Harvest activity is just around the corner for the Heartland with drought stress likely to lead to an early start to combining activities for many growers. Despite some wholesale input prices leveling off slightly in recent weeks, the seasonal uptick in demand expected during fall application season will likely send prices higher once again, especially with another La Niña weather event on the horizon.

NOAA expects another La Niña weather pattern will emerge this fall from cooler than normal ocean temperatures in the Pacific Ocean. It will be the second time over the past year La Niña weather patterns have influenced farmers’ field activities and the outlook is not as rosy for growers with late-planted fields.

Increased rainfall is characteristic of a fall season during La Niña. And while farmers in the Upper Midwest would welcome any additional soil moisture, growers in the Eastern Corn Belt have had more than their fill of showers this year.

The likelihood of excess rains in the east will increase as fall rolls on, which could delay harvest in late planted fields and increase drying times. This could hit farmers’ pocketbooks and harvest schedules if early action is not taken.

Propane availability may be an issue as well if a wet fall ensues. Inflationary pressures and low inventories are likely to keep costs high going into harvest. Propane inventories are restocking after an active export season earlier this year, but weekly inventories remained nearly a quarter lower than the same time a year ago.

Farmers who cannot start harvest early this year should look at bulking up on-farm propane supplies as quickly as possible. Farmers compete with residential demand for the heating fuel as colder weather approaches. And with the Delta variant sending more workplaces back to home offices, competition for what little propane is available will be steep this fall.

Nitrogen supplies shrink

Maintenance downtime at U.S. anhydrous ammonia plants this summer will tighten supplies heading into harvest. Global nitrogen supplies continue to tighten as global acreage expansion climbs during this era of high commodity prices.

Some early offerings reported at the wholesale level suggested that anhydrous prices could be offered at a discount despite the tight global supply outlook. Nutrien’s plant based in Trinidad has helped to offset some price pressure amid a plant closure in Saudi Arabia.

But anhydrous ammonia demand from the Black Sea and South America on continued acreage expansion will continue to limit reduced pricing opportunities in the global anhydrous market.

China’s ban on urea exports issued last week could further tighten global nitrogen supplies. In the short run, nitrogen prices do not appear to show signs of falling which may encourage more farmers to wait for spring to book 2022 applications.

Ever-rising phosphate costs

China�’s top fertilizer producers are temporarily suspending phosphate and urea exports, which could send key buyers India and Pakistan in search of alternative sources the U.S. has come to rely on in the wake of its countervailing tariff dispute with Russia and Morocco.

China is the world’s largest producer of phosphate. Leading up to this announcement last week, there was some optimism that Chinese supplies could help offset phosphate shortages in the U.S. as phosphate imports from key producers Russia and Morocco all but vanished following the last year’s countervailing tariffs dispute.

Fertilizer costs have hit record levels this year in China as a government-sponsored acreage expansion increased the demand for inputs. Recent flooding in central China’s Henan province has also stalled fertilizer production. Rising production costs and increased export demand due to a global acreage increase this year have also played a significant role in dwindling Chinese phosphate supplies.

Farmers remained somewhat optimistic that phosphate prices could see some relief going into harvest as new international sources increase their shipping presence to the U.S. But with China’s exportable supplies on lockdown, that optimism has faded in the last week.

As fall application season approaches, farmers will be well-served to pencil out anticipated profit margins for 2022 to determine if they are better served by booking phosphate supplies sooner than later. It remains unclear how soon – if at all – phosphate prices will calm down, but if farmers are confident in their revenue projections and comfortable waiting for a chance at lower prices after the New Year, it could be worth the gamble to wait.

Farmers pay for global turmoil

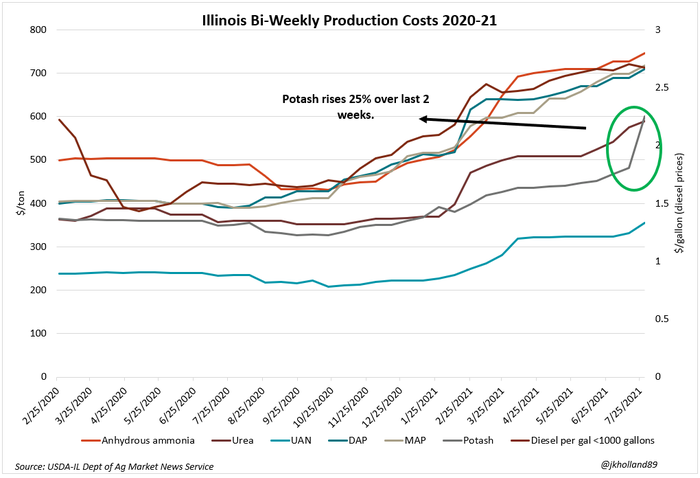

Potash prices listed by Illinois retailers skyrocketed on international political upheaval, up nearly a quarter over the past two weeks to $600/ton. The latest potash price surge is largely attributed to recent economic sanctions enforced on key producer Belarus by the European Union, United Kingdom, U.S., and Canada after the Belarusian government imprisoned high-profile political protestors.

Potash suppliers were already tight leading up to the sanctions, which will further restrict international flows of the potassium fertilizer. Belarus is one of the world’s largest potash producers. It remains unclear if U.S. producers Nutrien and Mosaic will have the capacity to rachet up production in time for fall application season.

Countervailing tariff disputes continued to lead phosphate prices higher. New UAN dumping disputes levied against Russia and Trinidad and Tobago by the U.S. sent prices climbing over the past two weeks and could spur UAN prices higher as well.

Growers awaiting spring pricing in the coming weeks will need to pencil out 2022 profit and cost expectations pretty rapidly in the next couple weeks to decide if availability is worth the current high costs of inputs or if they can afford to take a gamble and wait for prices to moderate in the increasingly volatile post-pandemic era.

Farmers may not be able to afford to wait for China to make the first move this fall to stimulate enough export demand so that grain revenues can offset higher input costs. Global economic uncertainty continues to loom large so if profit opportunities are presented during the earliest days of harvest, don’t be timid about pursuing them.

About the Author(s)

You May Also Like