All us farmer types ask each other during an “up” market, “Do you think the high is in?” We seek every opinion and reasoning for that opinion from anyone who will talk about it. However, there is one expert who knows better than any of us when the uptrend has changed. Yet, we seldom ask for that opinion because most of us do not know how to speak the language of that expert.

Old duffers will tell you the market is always right. It took me a couple decades to accept that statement as the truth, but yes, the market is always right in the long term.

Since we are talking about marketing grain, oilseeds, and cotton we harvest once a year, all we really need to know is the price outlook in the long term. We can debate on another day if the market is always right in the short run.

The expert, who is always right in the long run, is the market. I discussed last week the market freely tells us what it thinks the price outlook is, but we have to understand its language and the market’s language is technical analysis. Learning a new language takes a lot of time, so let’s get started.

Three trends

The markets are always trading in one of three trends: up, sideways, or down. The market tells us when it thinks a trend has ended several different ways, but one of the more common “statement” of a trend change is a Head & Shoulders formation, which signals the end of an uptrend or the end of a down trend.

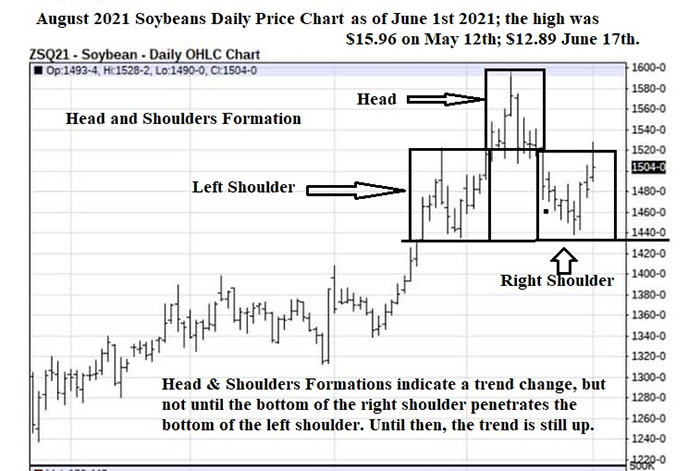

Below is the August 2021 soybean daily price chart. Each vertical line extends from a day’s high and low trade price with an “ear” to the left for that day’s opening price and an “ear” to right for that day’s closing price. You can see the three boxes marked left shoulder, head and right shoulder.

That is as perfect a H&S formation as you will see, but as of the date of this price chart, namely June 1, 2021, the formation had not confirmed an end to the uptrend. Why?

Because the right shoulder had not traded lower than the left shoulder. Until the horizontal line drawn across the bottom of both shoulders is penetrated on the right shoulder, there is no trend change.

However, as soon as the right shoulder trades below the bottom of the left shoulder, the market is saying uptrend is over. It does not necessarily mean a downtrend will be established; perhaps a sideways trend will develop. All we know for sure is, if that right shoulder trades lower than the left shoulder, the uptrend is over and you will get it straight from the mouth of the expert who is always right in the long run.

As it turned out, the confirmation of a trend change occurred on June 14. Three days later, August beans traded at $12.89, a whopping $1.47 loss in three days!

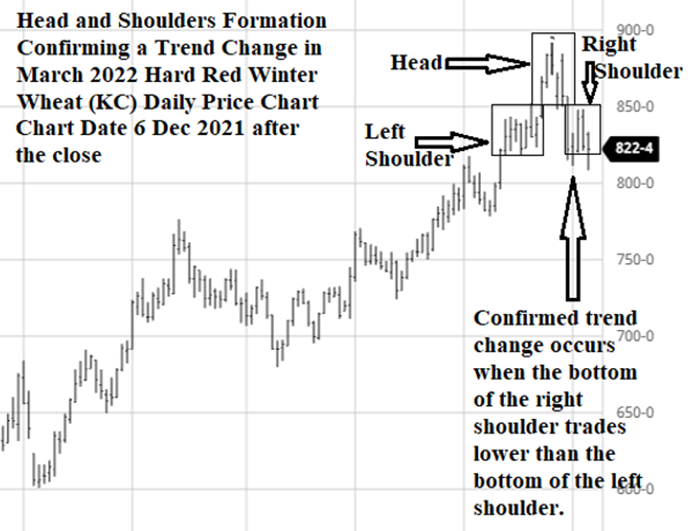

This second chart is the March 2022 Hard Red Winter Wheat as of Dec. 6, 2021. Look at the same three boxes. What is the market telling you?

There you go! You just learned a tidbit of a foreign language that is valuable for you!

Wright is an Ohio-based grain marketing consultant. Contact him at (937) 605-1061 or [email protected]. Read more insights at www.wrightonthemarket.com.

No one associated with Wright on the Market is a cash grain broker nor a futures market broker. All information presented is researched and believed to be true and correct, but nothing is 100% in this business.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like