Good Afternoon! In this special edition of E-corn-omics, we are going to take a deep dive into the results and implications of today’s Crop Production and World Agricultural Supply and Demand Estimates reports released from USDA.

For more report highlights, check out our real-time report coverage. In the meantime, here are the top factors I kept my eye on it today’s reports.

Corn supplies shrink to tightest level in eight years

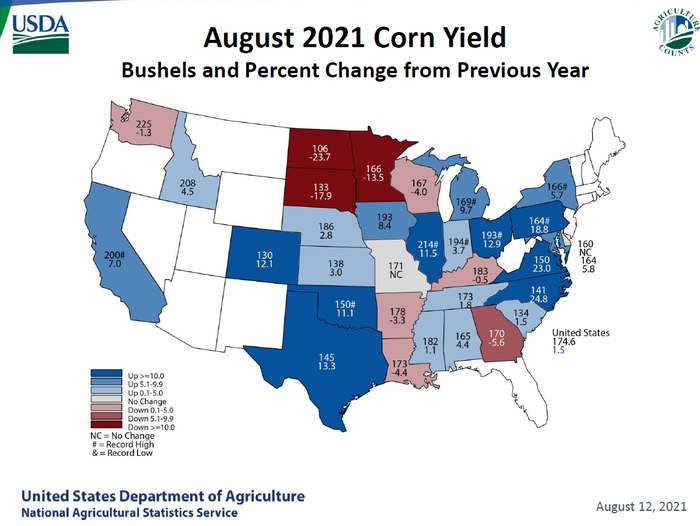

All eyes were on USDA’s latest Crop Production report and market watchers were not disappointed this morning. USDA trimmed 2021 corn yields more than markets were expecting in today’s report with the latest estimate coming in at 174.6 bushels per acre (bpa) – 1.1 bpa lower than the lowest trade guess.

Lower acres planted in top producers Iowa, Illinois, and Nebraska this year, paired with yield losses from Minnesota, the Dakotas, and Wisconsin led the 2021 yield estimate of 174.6 bpa to tie with 2016 as the third largest yield on record.

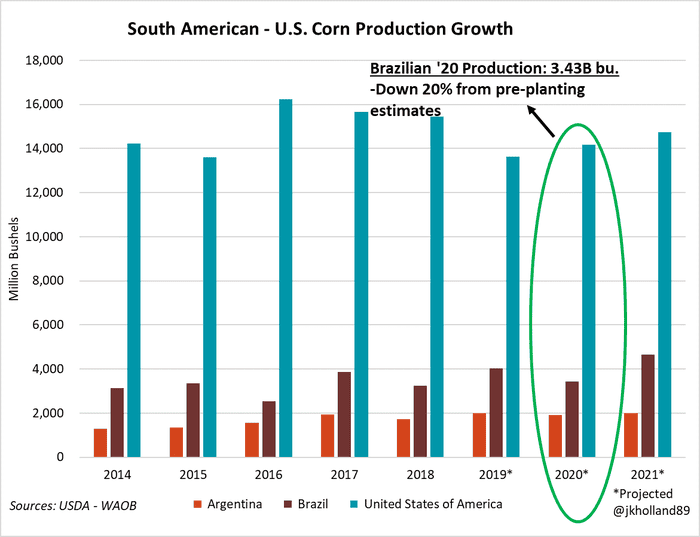

USDA’s new 2021 corn production forecasts of 14.75 billion bushels will be the second largest U.S. corn crop in history, behind 2016’s record haul of 15.15 billion bushels. Even though this year’s crop will top last year’s by 568 million bushels, the 2021 crop will likely be 415 bushels smaller than previous 2021 estimates, which will keep supplies tight for another marketing cycle.

