Corn futures had a price setback recently, as can be a common occurrence in early May. This is usually due to the “seasonal” selloff. In addition, fresh news is usually hard to find ahead of the May USDA WASDE report.

The early May price selloff is also connected to idea that in most years, the corn crop is starting to get planted into the ground with ease. A timely planted crop gives traders assurance that there will be ample production for the upcoming season, barring any surprises from Mother Nature later in summer.

It is currently no secret that the pace of the U.S. corn planting season has been slower than hoped. The recent rains have slowed the planting pace tremendously.

Yet, in spite of the fact that the U.S. corn crop is only 22% planted as of the most recent weekly crop progress report from USDA, traders have been mostly ignoring this – instead betting that the American farmer will win the day and get the crop planted.

After all, history has shown us that if the American farmer has a week of good weather and planting conditions, nearly half the corn crop can get planted in one week’s time.

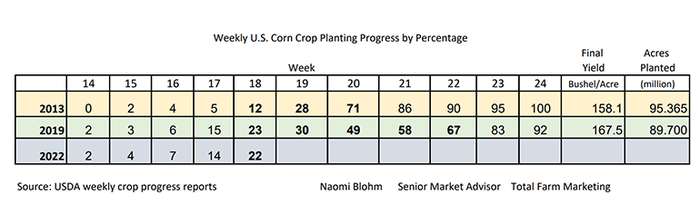

Looking back at some years, however, the crop has not able to get planted in as timely of a manner as hoped due to poor weather conditions. 2013 and 2019 were two of those years.

Well, you know me – I got curious and had to go back and look at supply and demand fundamentals during those two years, and I took a look at what kind of rally the corn market saw because of the planting delay. The results were intriguing.

The 2013 planting delay

On May 5, 2013, the crop progress report pegged the corn crop at 12% planted. The following week, May 12, the crop was still behind with planting only at 28% planted. Then, one week later on May 19, the progress jumped to 71% planted!

The May USDA WASDE report that year was released on May 10. That report pegged the old crop 2012/13 carryout at a small 759 million bushels (coming off the 2012 drought year) while new crop carryout for the 2013/14 season was pegged at 2.004 billion bushels due to increased acreage.

Now, because it had been projected for months that corn acreage would increase coming off the 2012 price highs, the price of the December 2013 corn futures had been trending lower since the beginning of 2013.

On May 1, the December 2013 corn price was at $5.55 and by May 21, it had pushed down to $5.12 as the crop had jumped from 28% to 71% planted.

That year, the reality of increasing ending stocks weighed more on the market than the delay in planting. In addition, the market also took notice of that one week increase of 43 percentage points.

The 2019 planting delay

On May 5, 2019, the crop progress report pegged the U.S. corn crop at 23% planted. The following week the pace increased to only 30%. By May 20, the crop was only 44% planted with May 28 still lagging at 58% planted. Even the following week, June 2, the crop was only 67% planted!

That year, the May 10 WASDE report pegged old crop 2018/19 corn carryout at a hefty 2.095 billion bushels. Also in that report, the USDA pegged the new crop 2019/20 carryout out at an even larger 2.485 billion bushels.

On May 1, the price of December 2019 corn futures was at a dismal $3.81. The May 10 WASDE report did little to improve price as overall carryout levels were still large.

But that year, even though the corn crop was so late in getting planted, many farmers flat out said, “I’ll take the prevent plant money, rather than stick a crop in the ground for no profit.” There was little price incentive to mud the corn in and get the job done.

Yet as it was still becoming obvious the crop was really going to struggle to get planted due to the soggy weather, new crop corn prices began to rally to offer farmers that incentive to plant.

By May 31, the price of December corn futures had rallied up to $4.51 to entice farmers to “bust a hump,” and get that crop in the ground!

Corn rallied 70 cents in one month because of the severe delay in planting and to incentivize farmers to plant. It took until Mid-June to get that corn crop planted that year, and new crop corn prices peaked that year at $4.73 on June 17.

The 2022 planting delay

And here we are, early May, with the slowest start to the U.S. corn planting season since 2013. December 2022 corn futures started the month near $7.50, with prices recently setting back to $7.03-3/4 on the notion that surely the weather would improve, and farmers would get the crop in the ground.

The coming week is crucial. The May 2022 WASDE report is likely to show overall continued tight ending stocks for both the 2021/22 and 2022/23 crop seasons.

What will Monday’s crop progress report show?

If the U.S. corn crop is not 50% planted by that report, corn futures prices will likely have a reason to trade higher in the short term. Right now, short-term resistance on that December 2022 chart is around the $7.50 price area. If prices can trade above that price level, the swing objective points to $8.00 December 2022 futures prices.

With the tight ending stocks in nine grain and oilseed commodities in the U.S., and with the world now seeing lower grain and oilseed supplies due to the Russian war in Ukraine, this is the year where the U.S. NEEDS to get it right.

We have to grow the perfect crop to keep the world balance sheets from crumbling. There is still a lot on the line – this corn crop is not in the ground yet.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like