Farmers’ focus is understandably on the here and now as freshly planted fields bake under a dry start to summer. But growers wear many hats, and it’s time to put on the green eyeshade of a purchasing manager.

Key inputs you’ll need to harvest and dry fall crops and get started on 2024 production are offering relative bargains compared to the sky-high prices of the past year. Fertilizer and fuel are following form, reflecting seasonal weakness that typically offers opportunity to purchase supplies at good value.

To be sure, the world – and its markets – always seem to be just a headline away from a train wreck that could make today’s deals look like duds. Weather, war, and a highly uncertain global economy make these decisions harder than ever. But serious discussions are needed right now with your suppliers to determine whether to lock in prices – and how best to do it.

Here’s a rundown on what’s happening.

A nice bear

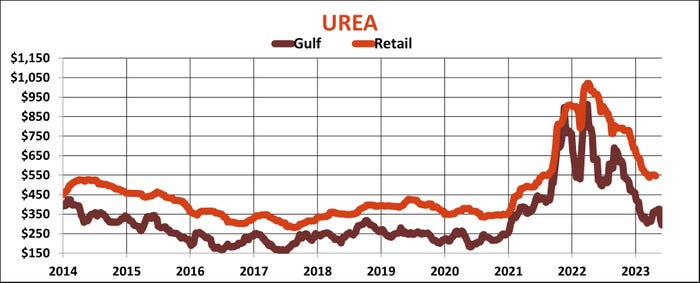

You know that gut-punch feeling when crop prices drop, and keep dropping and dropping? That’s what fertilizer manufacturers felt over the past year, especially in the nitrogen complex.

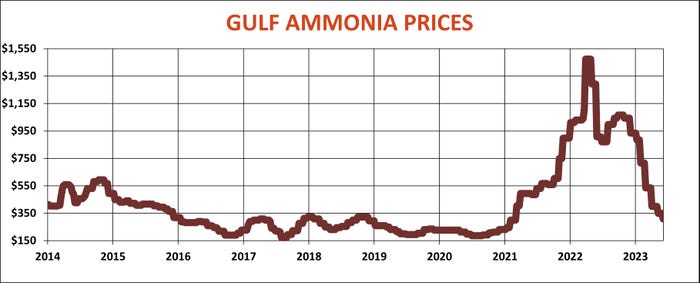

After surging to record levels in the wake of Russia’s invasion of Ukraine, costs plummeted. The latest settlement for June ammonia contracts at the Gulf came in at just $308 a short ton, a drop of nearly 80% from the market’s top last year around $1,425.

While sanctions by Western nations didn’t affect Russia’s ability to sell fertilizer directly, shippers were reluctant to move product around the world. And the largest ammonia pipeline in the world, from Russia through Ukraine’s Black Sea ports, was shut, just as natural gas prices sky-rocketed in Europe, choking plants there.

Now there’s talk Russian supplies may start flowing again – it’s a key bargaining chip in efforts to keep Ukraine’s grain exports moving. Lower prices for gas, the primary feedstock for nitrogen fertilizers, helped production resume in Europe, and reduced costs elsewhere too.

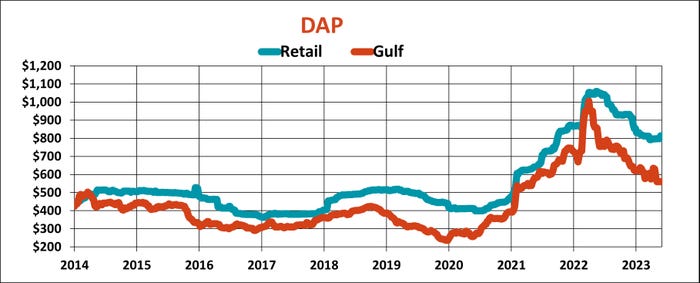

Anti-dumping tariffs remain on imports of phosphates from Morocco and Russia, but similar sanctions on UAN from Russia and Trinidad and Tobago failed.