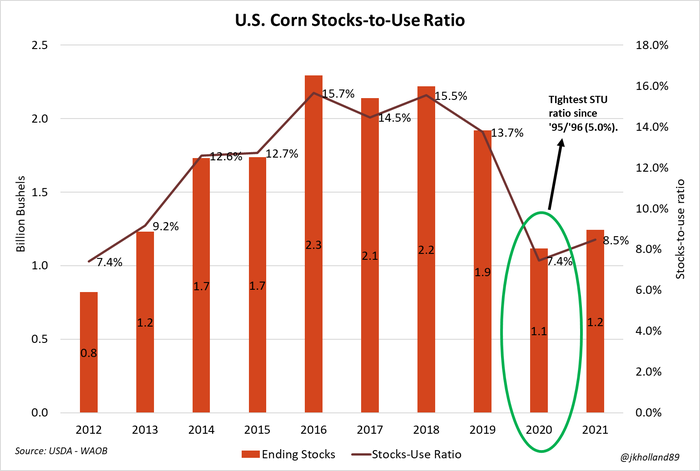

Despite raising 2020/21 ending stocks on slowing old crop corn export volumes and trimming 2021/22 feed and export volumes, USDA expects the smaller 2021 crop will tighten new crop ending stocks to 1.24 billion bushels. At a stocks-to-use ratio of 8.5%, this year’s crop will land as the fifth tightest on record over the past 60 years.

That bodes very bullish for new crop corn prices and should offer farmers some lucrative pricing opportunities at harvest this year.

Brazil’s safrinha struggles

Brazil’s corn crop was cut 6.5% to 3.43 billion bushels. A delayed start to planting, drought, and frost all took a toll on Brazil’s safrinha crop, tightening global exportable supplies through the rest of the summer and on into the new marketing year.

That could put more pressure on U.S. corn exporters in the coming weeks as USDA shrinks Brazil’s 2020/21 corn estimate figure by 197 million bushels to 906 million bushels – it’s smallest export volume since 2015/16.

Brazil is slated to be the world’s third largest exporter this year, following the U.S. and Argentina. It is traditionally the second largest corn exporter behind the U.S.

The smaller exportable stocks could point to more export opportunities for U.S. corn growers this fall. U.S. corn shipments to Central America and Southeast Asia have eased over the past six weeks as buyers await freshly harvested 2021 corn supplies. It could create lucrative basis opportunities at export and barge facilities in the coming weeks.

Hope remains for South America’s crops next year. Despite the drought, USDA left next year’s production estimates for Brazil and Argentina unchanged at 4.65 billion and 2.01 billion bushels, respectively. But a second straight La Niña weather system appearing in the Western Hemisphere this fall could exacerbate drought conditions and further tighten global corn and soy supplies.

