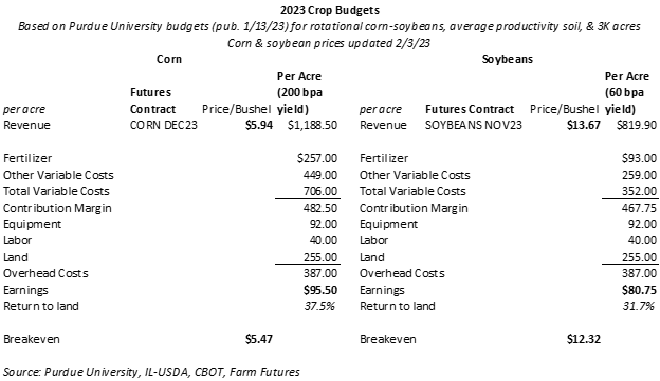

Author’s note: Since the original writing of this article in early January 2023, Purdue University has updated their 2023 crop budgets. I published this in late January without realizing changes had been made. But this most recent copy has been updated in early February 2023 to show the most accurate findings.

A special thank-you to Ken Morrison of Morrison on the Markets for bringing it to my attention!

Acreage projections for the 2023 season are still another two months from being finalized. But most growers have already decided 2023 acreage outlays. The January 2023 Farm Futures survey found that 70% of respondents had already locked in 2023 crop rotations as of late December 2022.

For the remaining 30% of our readers who are still undecided at the start of 2023 about which acres offer the most lucrative profit offerings, here are a few factors to watch in the coming weeks.

Cost factors

As a cost accountant in a previous life, my bias leans heavily towards the expense side of an income statement when making operational decisions. For those with similar tendencies, crop budgets provide a good launching point for deciding which acreage bundle will work best for the 2023 growing season.

Using Purdue University’s figures for a 2023 corn-soybean rotation on average productivity soil on a farm of 3,000 acres and factoring in changes in retail fertilizer costs since the most recent numbers were published in mid-January 2023, both corn and soybean acres look to be profitable options in 2023 when using early February 2023 futures prices.

At the end of January 2023, retail costs in Illinois for most standard NPK products, except for UAN, were flat to 4%-23% lower than the prior year, representing the first time in the last two years farmers have had the opportunity to take advantage of price breaks for inputs.

The nitrogen conundrum

A warmer-than-average January could keep a lid on energy prices in the coming months, which could in turn help moderate spring fertilizer prices. Preliminary global NPK usage estimates for 2022 have been reported lower, as farmers around the world scaled back applications in response to high prices and, in some cases (namely Ukraine), availability issues over the past year.

In the U.S., a soggy spring 2022 planting season and high failed acres likely also reduced some applications in the Northern Plains and Upper Midwest.

While the additional global fertilizer stockpiling has sent prices lower for anhydrous ammonia and urea (as well as phosphates and potash products) over the past several weeks, not all nitrogen products are seeing price discounts. UAN prices remain over 5% higher (+$30.45/ton) than a year ago, which could deter farmers from corn acres this spring.

UAN continues to be a hot item on the global export market, especially as European Union buyers seek fertilizer products for its upcoming growing season after the E.U.’s energy hassle with Russia over natural gas supplies over the past year. Soaring natural gas prices forced many E.U. fertilizer producers to halt production last fall, which has left farmers dependent upon U.S. exports for necessary supplies.

While some nitrogen prices are trending lower, farmers should not expect 2023 to be as profitable as last year. Purdue’s contribution margins calculate out lower than 2022 due in large part to the higher cost environment.

Even though my redneck math shows a profit for both crops, there likely won’t be as much wiggle room in 2023 margins as growers enjoyed a year ago, particularly if sales are not booked at current price levels.

New era for price uncertainty

Per acre earnings for corn rotations in these Purdue/Farm Futures estimations shake out to around $95/acre. For soybeans, that figure is projected just over $80/bushel. Returns to land for corn are calculated at 38% and 32% for soybeans, making both options viable profit opportunities at harvest next fall.

But again – margins are being squeezed on both sides this year. On the revenue side of crop budgets, expected market average prices in Purdue’s budgets were forecast 9% lower for corn and 5% lower for soybeans on an annual basis. While those figures were not used in this analysis, it does reflect market optimism for more readily available supplies in the new marketing year.

Futures prices remain slightly higher than these projections. But the financial world remains on edge over a looming economic downturn that would inevitably take a bite out of commodity prices. Better-than-expected growing weather in Brazil could also feed bearish price activity in the U.S.

Short of another unexpected weather downturn, don’t expect a lot of help from Uncle Sam for the 2023 season, either. ARC and PLC reference prices for corn and soybeans were reported at $3.70/bushel and $8.40/bushel, respectively, for the 2023 growing season. That makes the chances for any support from either of these price insurance programs slim, even if prices do shrink.

As any good accountant will tell you, these revenue and cost projections can vary across regions as well as with different management practices. Penciling out the numbers is an important exercise for growers on the fence this year, especially as inputs and financing costs continue to rise from last year.

About the Author(s)

You May Also Like