There was a full crowd in attendance last Thursday evening, April 15, at the KC Hall in Cascade, Iowa. The event was the sale of 200 acres of farmland in nearby Jones County. The attendees got to take in the emotions often generated from a public land auction venue, while also enjoying a cold beer, soft drink or refreshment of choice. Since the sale only took 20 minutes, some even joked about sticking around to play bingo afterward.

In a radio interview, the auctioneer said the sale was the biggest in his 44-year career. He dropped the final hammer at $18,800 per acre after fast and active bidding which began at $8,500 per acre. A local lender was there representing a farm client who was prepared to bid to $12,000 per acre, but they hardly had a chance to take a sip of coffee before the bidding blew past their limits.

Sale factors

The auctioneer credits multiple factors that contributed to this notable sale, including strong grain prices, low interest rates and a limited supply of farmland available for sale. The farm was owned by the same family for many years so this was a once-in-a-lifetime opportunity for local landowners. In fact, all of the four active bidders were from within 3 miles of the farm. Perhaps the biggest factor for this particular sale was the old adage in real estate of location, location, location!

Ag cycles

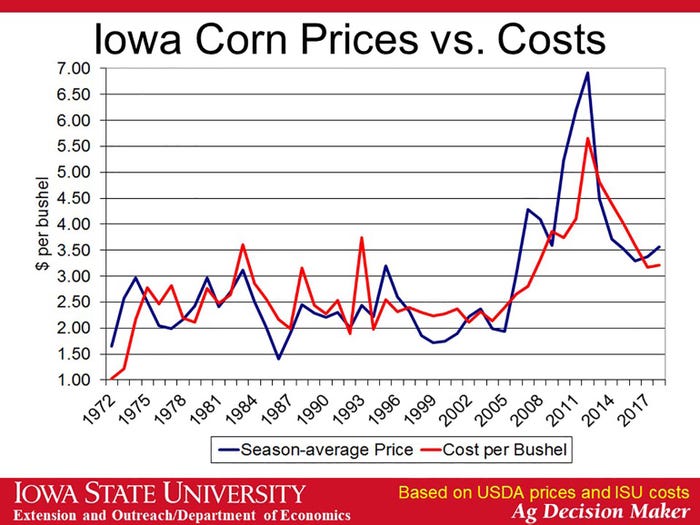

I can’t help but think of a lecture from one of my ag professors 20-some years ago talking about how agriculture is a cyclical business. In fact, you can identify 7 to 10-year cycles in commodity prices going back the last 50 years:

Ironically, it was 7 to 8 years ago when commodity prices, land values and cash rents were last setting new highs. It seems history may be repeating itself and the ag industry is poised for another bull market cycle.

$8 corn

In July of 2012 corn futures hit $8 and soybeans $17, and I remember a retiring farmer saying: “Wow, this is a great way to go out, but I’m afraid we’re all going to pay for this in the end.”

He may have been right as profit margins were razor sharp for many farmers over the last four to five years. Just this February, the front-page story of the Des Moines Register was about farm bankruptcies reaching 10-year highs. It is important to remember what followed $8 corn and $17 soybeans: rising costs for fertilizer and other crop inputs, machinery and land rents which were all reluctant to come back down as corn and soybean prices came back down to levels of $3 corn and $8 soybeans just a year ago at this time.

Outlook

It seems all the market factors are aligned to repeat another bullish price cycle last fueled from the drought conditions of 2012. This time the factors include tight global grain supplies, continued strong global demand for our food, fuel and fiber, as well as strong government support. However, there is no doubt our industry is not immune to unknown black swan events which could impact these trends. In the short term, it appears it’s time to buckle up because the next two to three years could provide for quite a ride in agriculture. This will generate both opportunities and challenges for producers as they try to manage this continued price volatility.

Downey has been helping farmers and landowners for the last 21 years with their family farm transition, leasing strategies, finances, and general land consultation. He is the co-owner of Next Gen Ag Advocates and an associate of Farm Financial Strategies. Reach Mike at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like