Today we saw the grain market change its attention from South American weather to upcoming production. USDA released its 2023 Outlook showing corn acres potentially increasing to 91 million acres, up from 88.6 million acres last season. With a projected yield of 181.5 bpa, that would give us the second largest production season on record with 15.085 billion bushels. Much of this boost in production lies in improved yield.

Remember trendline yields?

The last five seasons have been at or below trendline yields, partly due to La Nina weather. Meteorologists are closely watching the ENSO cycle and it suggests that La Nina is deteriorating as we head into spring, switching to ENSO neutral and potentially El Nino by late summer. El Nino does not guarantee abundant rainfall, but most seasons where we experienced above trend yields came following the El Nino weather pattern.

While last year’s yields were below trend, the overall yield average held up pretty well considering damage caused by drought. This begs the question: how well can yield perform when we have more beneficial growing conditions?

Breaking records

USDA is projecting a new yield record at 181.5 bpa. While on one hand that may seem overzealous, it is only 5% more than last season’s 173.3 bpa.

What would it do to ending stocks?

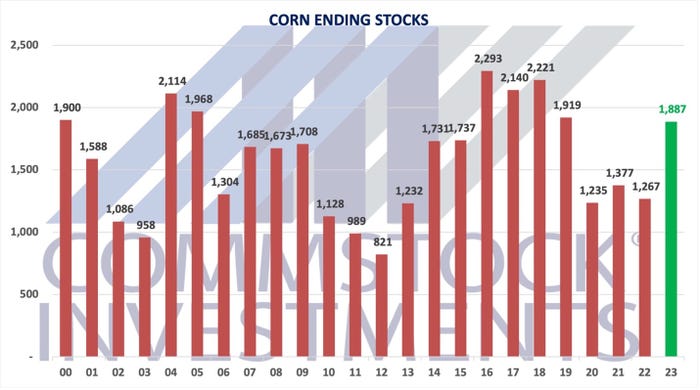

While corn ending stocks may currently be tight, it doesn’t take much gain in yield to begin accumulating inventory once again. Prior to COVID we had lingered around 2 billion bushels, which kept prices depressed below $4.A 181.5 bpa could potentially send ending stocks to nearly 1.9 billion bushels.

This is not to say that prices will make a beeline for $4, but the risk is apparent that we are sensitive to increased inventory. Much of that has come in the form of lost exports, which have dropped 800 million bushels in the last two years.

Getting that export market back will be vital if we want to provide support to commodity prices.

‘Peak acres’

The other important takeaway from the USDA outlook is that the combined corn and bean acres continue to remain flat. The last eight years have seen corn and bean acres remain at a combined 180 million acres more or less. In 2021 we saw them reach 180.5 million acres, but USDA sees them at only 178.5 million acres despite showing positive margins.

Some of these acres could shift to wheat. But it demonstrates once again how the U.S. has reached peak acres, which contrasts to that in Brazil where they have been steadily growing acres expanding at 4% year over year.

One positive form the report was that the soybean update was neutral to slightly positive. Soybean stocks stayed depressed despite higher yields mostly due to increased domestic crush. Many things can happen between now and then. But an above trendline yield has got the attention of traders and requires us to protect our downside risk. Traders will next look for the crop acreage report due March 31.

Matthew Kruse is President of Commstock Investments. Subscribe to their report at www.commstock.com.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

About the Author(s)

You May Also Like