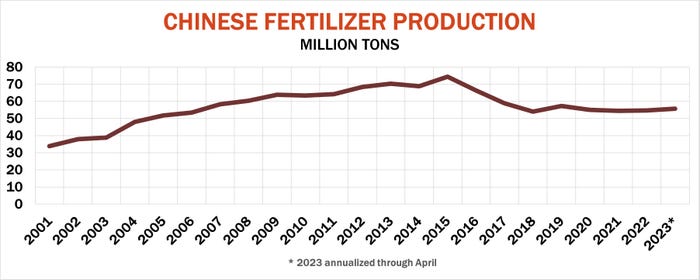

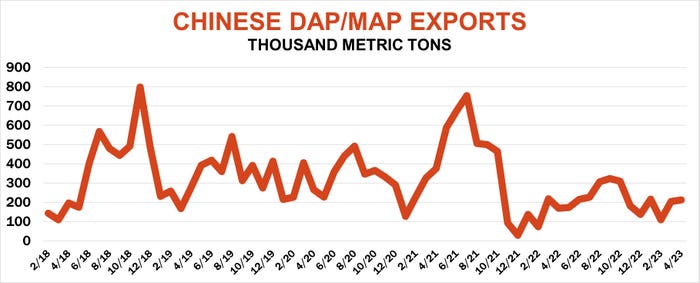

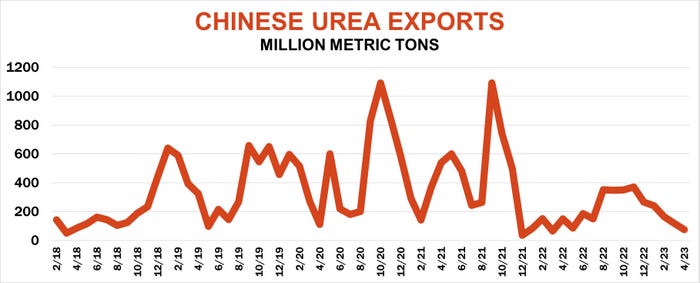

China also looks ready to return to its role as a big exporter of phosphates and urea, after first cutting production to control pollution and then restricting sales to keep product at home to fight inflation. Total Chinese fertilizer production is slowly starting to increase and its phosphate shipments are on the rise. Urea exports slowed in April, but could be ready to increase to take advantage of India’s latest tender, which could set a floor on the market unless other sellers panic.

China is also a big importer of potash, but doesn’t look like it will negotiate any new agreements this year, keeping prices on the defensive despite production cuts at some mines in Canada and ongoing sanctions against Belarus.

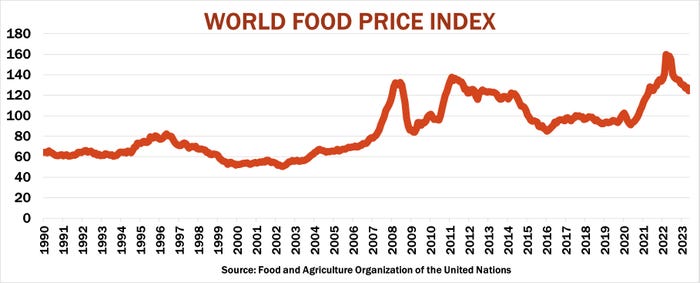

Food prices, a key driver of fertilizer costs, are also dropping, though slowly, keeping inflation a concern. The UN’s World Food Price Index reported Friday for May fell again. This metric is down 22.1% from its all-time peak in March 2022 but remains high by historical standards. World acreage for major crops is expected to be up 1% this year, after falling in 2022.

Gas pains

Natural gas futures fell to an all-time low last week, a plunge even greater than ammonia’s. The U.S. is the world’s low-cost producer of the fuel. While that should keep ammonia prices restrained, it’s also an incentive for nitrogen to flow out of the U.S. to supply markets around the world.

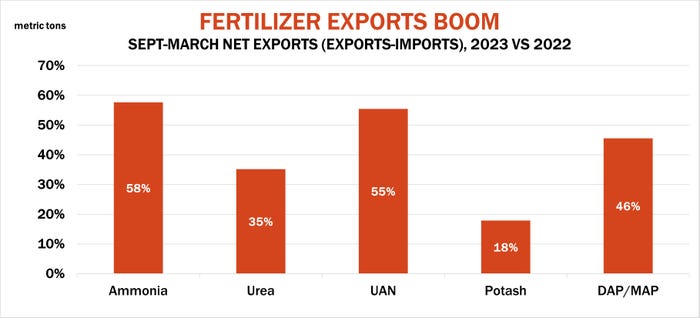

The U.S. continues to import N, P and K. But exports are growing faster, particularly for nitrogen products.

Supply chain bottlenecks could still hinder supplies from moving to farm markets in the Midwest and Plains, but shipping rates for trucks, barges and rail are falling. Flooding is no longer an issue on the river system, and water levels don’t look like they’ll drop low enough to restrict barges despite the recent dry spell.

