Fresh on the news that the Black Sea Grain corridor deal has been extended for another 120 days, Chicago wheat futures dug in its heels and continues to hold on to the $8.00 price support area. News of the grain deal extension being inked ahead of the November 19 deadline could have sent prices plunging lower, but instead, only a retest of recent support was the only thing to be found. Perhaps the fact that Putin today continued to bomb parts of Ukraine reminds us that while the grain corridor is open, the war continues around it.

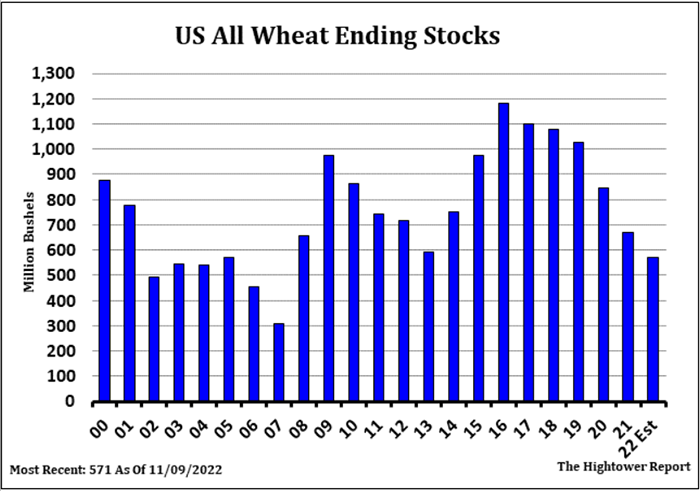

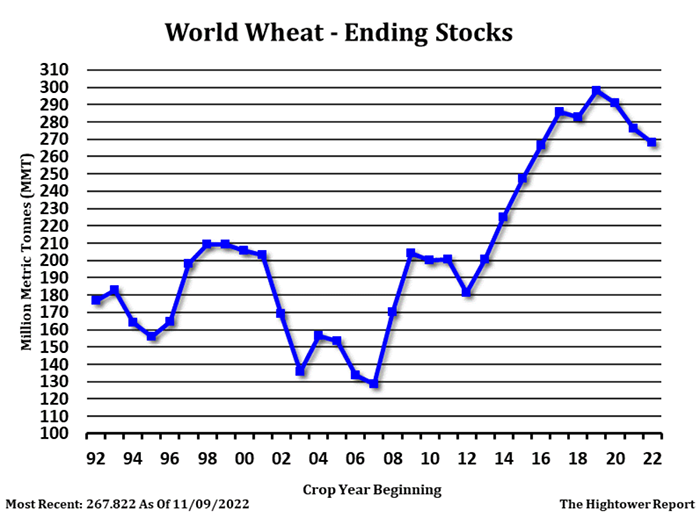

For now, the market is back to trading actual wheat market fundamentals. And the stark reality remains that ending stocks in the United States are cut in half from just a few years ago and global ending stocks of wheat continue to trend lower as well.

Global demand remains strong

Global demand for wheat remains strong, especially with this week’s news that there are now 8 billion people on this planet! Export sales in the United States are progressing along as expected, with a nice announcement that 150,000 tonnes of hard-red spring wheat was sold to Iraq.

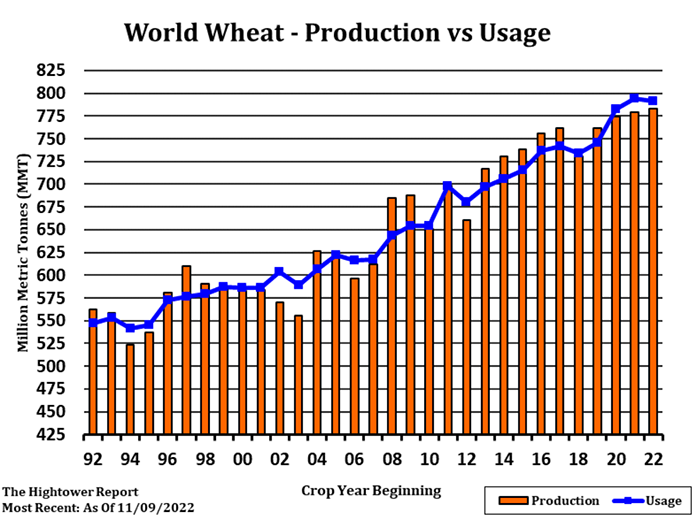

It is interesting to note that because of the Russia/Ukraine war and due to adverse weather around the world for the past two years, that global production of wheat has not kept up with demand.

Thankfully, the world had a large buffer of ending stocks supplies to lean on. But going forward, some of that ending stock buffer is again in question as Mother Nature continues to be relentless with wild weather.

Global production not perfect

While Australia was on the verge of a record crop, now it is said that Australia's large crop has lost nearly 30% due to heavy rain causing flooded fields, sprout damage, quality issues, and now even some grain storage facilities are said to be underwater!

Over in Argentina, the wheat crop has been compromised due to drought. Their wheat crop is said to now be closer to 10.0 mmt, versus last year’s production number of 22.1mmt. Currently the USDA has Argentina production pegged at 15.5 mmt. I look for the USDA to lower the Australian crop number in the December USDA WASDE report, which will likely bring global carryout down a notch, too.

With the war in Ukraine, they will not be able to produce their normal amount of wheat. Ukraine's ag ministry estimates winter wheat seedings were reduced from last year's 6.5 million hectares to 3.7 million this season. While production in Russia is said to be higher, it is not enough to offset lower production in the rest of the world. And don’t forget, here at home the drought continues in the Plains.

Bottom line, wheat prices are on long term support prices, and unless Mother Nature suddenly blesses the world with “perfect weather” and unless the Ukraine war suddenly stops tomorrow, $8.00 wheat might be a global bargain for end users.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like