The first principle of marketing grain is to separate locking in the basis from locking in the futures price. Why? Generally, basis weakens as futures price rises & vice versa.

As a grain producer, do not be thinking you need to sell corn, beans, milo, wheat, canola, etc. Your mindset needs to be selling the basis for each of those commodities and selling the futures for each of those commodities. In order to maximize marketing profit, you have two markets to monitor for each commodity you sell or buy, namely basis and futures.

It matters not which one of those two markets you lock in first. Your final cash price will be set when both the basis and futures are locked in.

Since basis is a function of local supply and demand, you are the one who must record the basis.

If you are not already doing so, start now recording the basis the same time every week the rest of your life for every commodity you buy or sell. This history is valuable information for you.

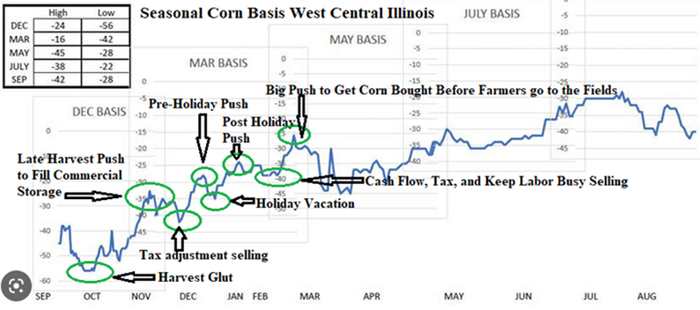

You will find the basis trend is quite predictable every year and the magnitude of the basis is impacted year to year mostly by deviation from normal production quantities and transportation costs. Here is the seasonal chart for corn basis in West Central Illinois. All locations east of the Rocky Mountains have the same trend. The actual basis varies greatly, but the trend is the same.

Note the labels for each of the green circles as they state the reason for the seasonal trend peak or valley. If the first winter storm or unusually cold weather happens the second or third week in December when merchandisers are trying to book grain for the holidays so they can visit their mother-in-law, that mid-December basis can get so firm, it may be your best opportunity to maximize your return to storage and cost of storage. During the winter, keep an eye on the weather forecast. Colder weather means firmer basis; warmer weather means weaker basis.

About the Author(s)

You May Also Like