Last week I met with a retiring farmer who owns nearly $2 million of farm machinery and equipment. He is very clear in his desire to not pay any tax for selling the equipment. In fact, he wishes he could simply gift it all to his two sons now. I asked him why not? He responded because he didn’t think it was even possible.

This led to a discussion about current gifting rules and the two levels of gifting available to all of us.

Annual gift exclusion

Most are familiar with the first level of gifting in the form of the annual gift exclusion. This is a tax-free gift we are allowed to make to any person every year with no questions asked and no IRS reporting requirements. This adjusted from $15,000 to $16,000 per person in 2022, and recent inflation numbers indicate it will increase again in 2023 to $17,000 per person.

Lifetime gift exemption

There is also a second level of gifting available using our lifetime exemption, also tax free. Most think of this as the federal estate tax death exemption, but it can also be used during your lifetime in the form of lifetime gifts. This however requires filing a gift tax return with the IRS to notify them you are using some of your exemption now.

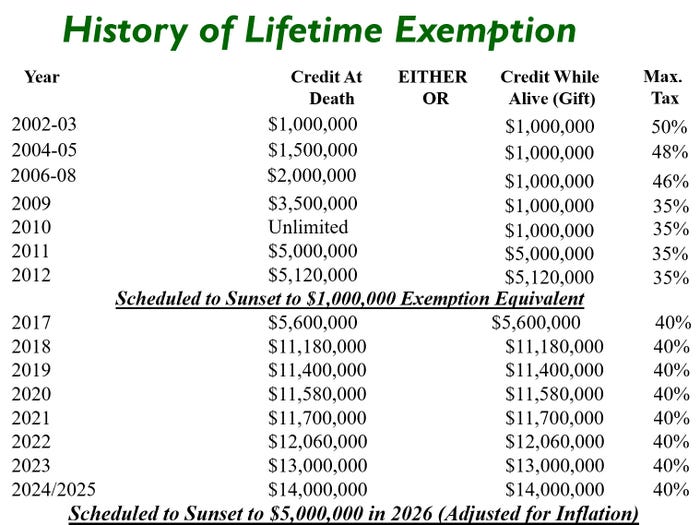

The current lifetime exemption amount is $12,060,000 per individual, or slightly over $24 million for a married couple. Recent inflation numbers suggest we will see the largest adjustments to these levels in history. It is estimated this will increase by $860,000 in 2023 to near $13 million, and if inflation stays high it could exceed $14 million by 2025.

This is an important timeline to be aware of, as unless Congress votes to extend them, these amounts will sunset back to the pre-Trump levels of $5 million per individual on Jan. 1, 2026. A couple years ago I wrote the article What landowners should know about end-of-year gifting and that some view this as a “use it now, before we lose it” type decision. In other words, use some of your lifetime exemption to make tax-free gifts now while they are the largest ever in history. See the chart below for a history of lifetime exemptions amounts.

Know the trade-offs

I was the hero of the day, and this particular retiring farmer was ecstatic to learn he could in fact, give the equipment to his boys, tax free to all of them, and the assets will transition to those in the family he wishes them to go to anyway. There are some trade-offs to consider though.

First, your legal advisors may caution you that once you make a gift, its irrevocable. Meaning, it’s difficult to undue or take this back once the gift has been made. Secondly, under current laws, any assets which pass through your estate to your heirs receive an adjustment in cost basis, commonly referred to as step-up in basis. However, any gifts made during your lifetime carry over with the gift, commonly known as carryover basis.

In this case, he was comfortable the boys would get his current lower basis in the equipment. They would also have all the equity in the equipment to better position them trade and upgrade when needed. They will most likely step in and fill his shoes of using depreciation from new purchases to offset recapture tax from the sale of the trade-in.

Depending on what state you live in, also be aware of any state laws where lifetime gifts may impact estate tax at the state level. In most cases, it is still a tax advantage to make gifts at the state level, but may not be a true dollar for dollar benefit as at the federal level.

Talk to your advisors

Work with your tax advisors to understand the estate planning and gifting strategies available between now and end of 2025. Most may not have an estate tax concern even if the current high estate tax exemptions are cut by approximately one-half at the end of 2025. However, gifting of operating assets such as equipment and livestock is a common strategy used in family farm transitions. If so, you may want to consider implementing these in the next few years while gifting exemptions are at all-time highs.

Downey has been helping farmers and landowners for the last 22 years with their family farm transition, estate planning, leasing strategies, finances, and general land consultation. He is the co-owner of Next Gen Ag Advocates and an associate of Farm Financial Strategies. Reach Mike at [email protected].

Read more about:

TaxesAbout the Author(s)

You May Also Like