The calendar has flipped to May and spring planting has begun for most of the Midwest. Looking ahead to next Friday, May 12, is the next USDA WASDE report. The May report is a big one as it will show both old crop supply and demand fundamentals for the 2022/23 crop, and we will see the first glimpse of guesstimates for the new crop 2023/24 crop year.

Heading into next week’s report, trade has been anticipating that the report will likely show less demand for old crop corn and larger old crop supplies.

From a historical perspective, supplies of old crop corn are tight. But what is interesting is that just one week after the April 2023 WASDE report, corn futures prices started trending lower. Suddenly trade was anticipating less future demand for both old crop and new crop corn.

Trade quit focusing on the fact that old crop corn ending stocks for the 2022/23 crop are still historically tight. The focus instead shifted to global recession fears, the second crop corn in Brazil off to a decent start, and China cancelling previous corn export purchases.

Negatives priced in

For the past few weeks, trade has been pricing in this bearish news, for both old crop and new crop corn. July 2023 corn futures lost 70 cents with the December 2023 futures contract losing over 50 cents.

The market is already anticipating larger ending stocks on the upcoming May WASDE report. The market has already priced that in with the recent price drop.

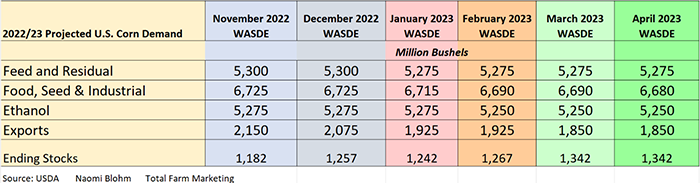

Looking back at the past six months of WASDE reports, I made this chart to compare old crop corn demand. All major demand categories have fallen over the past six months. This is in response to high prices.

The next question is what will the USDA peg for corn demand next week?

Ethanol

The market already anticipates a drop in corn use for ethanol in next week’s report. Why the drop in demand? Because corn use for ethanol is currently not on target to meet USDA demand projections when you look at weekly ethanol reports.

According to the most recent report, daily ethanol production for week ending April 28 averaged 976,000 barrels/day. The amount of corn used for the week was estimated at 98.1 million bushels. Corn use needs to average 102.6 million bushels per week to meet USDA's forecast.

That last sentence is your largest clue. Weekly (old crop) corn use for ethanol has to pick up the pace in order to meet current USDA demand target of 5.25 billion bushels.

Exports

The market already anticipates a drop in corn use for exports in next week’s report. Why the drop in demand? Like ethanol, we are not on the current sales pace to meet demand forecast. Looking at weekly export sales reports, USDA reported that for the week ended April 27, export sales of corn for the 2022/23 marketing year came in at a reduction of 315,600 metric tons. Trade knew that this was likely to occur since China cancelled sales last week of 562,800 tons.

Corn export sales commitments now total 1.501 billion bushels for the ‘22-23 crop year and the USDA goal is 1.85 billion bushels. We are still behind pace.

Granted, countries will still be buying from the United States, but maybe just hand to mouth for a little while.

Again, this demand loss has been expected, and is priced into the market. While the demand may be reduced on next week’s report for old crop corn, the market already has traded that news.

Bullish reversals

It was encouraging to see corn futures for both old and new crop dig in its heels earlier this week and post bullish key reversals on charts on major support levels.

The market may be trying to signal that the bearish sentiment has been priced in for now, and perhaps end users should step up and take advantage of this recent price sell off. After all, the U.S. crop isn’t planted yet, there is a lot of spring and summer weather to get through before it is safe to assume there is legitimately a record new crop coming, and the Safrinha crop in Brazil will be pollinating soon as their weather is turning dryer.

Between weather watching along with geo-political events in the weeks to come (Black Sea grain export corridor, a G7 summit), corn might have a few bright shining moments.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like