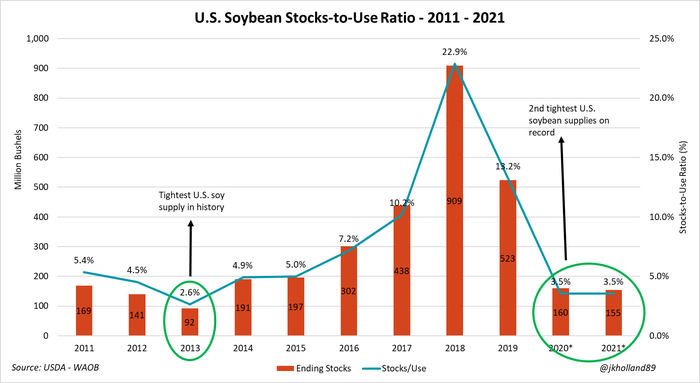

Soybeans stocks tighten back to 2020 levels

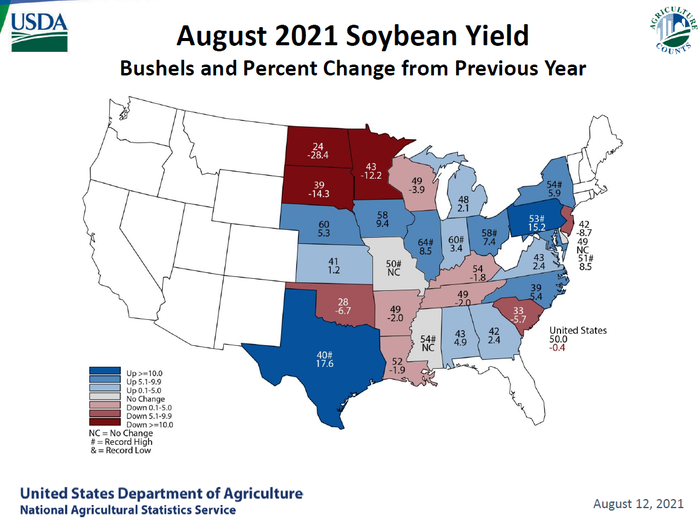

USDA trimmed soybean stocks only slightly – down 0.8 bpa to 50.0 bpa, well within trade estimates. The new yield estimate is likely to be the fourth highest on record after a turbulent growing season kept the top end of yields away from producers.

Despite higher 2021 planted acreage, drought in the Upper Midwest cut yield forecasts in key producers Minnesota, North Dakota, and South Dakota, according to USDA-NASS data.

That places 2021 soy production estimates at 4.34 billion bushels, down 66 million bushels from previous production estimates in an era of already tight soybean supplies. But that volume is likely to be the third largest soybean crop the U.S. has ever harvested, following 2018 (4.43B bu.) and 2017 (4.41B bu.).

Even with smaller 2020/21 export and crush usage rates, USDA does not anticipate that the 2021 crop will satisfy growing domestic and international demand for U.S. soybeans. USDA cut 40 million bushels of 2021/22 usage rates on the smaller crop, keeping ending stocks at a paltry 156 million bushels.

That means that the new ending stocks to use ratio for 2021/22 will likely remain very similar to that of 2020/21 at a meager 3.5%.

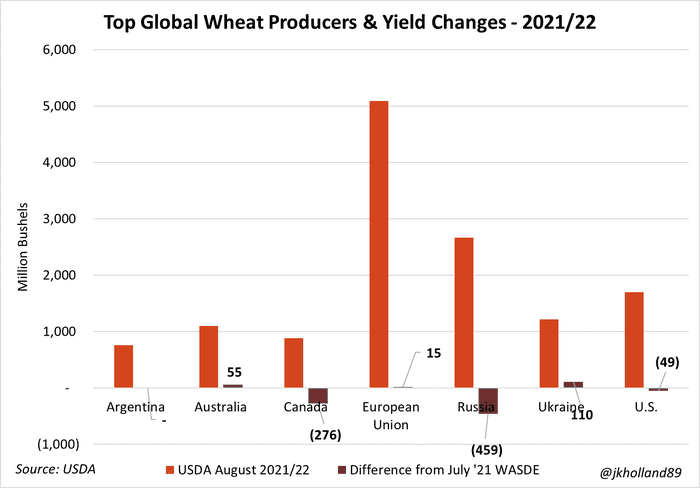

Global wheat supplies shrink

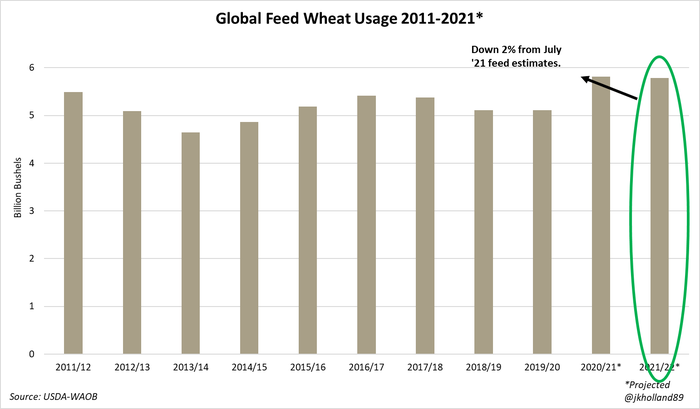

Wheat is not usually a significant beneficiary of new USDA updates. In fact, wheat prices typically follow those of corn in the aftermath of WASDE reports. But in the past month, wheat has stepped out onto its own stage as global production shortfalls push prices higher.