Still, the spread between Gulf benchmarks and retail prices farmers pay remains high as dealers get ready to restock. Some suppliers in the southwest Plains and Midwest are offering ammonia at $800 or less, but that’s still much higher than historical Gulf-retail spreads.

Global urea values are also in a downward spiral, taking Gulf swaps below $300 a ton for the first time since January 2021. Back then retail prices were well below $400, but costs out in the country these days are still averaging around $570 – and a few offers actually increased last week. UAN retail offers are also stagnant, though Gulf swaps for 32% fell to $212.50 last week, with summer contracts down to $187.50.

International phosphate prices trading $450 a short ton or less are on par with Gulf swaps through the fall, but it’s hard to find retail offers for DAP much below $800 – and some dealers under that level actually raised their offers last week. As with many fertilizer products, supplies in position for farmers remain tight after a challenging spring.

Potash prices internationally are trading $350 or less per short ton. Some retailers dropped offers to $550 or less recently, but patience may be needed unless leftover inventory is available.

Watch China

China was a market mover in the energy sector last week. Crude oil prices briefly dipped below $70 a barrel on weak economic data, but quickly turned around on hopes Beijing would stimulate the country’s beleaguered housing industry.

Farmers don’t trade crude, unless they own an oil well or two, but black gold is a key driver for two essential fuels they’ll need this fall. Both propane and diesel follow crude mostly, but also trade their own seasonals that are sounding alarms.

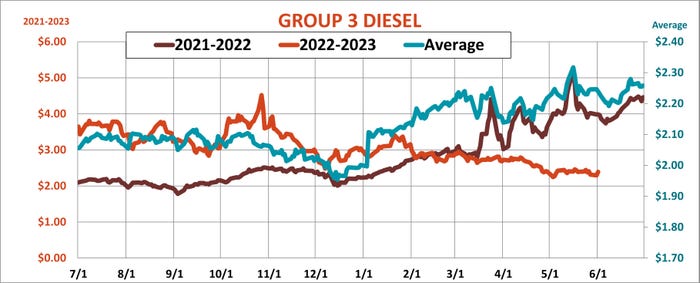

Agricultural use is the key swing factor in diesel demand, and with planters parked that usage is drying up. Midwest farmgate diesel fell to its lowest level since January 2022 recently. ULSD futures held their 2022-2023 lows last week on the crude drop, but quickly rose a dime a gallon. Wholesale benchmarks used by Midwest dealers followed suit, including Group 3 swaps.

Fuels prices typically bottom early in June before trending higher into fall on ag demand, one reason to refill tanks soon, especially with hurricane season underway. OPEC and its allies met over the weekend, and though production cuts weren’t expected yet, there’s risk the cartel could try to get crude back over $80. Crude seems fairly priced around $75 according to my model, leaving room to the upside around $87.50 if the market gets spooked.

The dollar could be a key factor as well. Friday’s May employment report was confusing, showing a higher unemployment rate but surprising jobs growth as well. The dollar gained despite a surge on Wall Street to new one-year highs, as investors bet the Federal Reserve will pause on hiking interest rates at the end of its next meeting on monetary policy June 13-14. The greenback continues to look overvalued from a fundamental perspective of supply and demand, so an improving mood globally could convince traders they don’t need a safe haven as much.

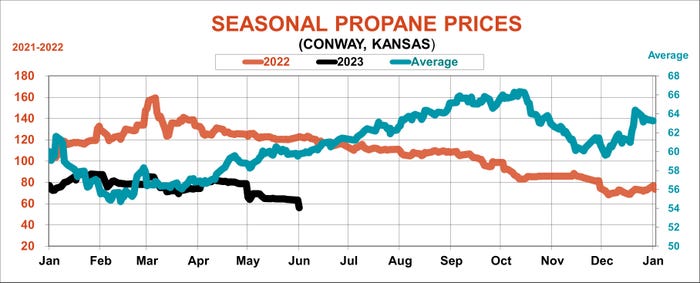

Weaker dollars tend to be bullish for commodities, especially oil. Higher oil prices could also impact propane. Cost of the drying fuel tends to follow WTI, but typically show a weaker trend into the end of spring after heating demand wanes. The latest dip to two-and-a-half-year lows came right on schedule for those needing to refill tanks or lock in fall supplies.

Read more about:

FertilizerAbout the Author(s)

You May Also Like