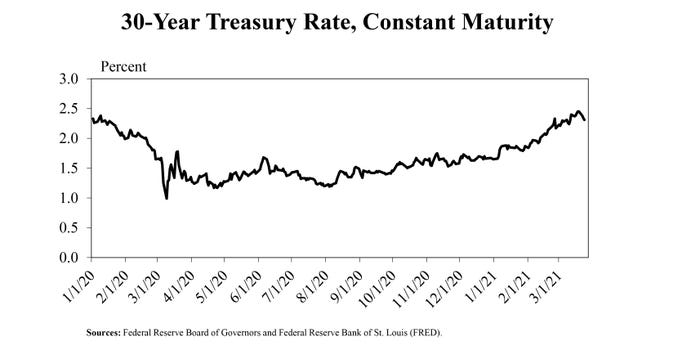

If you have looked to refinance recently, you may have noticed that long term rates have been on a steady incline. We are still in a good territory for refinances, but rates are not what they were at year end 2020.

How high will they go? No one can answer that. How quickly will they go up? No one knows that either, but here is what you can do now.

Take a look at all of your current interest rates and compare to current market rates. Are your current rates close? Or are they a point or more higher? I wouldn’t go looking for a refi over 10 basis points of difference, as closing costs will eat up those saving quickly. However, if you notice your long term rate is 100 basis points higher than the market, now might be the time to move before the gap narrows (if rates continue to trend upward.)

Take a look at how long your current rate is fixed for. Was it fixed for five years and you are about to start year four? It might be worth going ahead and looking at the options now and locking in again. Rates could be much different by the end of year five.

Go ahead and take a look at your full debt picture. Could you consolidate several loans and get a better rates across them all? How much money would that save? If one loan is about to be at the end of its fixed rate period, you might as well take the time to look at all your loans and run the numbers.

If you are unsure about what to do, be sure to watch the market. There are several different newsletters that contain weekly rates. Keep yourself educated on where the market is on rates and when you start to look, you will know what type of deal to expect.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like