New crop production estimates for top exporters Russia, the U.S., and Canada were slashed a staggering total of 784 million bushels. In the U.S., smaller spring wheat, white wheat, and durum crops resulted in the smaller 2021 production estimate after drought in the Pacific Northwest and Northern Plains decimated farmers’ hopes for better yields and export opportunities this year.

For the first time in over a year, USDA cut global wheat consumption rates for livestock as soaring wheat prices make corn a more attractive and affordable option for livestock feeders’ rations around the globe. Global old crop wheat feed estimates were trimmed 4 million bushels, while 2021/22 projections were slashed 117 million bushels as exportable supplies around the world begin to dry up.

Chicago and Kansas City futures prices rallied $0.30-$0.34/bushel higher on the prospect while Minneapolis futures soared $0.16-$0.17/bushel higher. For growers who were able to salvage wheat crops this year, that presents a very lucrative pricing opportunity for any bushels that may remain unpriced.

And for growers looking to 2022, competitive wheat prices could steal always more acreage from corn and soybeans as growers begin to make winter wheat – and other crop varieties – planting decisions about 2022 in the coming weeks.

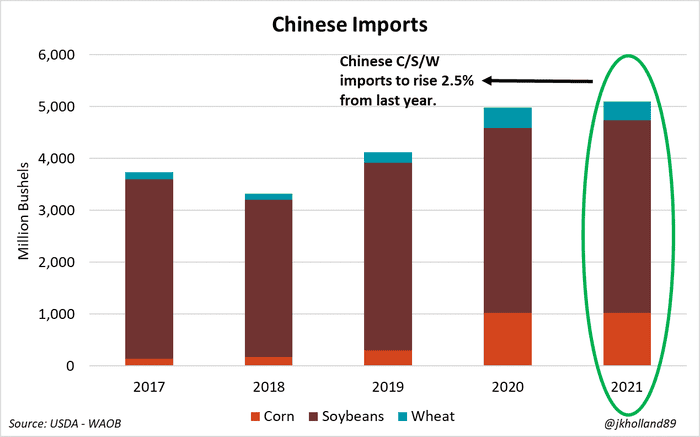

Chinese soy imports trimmed

USDA trimmed old crop (37M bu.) and new crop (37M bu.) soybean imports to China as tightening crush margins limit processing demand for the oilseed. China’s recent policy guidance recommends farmers use alternate protein feed sources to substitute for more expensive soy rations.

With that in mind, USDA expects China will import 4 million more bushels of wheat in the coming year. China’s total corn, soybean, and wheat imports are expected to total 5.1 billion bushels, a 36% increase from 2017’s import volumes for the three crops.

White wheat growers in the U.S. Pacific Northwest profited off a 33% annual increase in white wheat exports last year on unprecedented Chinese demand. Over 11% of 2020/21 U.S. wheat was shipped to China, compared to only 2% the year prior.

But Chinese and Southeast Asian wheat shipments have been slow out of the gate during the 2021/22 marketing year, so it is not yet clear if U.S. wheat growers will benefit from USDA’s uptick in Chinese wheat imports.

With U.S. soybean supplies remaining at short volumes, less Chinese demand may not be as bearish as previously thought. If China continues forward with less soy processing for its livestock and poultry rations, corn and wheat stand to lose. But as China’s hog herd returns to full strength following the 2018 African swine fever (ASF) outbreak, it is likely to continue being a large consumer of global grains as long as supplies are available.

For U.S. farmers, that may make all the difference in maintaining a profitable outlook heading into 2022.

Read more about:

WASDEAbout the Author(s)

You May Also Like