may have some technical triggers that could bring some price correction.

On Tuesday this week, March feeders failed at the Dec high trading to $188.575 before reversing into the close. The price action saw further weakness on Wednesday slipping another 0.750 into the close today, giving the market some follow-through selling pressure.

This could set up the possibility of some additional price correction and a possible test of lower levels. The pullback may be healthy for longer term price support, but in the short term, the Feeder market may look to move some money to the sidelines.

Live cattle

The price action in the cattle market was weaker overall after the turn lower on the close Tuesday. The market is fundamentally supported, but the momentum at this point seems to have slowed.

The development of cash trade could wake the market back up, but that news is still developing this week. The countryside cash trade was quiet again on Wednesday and bids are undefined, but asking prices remain firm at $161-162 in the south. Cash trade will most likely build as the market moves through the end of the week.

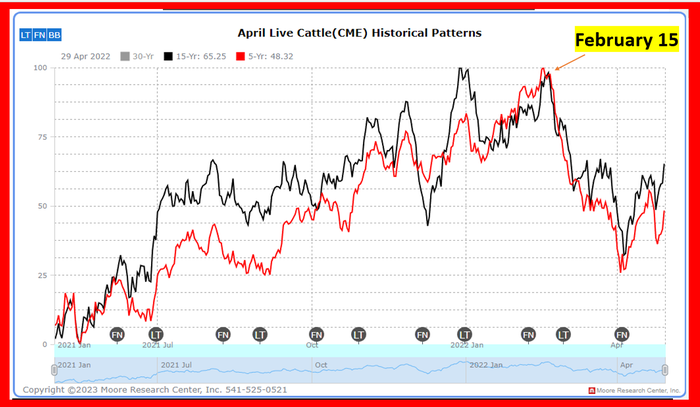

Seasonals

Both the April live cattle futures, and June live cattle futures have a seasonal tendency to see a price pull back starting around February 15.

The price pull back or correction tends to last for a month or so. That being said, I do not feel that this is “the high” for cattle futures, yet the market is overbought and a price correction would be healthy for the bigger picture.

Seasonally, the February 15 time frame makes sense for a price pull back as the restaurant demand for steaks for Valentine's Day meals has been met, as has demand for beef at the grocery store been met due to Super Bowl football parties.

The trend in the cattle market is higher overall, but the price action Tuesday and Wednesday brings some caution. The market is overbought and could be due for some pullback on the technical side due to loss of momentum and the strong money flow over the past couple of weeks.

Again, due to the friendly underlying fundamentals of tight supply, I still like the upside longer term, but the cattle market may be due for a healthy price correction.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like